A research paper to be presented at the Brookings Papers on Economic Activity (BPEA) conference on 28 March, argues that central banks, particularly the Federal Reserve, should implement targeted interventions in the US Treasury market by backstopping hedge funds involved in the basis trade during periods of extreme market stress.

The paper, authored by Anil K Kashyap (University of Chicago Booth School of Business, former external member of the Bank of England’s Financial Policy Committee), Jeremy C. Stein (Harvard University, former governor of the Federal Reserve Board), Jonathan L. Wallen (Harvard Business School), and Joshua Younger (Columbia University, formerly a senior policy advisor at the Federal Reserve Bank of New York), highlights a growing fragility in the Treasury market driven by hedge funds’ heavily leveraged trading strategies, and proposes a novel policy mechanism aimed at mitigating systemic risks without creating moral hazard.

The research describes the basis trade; the strategy is used by hedge funds to exploit discrepancies between cash Treasury securities and their corresponding derivatives such as Treasury futures. Hedge funds typically borrow aggressively via repurchase agreements (repos) to fund large purchases of cash Treasuries, simultaneously selling short Treasury futures.

By February 2020, hedge fund involvement had sharply escalated, with their net short futures positions reaching about US$900 billion, paired with cash Treasury long positions funded by around US$1.4 trillion of repo borrowing. Leveraged hedge funds commonly operated at leverage ratios of 50-to-1, meaning even minor market disruptions could trigger margin calls capable of forcing rapid unwinds.

The paper provides extensive evidence surrounding the severe dislocation during the onset of COVID-19 in March 2020. Initial margin requirements on Treasury futures more than doubled for certain maturities, forcing leveraged hedge funds to rapidly unwind positions. From 3 March to 17 March, hedge funds reduced their short futures positions by approximately US$62 billion, matched by a simultaneous unwind of repo funded cash positions. Dealers initially absorbed these positions, increasing their futures shorts by approximately US$57 billion, but quickly reached their capacity constraints.

