Electronic trading between dealers and buy-side institutions is taking different paths in government bond markets, globally. Lucy Carter investigates.

“We have seen growth in the electronification of clients’ execution,” Liyan Yu, global head of rates electronic trading at JP Morgan, says. “The volume going through third-party electronic platforms has increased by 50% from 2021 to 2024, and the ticket count has increased even more. This means the clients are electronifying the execution of smaller tickets as they try to be more efficient.”

Electronic trading makes up more than half of trading in US Treasuries, according to analyst firm Coalition Greenwich, with overall e-trading taking 58% of total volume and 61% of dealer-to-client volume in January 2025. Often a global leader in market structure, the country sees greater trading volumes, better liquidity and tighter pricing as a result.

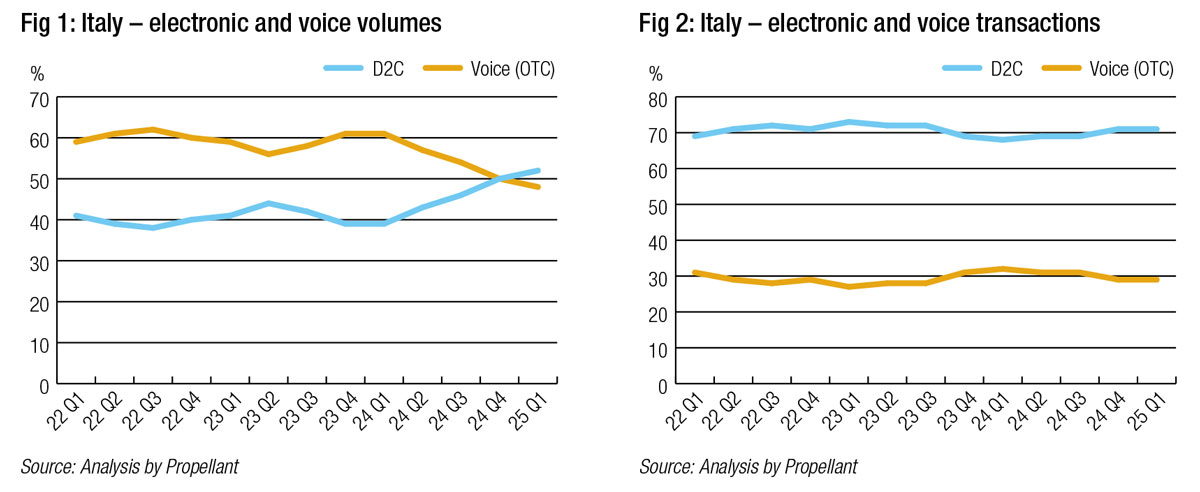

In the dealer to client (D2C) space, Italian government bonds (BTPs) have seen the percentage volume traded electronically, rise from 41% to 52% since Q1 2022, according to Propellant, an analytics technology provider.

This 11% rise is not reflected in the number of transactions made, suggesting that electronic trade sizes are increasing. Between Q1 2022 and Q1 2025, the percentage of transactions electronically traded was up just 2%.

Caroline Serdarevic, head of international and global head of sales at Millennium Advisors draws attention to the role of retail participation in Italy’s government bonds.

“An absolute ton of e-trading retail flow goes through local Italian exchanges, with MOT probably the most significant,” she says. “Via exchange, it’s all anonymous flow. You trade versus the exchange.

Laurent Paulhac, group CEO of Millennium Advisors added, “As a liquidity provider, we do most of our business with counterparties such as institutional investors, wealth managers – a wide range of others. We do trade in the interdealer market, predominantly to collapse risk. If we’re accumulating too much risk, the interdealer market is a very effective outlet and can be pretty active there.”

