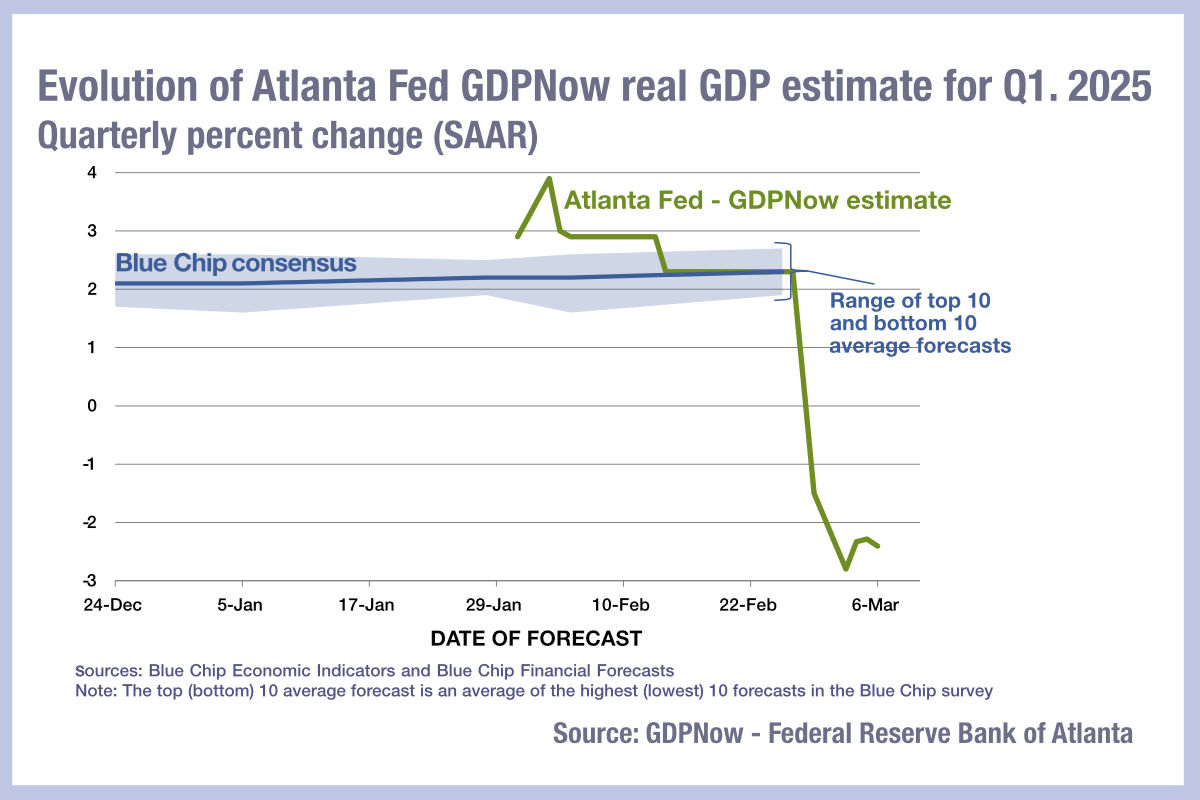

The Atlanta Federal Reserve’s GDPNow estimate for real GDP growth in the US hit 2.4% on 6 March 2025, up from -2.8 percent on 3 March, based on new economic data around consumption, private domestic investment growth and net exports.

The measure, which is a running estimate of real GDP growth based on available economic data for the current measured quarter, has raised concerns about the impact of US tariffs and retail responses to economic concerns.

The level of concern amongst investment bank analysts reflects a less severe view of the economy, with Morgan Stanley’s analysts noted that the base case for consumption had been driven up by spending triggered by hurricane threats/damage, which accentuated the decline in spend when the danger had passed.

“While some indicators like the Atlanta Fed GDP Nowcast have declined a lot, most of that decline has been from the net trade component, which is likely skewed by higher imports for inventory build-up ahead of tariffs,” the MS analysts observed on 6 March. “In comparison, our economists are tracking Q1 GDP growth at ~1.4%, although their estimates have also come down in recent weeks.”

An interview conducted by Fox News with US president, Donald Trump, also on 6 March cited his response to the risk of a recession as being, “I hate to predict things like that. There is a period of transition, because what we’re doing is very big.”

This raised hackles in the week beginning Monday 10 March, after it was aired on 9 March, and triggered a sell-off in the US equity markets.

The MS research, authored ahead of the president’s comments said, “We would also emphasise that our economists’ base case over time is not for a recession, but for a slower rate of growth. For 2025 and 2026, they expect growth between 1-2%. That is clearly a step down from the last two years. But, nonetheless, we would still frame these as ‘credit friendly’, based on historical data.”

They show that credit has performed at its best when the economy grows steadily – typically by 1-2% – indicating that “cooling growth may temper animal spirts and reduce corporate debt supply, a technical positive against macro uncertainty.”

©Markets Media Europe 2025