While US stock markets are in turmoil, US investment grade bond markets are also reflecting the greater uncertainty caused by an erratic approach to tariff application and flip-flopping on both foreign and domestic policies.

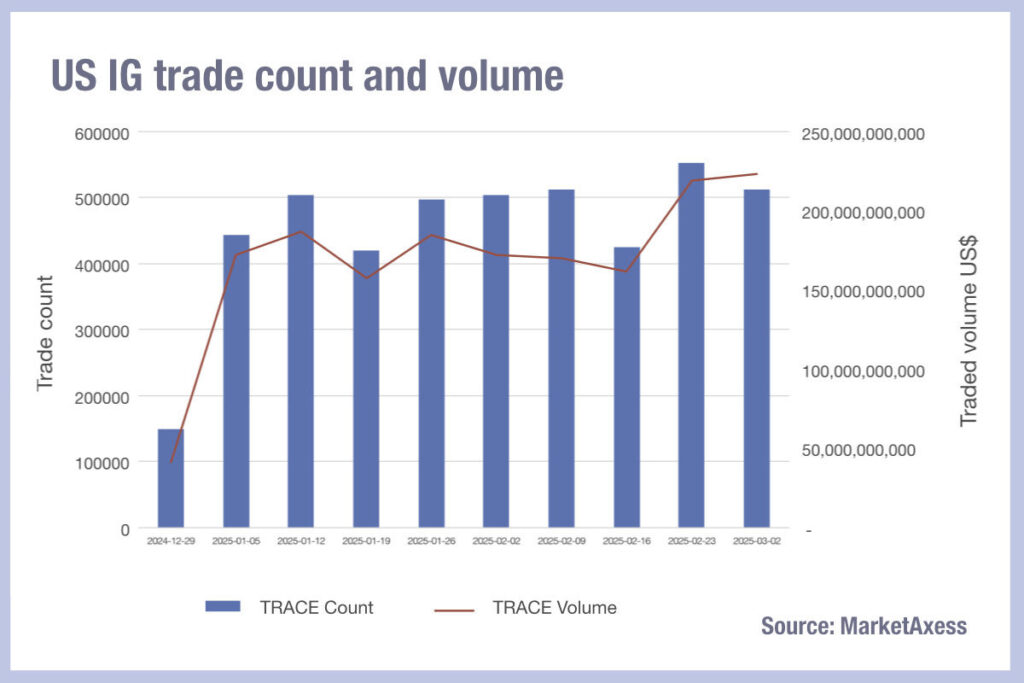

TRACE volumes of trading in US investment grade corporate bonds ticked up somewhat in late February with the year’s highest count in the first week of March at US$223 billion, according to MarketAxess data, while the trade count in the final week of February hit the year’s high at 553,274, the average range having been between 400-500,000 trades per week, relatively consistently.

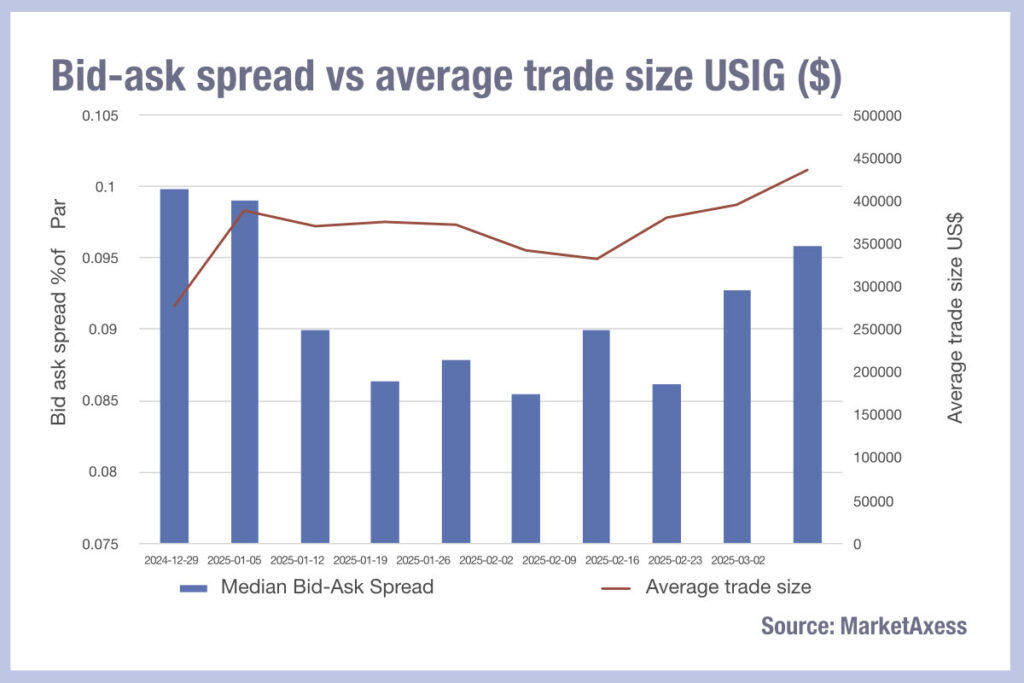

If we look at median bid-ask spreads for the year, MarketAxess CP+ data shows they were tightening up to mid-February, staying below 0.09 from early January onwards, before rapidly expanding towards the beginning of March, rising from 0.0862 to 0.0958 in three weeks.

At the same time the average trade size had fallen to 331,000 in early February but then began expanding to 435,000 by the first week of March.

An increase in average trade sizes can reflect trading in a highly directional market, where getting an order filled is of primary importance as pricing is moving against the trader, making price improvement less likely.

A combination expanding bid-ask spreads and increasing trade sizes suggests that the cost of liquidity is increasing, and immediacy of execution is becoming more important, despite there being no material changes in trading volumes – therefore no major trigger based on activity.

One way to read this, is that buy-side traders are feeling the need to move positions at size, but their sell-side counterparties are increasing the cost at which they are prepared to take on risk. Market measures of bond market volatility indicate that vol is up since mid-February, albeit not at the same scale as November following the election.

©Markets Media Europe 2025