Dealers are backing several new trading platforms who are fighting major incumbents for market share.

In the bond market, the trading platform landscape has been well set for over a decade, with fierce competition in credit and rates between the incumbent trading venues, including MarketAxess and Tradeweb, platforms like Brokertec which have allowed non-dealers to enter the interdealer rates market, and the ubiquitous Bloomberg whose presence across data, messaging, news and trading has made it a successful participant throughout the trading workflow.

There are nevertheless other major platform operators who are stepping in to fight for market share, and the potential for moving liquidity away from incumbents is ever present in an over-the-counter market.

Semi-precious about liquidity

The kingmakers for new entrants are often the liquidity providers, who are competing driving their platform partners to lower fees and allow higher margins. These firms, traditional dealers and electronic liquidity providers, can make or break a platform.

They have frequently teamed up in the past to try and support a competitor to the major platforms, such as the failed Project Amber. Like its semi-precious namesake ‘Project Turquoise’, which forced down pricing in European equity markets in 2008 after MiFID I, it was hoped to deliver a dealer-led trading platform.

Where exchange-traded markets always have a home bias towards trading certain securities on the exchanges that list them, bonds have no such relationship to trading venues, and trading is largely conducted bilaterally with each counterparty consenting to execution, rather than a platform matching orders on their behalf. As a result, liquidity has shifted relatively easily between different providers, based only on user preference. A good example is the US treasury market, which has seen huge market share swings between successful electronic venues.

As a dealer-led initiative has not emerged, the major contenders stepping up to the top tier are all experienced platform operators, but crucially each is backed by teams of liquidity providers to try and help them realise their potential.

FMX has a future

In the US, BGC Partners has launched FMX Futures in September 2024, which currently trades SOFR futures contracts, but is expected to launch Treasury Futures in competition with incumbent trading giant CME. The incumbent owns Brokertec, the interdealer platform for Treasuries trading, allowing it to provide access to both bonds and future contracts.

Its owner BGC Group, was formerly led by Howard Lutnick, now the secretary of commerce in the Trump administration, and currently counts his son, Brandon Lutnick, as one of its board of directors.

FMX has also equity shares owned by Bank of America, Barclays, Citadel Securities, Citi, JP Morgan, Goldman Sachs, Jump Trading Group, Morgan Stanley, Tower Research Capital and Wells Fargo.

According to sell-side market analysts, investors are negative on its prospects, however the banks themselves are positive.

In December, before Howard Lutnick had left the firm and divested his ownership. Morgan Stanley’s analysts, Michael Cyprys and Stefanie Ma, wrote, “FMX launch of interest rate futures is still too early to assess success or traction, and our experts express some scepticism.”

Despite the firm’s success in the cash treasuries market, via Fenics UST, where it gained 30% market share of volumes in the inter-dealer market, competing on better technology and lower pricing, they said investors saw the biggest hurdles would be getting the clearing arms at broker dealers up and running to clear products, which is time consuming.

“Additionally, building liquidity will be key to garnering broader market participation, particularly from the buyside where benefits of a new exchange are viewed with more scepticism initially,” they wrote. “What does success look like? One expert noted if they gain 10-15% market share of rate futures, that could be determinant of success compared to the 30% share in inter-dealer treasuries, though the biggest question is what’s the timeframe and path to get there. Most experts echo that a better case scenario would be if CME takes action to lower pricing to remain competitive.”

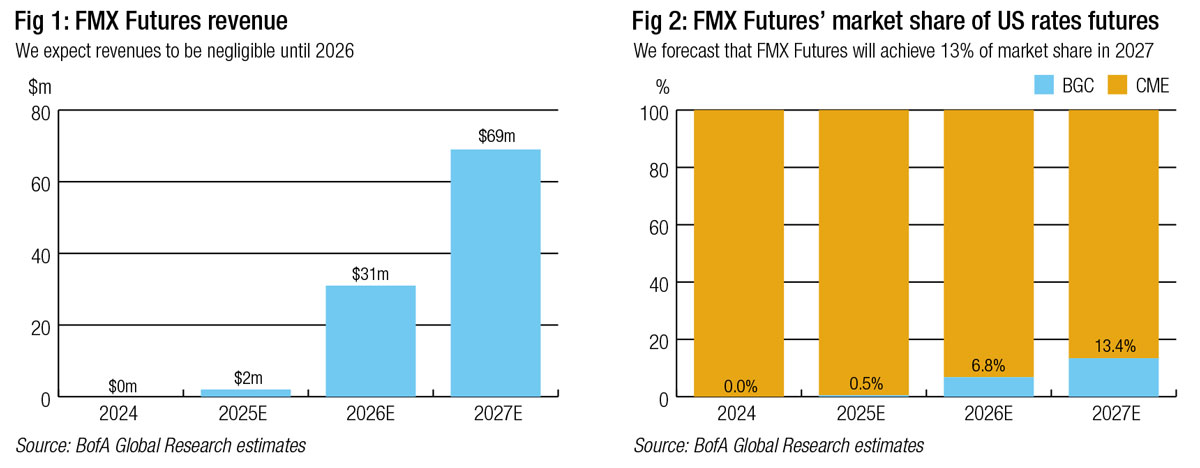

In February, following the departure of Howard Lutnick, Bank of America analysts said they stood in opposition to investor views, of FMX, which were still negative.