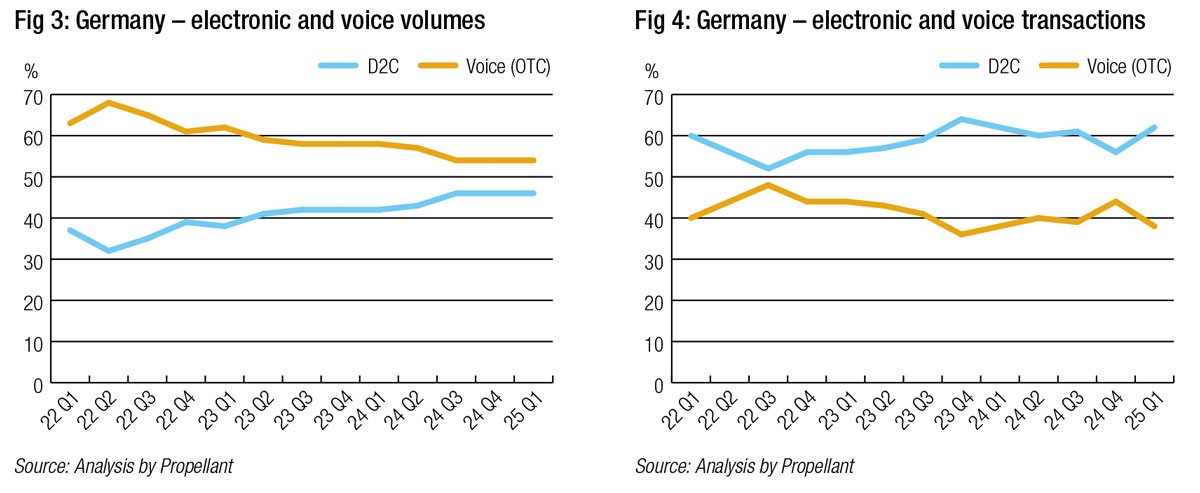

Germany is a little behind Italy when it comes to D2C rates trading electronification, according to analysis by Propellant. Although the percentage of volumes traded electronically has risen 9% over the last three years, the majority of the market remains voice-traded in terms of volumes. Since Q3 2024, the ratio has remained at a stubborn 46%/54%, in favour of voice.

By transaction count, electronic trading grew by 2% in tandem with Italy. However, voice remains far more prevalent in Germany, accounting for 62% of transactions in Q1 2025 after a Q4 2024 blip that saw the figure fall to 54%.

Japan

Japan, which boasts the largest holdings of US Treasuries outside the states, is directly influenced by the market’s e-trading trend. Growth of the strategy in Europe has also swayed the country. “While e-trading in Japan lags other developed markets, our research has found that adoption […] is growing as local investors seek out liquidity in both local and foreign markets,” a 2024 Coalition Greenwich report said.

This interest has seen managers searching for new volume and data management tools to deal with heightened demand, introducing e-trading functions specifically created to handle domestic flow.

“The international client base has become the main driver of the JGB market,” says Lu Fu, managing director and EMEA head of digital global markets at Mizuho. “International clients have become the major flow for us with JGBs globally. The domestic client flows have grown steadily over time, but there is a very sharp increase in the international client space. It’s very natural then, because these investors trade other products electronically, that there will be a boost of the electronic trading ratio in JGBs.”

However, there are a few factors preventing the market from rising up the e-trading ranks as fast as it could. Not least of these is the cultural preference for relationship-based trading. As of Q3 2024, 41% of Japanese fixed income investors determined allocations based on sales relationships, Coalition Greenwich said. Just 27% prioritised execution quality.

In line with this, global platforms like Tradeweb support e-trading in Japan, as does Yensai, an online Japanese government bond trading consortium for institutional investors established jointly by Daiwa, Nikko and Nomura, where liquidity provision is dominated by local firms.

That personal touch might be set to change, though, as the pace of trading accelerates.

“Asia-based investment managers average only two to four traders per desk across these asset class segments,” Coalition Greenwich’s report warned. “Augmentation via e-trading is the only way to keep up.” The benefits of e-trading, including an enhanced market view, improved distribution and workflow efficiency, are particularly useful for smaller teams, it added.

Drivers of change

A key contributor to rates market liquidity is the support of a well-functioning futures market. Futures are generally used for speculation, to sound out market sentiment and bet against expectations, or hedging. In the latter case, investors lock in prices to minimise their losses if interest rates rise and bond prices drop.

As exchange-traded products, futures are typically liquid and accessible, making them popular tools.

“The client range for Bund futures is pretty huge, nearly every financial market participant trades them,” Kai Rothenmeyer, derivatives trader at Allianz Global Investors, says of the German market. “It’s a Eurex contract, and only traded on their exchange. Liquidity is mainly provided by sell-side banks.”

By contrast, the Japanese market sees futures largely used by market makers, with some restrictions on the tenor of contracts available.

“Japanese government bond (JGB) futures are mainly used for hedging by liquidity providers,” says Fu. “However, we also see investor clients wanting to trade them, mainly because they want to trade JGBs but don’t have the cash to do so. The futures are a way for them to access the market at their level of risk appetite.

“We only have 10-year futures, unlike other govies that have multiple maturities,” Fu continues. “Longer maturities would help us have much better risk management in volatility.”

That said, she noted that JGB markets are seeing a growing number of investors opting for interest rate swaps on the bonds, via the over-the-counter (OTC) market.

Another accelerant has been the post financial crisis impetus to create better records of transactions which lends itself to electronic trading.

“The main driver behind increased e-trading is probably regulatory change over the past decade,” Fu says. “Regulations have been introduced to try to improve transparency, and the easiest way for people to provide more transparency is to go to electronic trading platforms.”

There is a resource gain saving traders time and firms money. Greater electronification and more efficient trading improves overall market liquidity.

“With e-trading, clients can get access to more liquidity, different types of trading protocols and a much wider range of liquidity providers,” she explains. “There are more options than just going to a traditional bank.”

Commercial imperatives

The dealer-to-dealer market which is highly electronic has become dominated by non-bank liquidity providers in the US Treasury space, and these firms are also finding commercial advantage by engaging in the D2C market.

“There has been an increasing number of non-bank liquidity providers (NBLPs) coming to market over the last few years. It’s has been a big trend worldwide,” agrees Paulhac.