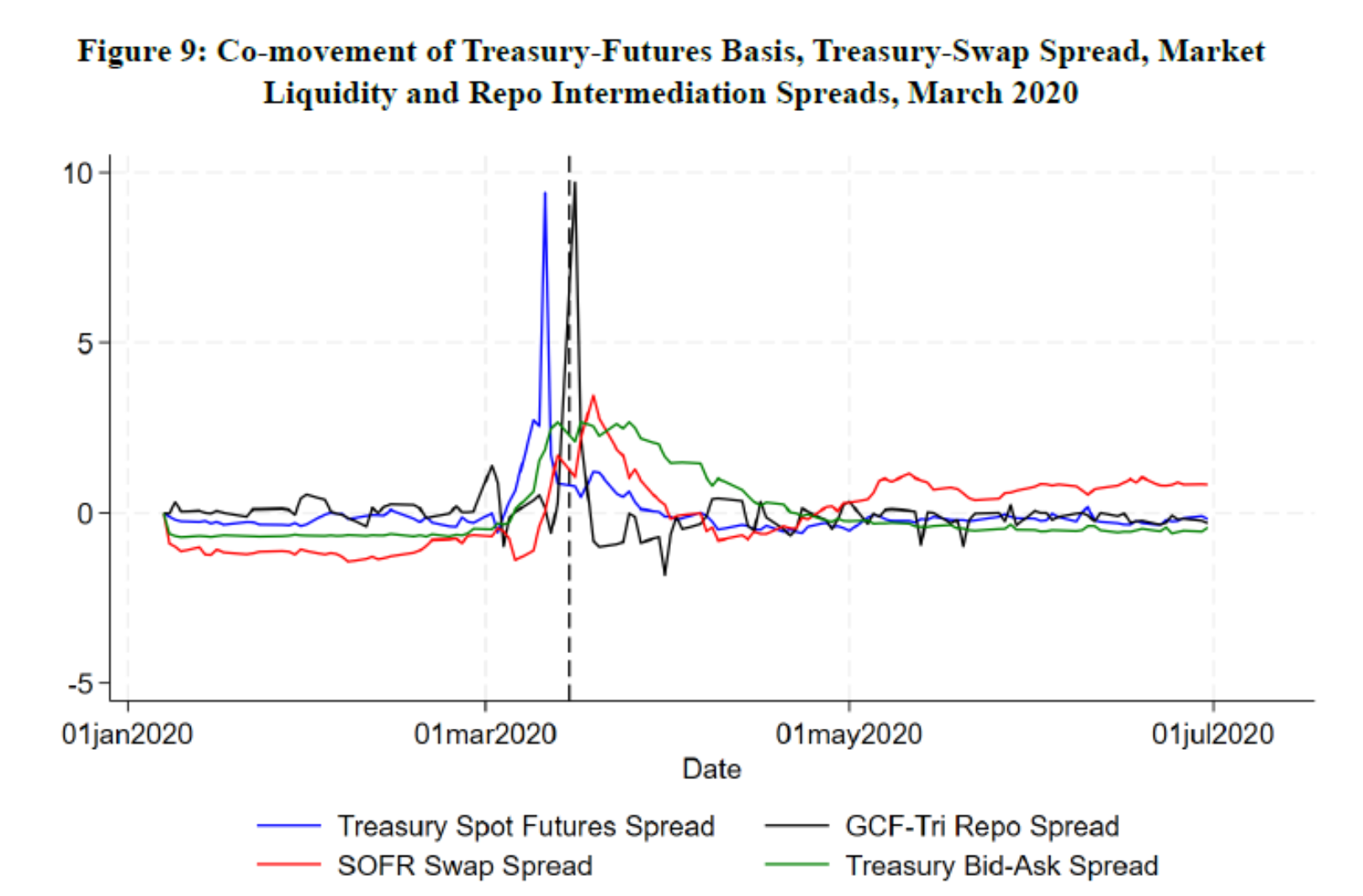

Consequently, the cash-futures basis spread spiked dramatically exceeding seventy basis points at its peak, compared to a typical average spread of around five basis points. The dysfunction spilled into other segments of the market, with Treasury bid-ask spreads more than quadrupling and repo intermediation spreads also rising significantly.

Empirical Evidence and Model Description

To better understand the dynamics, the authors construct a model involving three market participants: broker-dealers, hedge funds, and asset managers. Broker-dealers and hedge funds hedge interest rate exposure, but asset managers, such as pension funds and insurers, remain structurally long Treasuries and Treasury derivatives to achieve duration targets necessary due to insufficient availability of suitable long term corporate debt. The authors highlight that the total volume of liabilities for defined benefit pension funds and life insurance companies exceeded US$25 trillion by late 2024, dwarfing the available US$2.8 trillion in long duration corporate bonds.

Their model quantitatively demonstrates how an increase in Treasury supply exacerbates fragility, as hedge funds proportionately increase leveraged positions. Specifically, a regression analysis suggests that a US$100 billion increase in Treasury supply increases hedge fund short positions in futures by about US$5 billion, indicating significant vulnerability as Treasury issuance expands. The Congressional Budget Office (CBO) projects it will rise sharply in the next decade.

Policy Recommendations: Hedged Purchases

Acknowledging the Federal Reserve’s massive, unhedged Treasury purchases totalling about US$1.6 trillion between March and May 2020 as necessary but problematic due to blending financial stability measures with monetary policy, the authors propose a more surgical policy tool termed “hedged purchases.”

Under this mechanism, the Fed would purchase Treasuries while simultaneously selling Treasury futures. These purchases would directly match the positions hedge funds are forced to unwind, thus immediately alleviating pressure without affecting monetary policy stance or influencing term premia significantly.

Importantly, the authors propose that the Fed conduct these transactions via auctions at penalty discounts. This ensures market participants do not anticipate full protection from losses, effectively addressing moral hazard concerns. They argue that because hedged purchases explicitly exclude duration risk, unlike conventional Quantitative Easing (QE), this approach reduces the incentive for risky behaviour, limiting the potential for a Fed induced moral hazard.

©Markets Media Europe 2025 TOP OF PAGE