In a show of strength, exemplified by Itaú Unibanco’s US$1 billion issuance on 27 February, South American debt capital markets have carried on functioning unabated.

Amidst a broader correction in US markets, South American issuers continue to successfully access debt capital markets. Itaú Unibanco’s landmark issuance of US$1 billion in senior notes on 27 February 2025 underscores the region’s robust investor appetite.

The Itaú transaction, with a coupon of 6.0% maturing in 2030, was well-received by international investors, highlighting continued confidence in major South American banks. Further illustrating the market’s depth, Raízen, a prominent Brazilian biofuel and energy company, also successfully placed a US$1.75 billion green bond earlier this year. This included US$1 billion of 6.45% notes due in 2034 and US$500 million of 6.95% notes due in 2054, attracting ESG-focused investor demand.

According to recent research from Bank of America’s GEM fixed income strategy team, despite broader market volatility and EM high yield spreads narrowing relative to US counterparts, investor flows into Latin American local debt markets, notably Mexico and Colombia, remain positive. In February alone, foreign investors purchased US$2.1 billion in Mexican local government bonds, reversing earlier outflows.

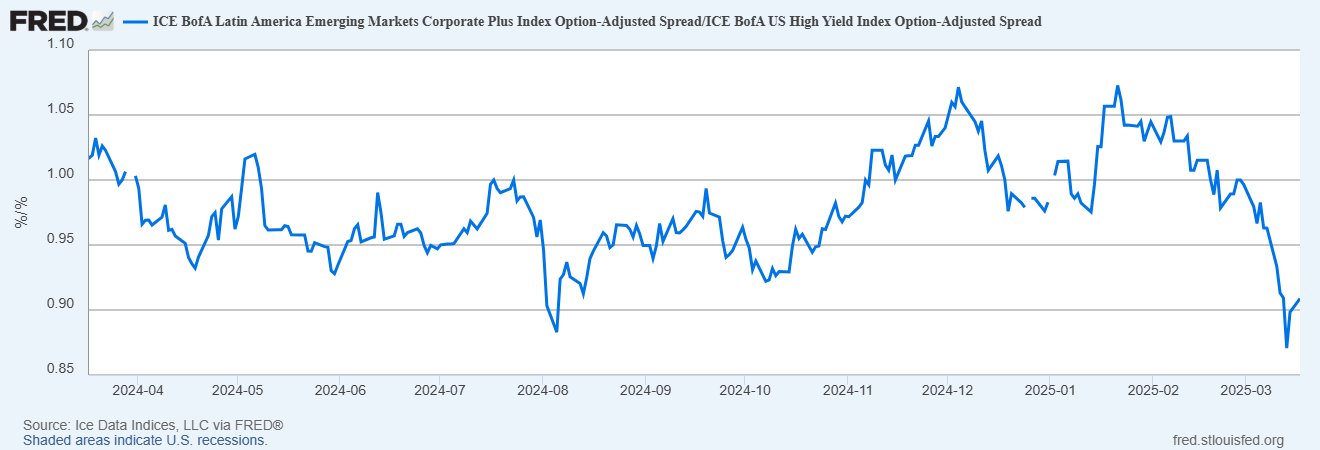

The Latin American Corp+ Option Adjusted Spread (OAS) ratioed to US high yield (H) OAS has been trending strongly lower despite US risk off moves these past few months.

In the sovereign space, significant activity includes Mexico’s largest-ever issuance of US$8.5 billion in January, consisting of three tranches due in 2030, 2037, and 2055, with yields ranging from 6.00% to 7.375%. Chile also accessed international markets with a dual-tranche US$3.3 billion issuance, including a €1.7 billion social bond due in 2032 and US$1.6 billion in notes due in 2037.

©Markets Media Europe 2025