JP Morgan raced ahead of competitors in fixed income trading revenues over the first three months of 2025, reporting over US$1 billion more than runner-up Citi.

During the company’s results call, CEO Jamie Dimon called on the Fed to remove Treasuries from the supplementary leverage ratio (SLR), an element of deregulation that has been part of the Trump government agenda.

“This isn’t about relief to the banks; it’s relief to the markets,” he told analysts. “JP Morgan will be fine with or without an SLR change. The reason to change some of these things is so the big market makers could intermediate more in the markets. If they do, spreads will come in, there’ll be more active traders. If they don’t, the Fed will have to intermediate. I think it’s just a bad policy idea that every time there’s a kerfuffle in the markets, the Fed has to come in and intermediate. So they should make these changes.”

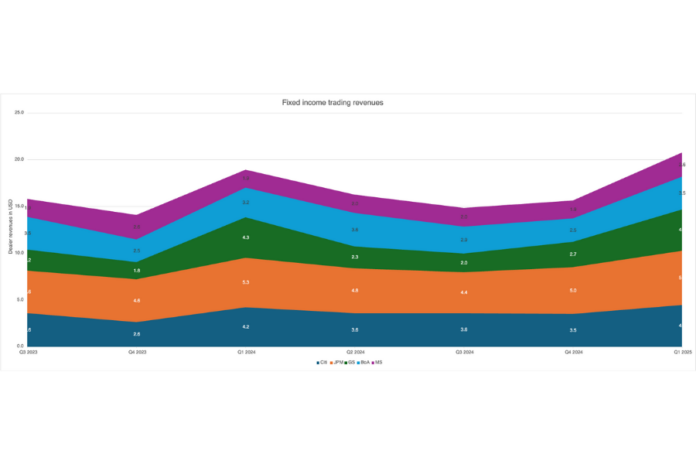

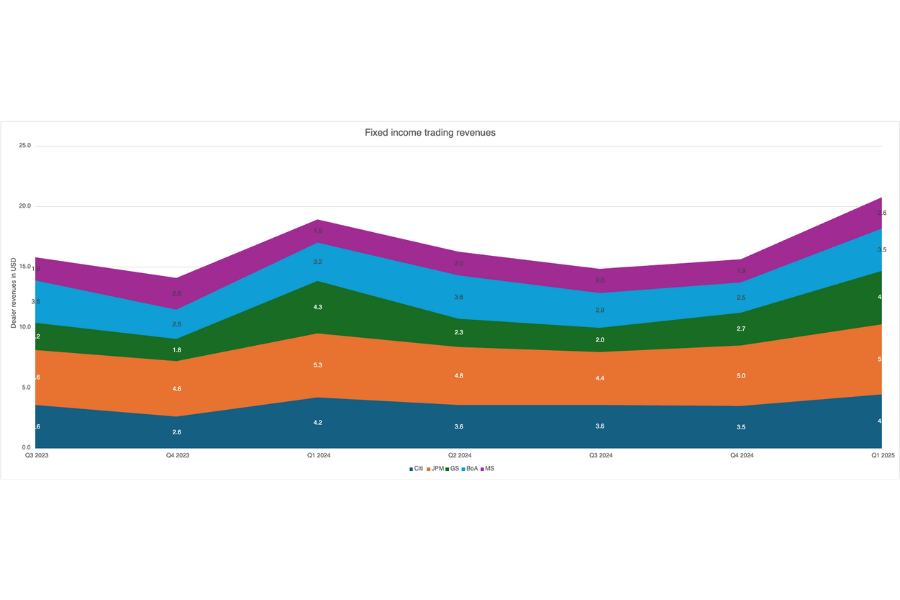

The bank’s US$5.8 billion represented a 16% quarter-on-quarter (QoQ) increase – the most marginal of the cohort – and a 9% rise year-on-year (YoY).

Goldman Sachs saw a 63% QoQ spike in fixed income trading revenues in the first three months of 2025, the most significant of the group. Despite the increase, though, it ended the quarter in third place by net revenues with US$4.4 billion. Its year-on-year (YoY) revenue increase was also the smallest of its peers, up just 2%.

Citi saw a considerable hike in revenues, up 29% QoQ and 7% YoY to US$4.5 billion.

Combined trading revenues for the banks ticked up just 1% to US$19.1 billion by the end of the quarter, from Q1 2024’s US$18.9 billion.

Banks with smaller revenues saw the greatest percentage increases over the quarter, setting trajectories that, if they continue, could offer a challenge to the larger players. Bank of America’s US$3.5 billion was up 40% quarter-on-quarter (QoQ) and 9% YoY, while Morgan Stanley’s US$2.6 billion – the lowest revenue of the group – was up 37% both QoQ and YoY.

The supplementary leverage ratio (SLR) was a popular topic in results calls, with Bank of America CEO Brian Moynihan stating: “[The requirement] to hold capital at the level against riskless assets and treasuries and cash that doesn’t make a lot of sense and we’ve been saying that for a long time.”

With the deregulation agenda of the second Trump presidency, he continued: “We expect – we’ve heard it said – that there will be relief in that. That will help us provide liquidity to our clients.”

READ MORE: US president to oversee financial institution regulation amid deregulation drive

David Solomon, Goldman Sachs CEO, agreed. “I do think for the system broadly, SLR relief would have a benefit to Treasury markets. I think it’s an important structural reform,” he said.

Corroborating Moynihan, he added: “[We’ve] heard messages from both the Fed and the Treasury that this is a very, very high priority. We’re certainly optimistic, given the way they’ve been messaging, that there’ll be activity on that, and I think that’s broadly good for the system.”

Morgan Stanley’s chief financial officer Sharon Yeshaya argued that SLR should not be considered in isolation. “SLR has been, over various quarters, our biasing constraint,” she affirmed. “If there’s SLR reform, then we will move into a common equity tier 1-constrained world, and that provides us with additional opportunities as you think about capital deployment. That being said, it depends on what SLR reform you see.

We welcome regulatory reform, but from our perspective we should be looking at everything holistically.”

Dimon agreed that SLR should not be considered in isolation. “SLR alone isn’t going to change that much for us,” he commented. “We really need reform across SLR, global systemically important financial institutions (G-SIFIs), comprehensive capital analysis and review (CCAR), Basel III and the liquidity coverage ratio (LCR), all of which have deep flaws in them to make a material change.

©Markets Media Europe 2025