“In our view, the market is substantially underestimating the viability of FMX Futures,” they wrote. “The vast majority of our investor clients believe that FMX Futures is unlikely to exist as a going concern in 2030, much less mount serious competition to CME. In light of (1) the superiority of FMX relative to prior competitors, (2) the untapped opportunity for innovation and further capital saves and (3) CME’s heightened vulnerability, we think that FMX Futures is a highly credible new entrant.”

They predicted a potential 10% share of interest rate futures market share by Q4 2027 “with de minimis profits” but noted that a 20% share is possible.

“BGC CEO Howard Lutnick doubles as the co-chair of Trump’s transition team and the secretary of the Department of Commerce,” they wrote. “He has been very vocal on his feelings toward CME. Lutnick has referred to CME Group as a monopoly dozens of times, dating back decades. A short regulatory leash could limit CME’s manoeuvrability, hinder their efforts to defend share and divert management attention.”

A glowing BondVision

In Europe, MTS Markets, part of Euronext Group, has longstanding strength in the rates markets, but last August launched an exerted effort into the corporate bond space in earnest.

Euronext’s bond trading revenues, which are channelled via MTS Markets, increased from €107 in December 2023, to €146 million in December 2024, and in February 2025 Morgan Stanley upgraded its predicted full year revenues for Euronext’s bond trading revenues for the next three years by 3% a year.

“Prior to September, BondVision had an EGB market share of about 7%, now it is in double figures and it’s rising steadily,” says MTS Markets’ CEO, Angelo Proni. “We’re also rolling out functionality in support of that. The incumbent platforms are beginning to respond, but our momentum remains strong. Features and trading protocols that we’re rolling out will be challenging to catch up on in a short enough space of time to stop us in our tracks.”

The analysts argued that February 2025 data evidences, “continued cyclical improvement, running ahead of our above consensus estimates for Euronext, with cash equity +32%, average daily volume year-on-year, fixed income MTS cash +63% and FX +25% all running ahead of expectations.”

Proni observes that the firm’s dealer support is key to success, as the pressure on fees from other platforms has led dealers to look for more cost effective alternatives, and MTS is seeing a continued onboarding of liquidity providers.

“On the credit side we launched the initiative with four dealers connected. We’ve now added another six, amongst which major names; JP Morgan, Citi, Bank of America, Deutsche Bank and Morgan Stanley, with another six or seven to come over the coming weeks. We are now getting to the point where we really have a critical mass of dealers and liquidity providers who are supporting us.”

These firms are also offering a better outcome for their clients, he notes, as a result of the advantageous pricing.

“Some of the dealers tell us that they are beginning to price differentiate on the platform and in their streams, because they’re building the commercial advantages that we are offering them into their pricing models. In addition to that, we are adding portfolio trading by the end of the year.”

At present, trading protocols are primarily request-for-quote (RFQ) and click-to-trade, however this is evolving.

“We also have introduced what we call the Dealer-to-Client Ticket (DCT) which supports non-competitive order flows with specific functionality to increase efficiency for both buy and sell-side,” notes Proni.

At its European Financial Conference, Morgan Stanley posed this question to Euronext’s management, “Fixed income appears to have scope to grow both due to Internationalisation, extending the platform to offer trading of French, Dutch and other debt beyond just Italian Sovereign, as well as benefitting from the electronification of credit markets – how are discussions with the debt offices going on the former, and how to think about the latter – how penetrated is electronic – could MTS become the Tradeweb of Europe?”

Highly Liquidnet

Finally, a relatively unknown player, will result from the launch of Liquidnet’s credit business and the recently acquired axe-streaming service, Neptune, combined into a new entity.

The combined business will be owned by Liquidnet, but with a shareholding of nine banks who will also be liquidity providers on the service, according to sources. Although this is highly secretive, and Liquidnet has declined to make any comment on the new entity, from a bond trading point of view it makes sense.

The ‘axes’ that Neptune streams to users are adverts for dealer activity. They are hoped to draw in buy-side counterparts who will trade with the bank or liquidity provider over-the-counter (OTC). For really large buy-side orders, finding a liquidity who will trade the whole order allows the buy-side trader to approach them without putting the order into competition (non-comp) with other dealers.

This will then typically be traded as a block trade. As a platform that specialises in block trades, Liquidnet would be ideally placed to then execute any order that were matched by the trading desks based on axes they have seen.

Although there is no information on the platform available, conceptually this could be a highly efficient way for Liquidnet to deliver a workflow for buy-side clients that then allows dealers to maximise their access to non-comp trading.

©Markets Media Europe 2025