A continued sell-off in Treasury bonds, exacerbated after a notably poor 3-year auction on Tuesday, 8 April, has sparked widespread speculation among market participants. Analysts have proposed several drivers, including basis trades, SOFR versus Treasury trade stop-outs, and the aggressive sale of US bond holdings by the Chinese government. Though the precise reasons remain uncertain, recent market indicators signal heightened stress.

A macro hedge fund manager who wishes to remain anonymous told The DESK:

“Rumours are swirling as to the gyrations, from leverage statistical arbitrage unwinds in basis and relative value trades to foreign governments, particularly China, selling off their treasury holdings. No one knows, but these last few days have been one hell of a ride with some people getting seriously hurt.”

Mark Cabana, a rates strategist at Bank of America Securities, observed a significant recent shift in Treasury demand dynamics on 7 April, attributing it partly to concerns around inflation and a worsening fiscal situation. Cabana highlighted the diminished demand from traditional foreign buyers such as Japan and China, noting specifically a shift away from official foreign holders toward private investors, which could further challenge Treasury market stability. According to BofA, the demand from these critical players has decreased from 48% of the Treasury market in 2019 to about 39% currently.

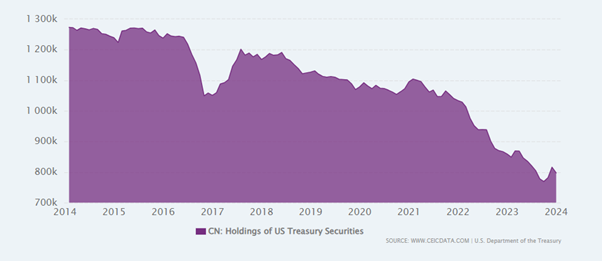

China has been steadily reducing its holding of US treasuries since the first Trump administration. They now stand at US$759 billion, according to US Department of the Treasury figures.

Concerns around foreign holdings were echoed by Deutsche Bank’s strategist George Saravelos, who suggested on 9 April that current US administration policies are inadvertently encouraging the sell-off of US Treasuries, particularly noting the ongoing tariff escalation and financial tensions with major foreign investors like China and Japan. Saravelos specifically highlighted the potential threat of a broader financial conflict with China weaponising its holdings of US assets, a move which would cause both Chinese owners and US issuers to suffer.

Adding to the complexity, UBS economists Julien Conzano and Matthew Mish observed a widening in EU credit spreads at the end of Q1 2025, suggesting increased market volatility. They attribute this volatility to a shift towards a new regime where credit fundamentals are overshadowed by technical and broader market sentiment.

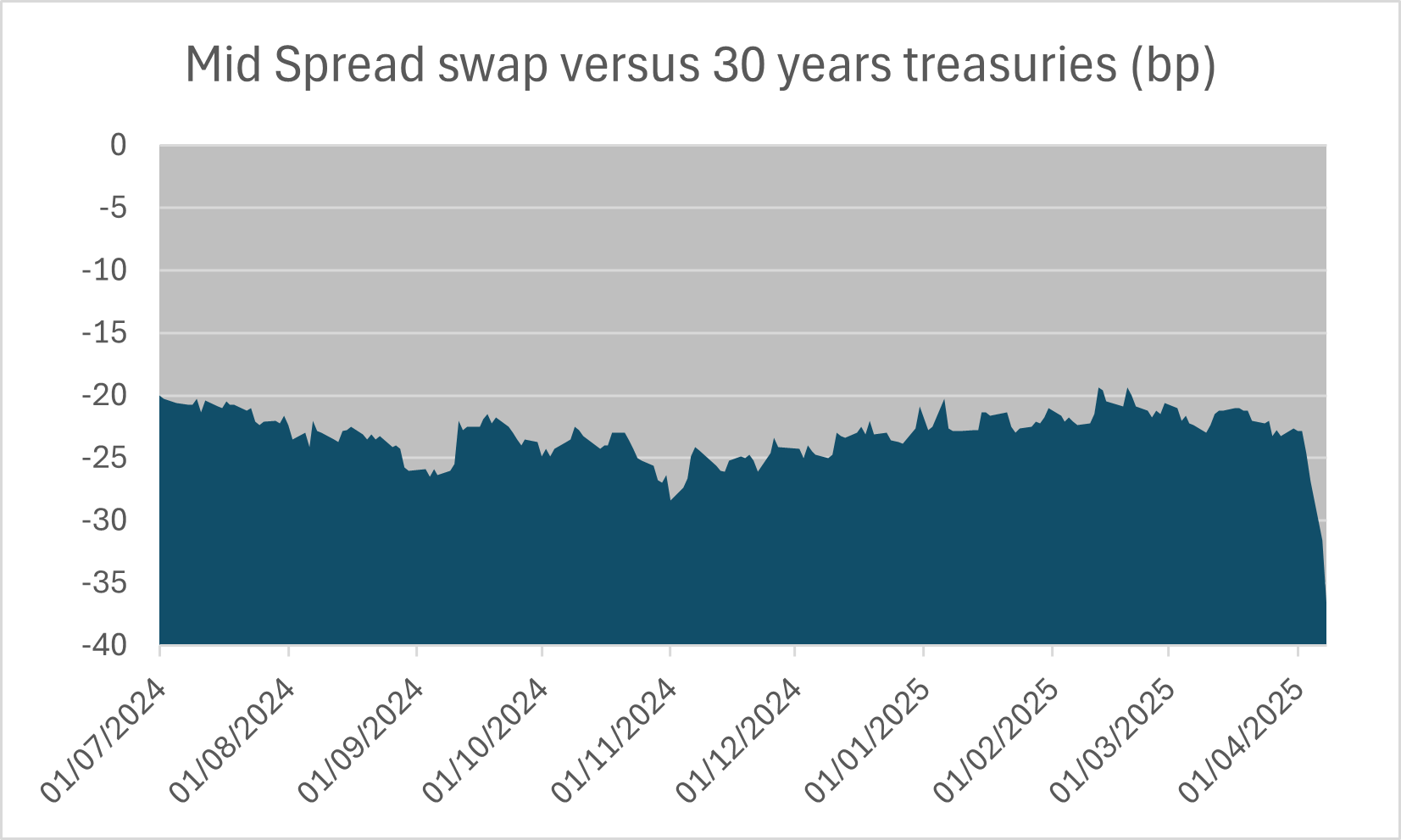

According to data from Tradeweb, the market showed clear stress signals through increased bid-offer spreads for on-the-run (OTR) US Treasuries. Mid swap spreads in particular showed major moves. One popular macro trade this year was based on the assumption that deregulation endeavours from the new administration would give banks further flexibility to hold Treasuries rather than swaps. This trade was unwound rapidly over the past week.

Open interest in the US bond future complex showed extreme deleveraging in the week finishing 9 April, with 5-year notes future open interest dropping 280,000 contracts between 8 and 9 April.

A conjunction of reasons is at play, from lower foreign investor participation in auctions to forced deleveraging in highly levered strategies like the basis trade or SOFR/Treasury spreads.

Recent research presented at the Brookings Institute called on the Fed to back-stop the plumbing of these very trades.

Read more: https://www.fi-desk.com/central-banks-should-backstop-hedge-funds-arbitraging-the-basis-trade-new-brookings-paper-suggests/

©Markets Media Europe 2025 TOP OF PAGE