“The Italian market is a great illustration of the fragmentation and distinct regional flavours of the rates space(s) across Europe,” Serdarevic says. “In Italian government bonds (BTPs), almost all Italian counterparties will have access to, and actively participate on, the exchanges. The landscape is shifting all the time, and we are seeing other smaller venues compete for market share.”

Elsewhere in Europe, some smaller liquidity providers are being superseded by industry giants.

“Local banks are usually the standard counterparties, but when it comes to Bunds in particular the German banking landscape has shrunk over time,” a trader at a large German investment company told The DESK. “Prime brokerage for Bunds is quite costly, so the likes of Commerzbank have dropped out and been replaced by other, larger players from the EU and US banking sector.”

Japanese sell-side firms are also facing competition from international players, particularly when it comes to foreign investment in JGBs.

“Domestically the major players are big Japanese banks, but internationally there’s increasing competition from international banks in liquidity provision,” Fu reported. “However, there’s not much of a non-bank liquidity provider (NBLP) presence.”

“I’m not sure that will change,” she mused. “NBLPs are data driven, they require a lot of transparency and a really robust risk management system. I don’t think we have that at the moment for JGBs. NBLPs have very quantitative approaches, which fits with the US Treasuries markets and could work in EGBs. But for JGBs, the transparency and market structure for hedging may not be there.”

“In general, I think it’s a good mix of all different types of counterparties,” Fu observed. “I don’t think the nature of the JGB market is like Treasuries, where latency is such a critical thing, and you have a lot of high frequency trader-like players. It’s a different situation; speed is not the main thing for JGBs.”

Automation

Rothenmeyer notes that electronification reduces friction in trading but is not the same as automation. This has been the facilitator of NBLPs in the D2D space. The next evolutionary step towards that is the use of machines and algos to trade, which he observes already happens on the buy and sell side.

”You have to distinguish what you really define as electronification,” Rothenmeyer explains. “Electronification for me is trading bonds and those futures and electronically via a platform, not through chat or via telephone. That’s well-established in the European government bond (EGB) market. I can’t imagine trading a future or a German government bond (Bund) by voice, especially when you take the number of trades and the time saving you have versus best execution. When it comes to automation it’s a different story. Nowadays, in EGBs, lots of paper trades by algos. You as a human being don’t really interact with your sell side or broker, the algo does the work for you. That’s the next step in electronification.”

“Automation trends are very much following e-trading trends in fixed income more broadly,” adds Serdarevic. “Automation works really well where you have markets that are transparent and have deep pockets of liquidity. You see all of those hallmarks in the BTP and EGB markets.”

One trader familiar with the matter told The DESK that, across EGBs as a whole, D2D e-trading volumes and ticket counts have doubled between 2022 and 2024.

However, although European rates markets are broadly following the US trend of electronification, the eurozone is hamstrung by one of its most troublesome issues – fragmentation.

In the US, a single, concentrated liquidity pool means that turnover is high. In a region with already fragmented markets, centralising players and aligning requirements and approaches is a major challenge. It is inevitable that some countries will get ahead of others.

There is also considerable disparity between the size of rates markets in the region, meaning that their liquidity is limited. Although e-trading is often used to increase liquidity, an initial lack of it can mean that markets don’t think the payoff will be worth it.

The electronification of the EGB market will continue to increase, Serdarevic predicted, but fragmentation will likely keep it behind the US rate of adoption.

“Simply by virtue of the fact you have many government issuers in Europe, liquidity is more fragmented. In the US, a decent amount of automated treasury flow is hedging credit trading. For Euro credit, you’ll see that hedging activity predominantly in Bunds, but less so in SPGBs or FRTRs for example. There are structural hurdles in the way of absolute adoption. These could put a cap on how much of the market can be electronified, preventing Europe from reaching the US’s lofty ratios.”

One buy-side trader concurred, “There are various differences compared to the US. Some US papers are coded in yields only, where the quoted price is a yield rather than a price level, which you don’t have in bunds or EGBs. You can imagine from face notional that those US papers have a bigger turnover.”

However, they added that liquidity in European bonds is far from problematic. “We don’t face any problems when it comes to liquidity. The pieces you get back are either close to mid or exceed your expectations. The European government bond market is quite efficient. We are able to trade all the time, mostly at mid or better, regardless of size or maturity. That tells you how liquid those markets are.”

They acknowledged that smaller markets, such as Spain or Finland, may have to opt for trading below mid. “But still, the liquidity providers there are quite efficient and do provide a very fair market,” they argued.

Strong liquidity in the market raises the question of whether further electronification is needed. If markets are operating efficiently, the time, money and effort required to bring in new trading practices and systems may be redundant.

While the timelines may be more slow-and-steady than hare-like, experts like Serdarevic are confident in the path forward.

“The US is the biggest fixed income market in the world, and it is setting the direction of travel. There may be lag in adoption, or region-specific nuances to be taken into account elsewhere, but overall, it’s a one-way track.”

©Markets Media Europe 2025