In January 2025, Debt Capital Markets (DCM) for credit issuance retreated in the US and in Europe while primary activity for municipal bonds (Munis) grew.

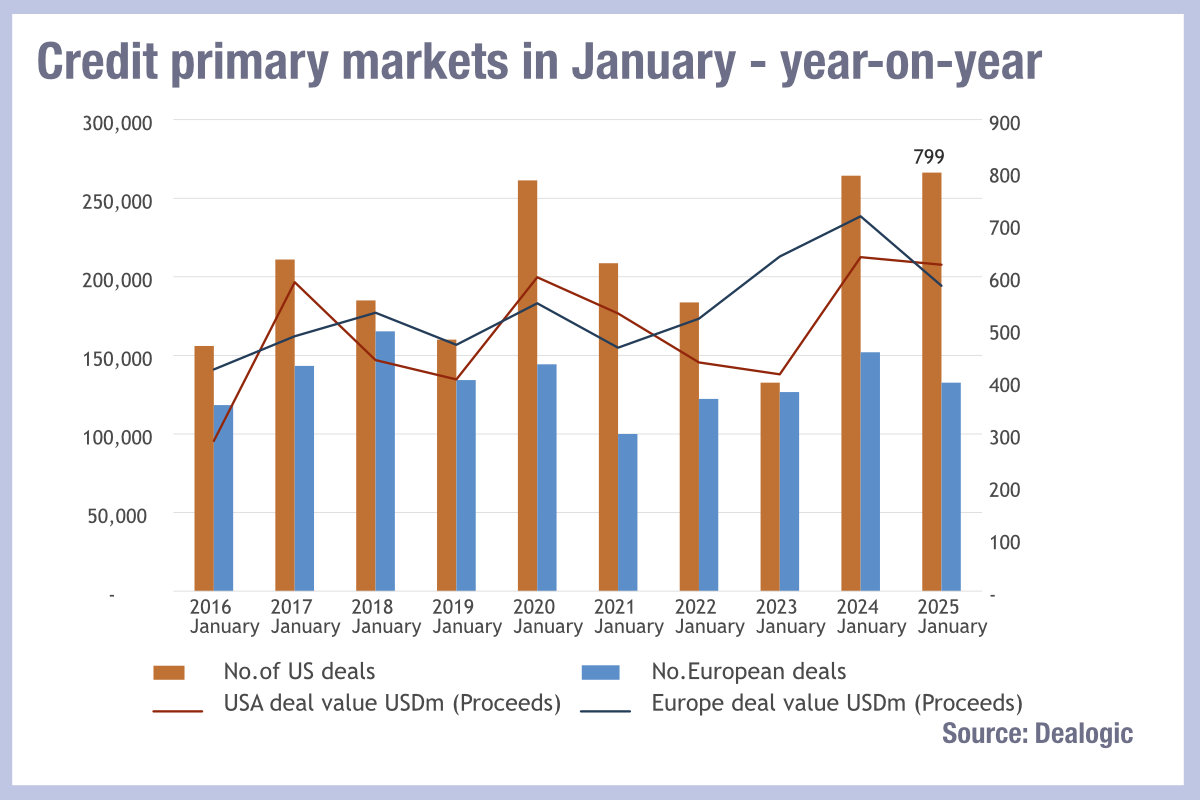

Data provided by Dealogic shows European and American credit primary markets were active in January 2025 but did not surpass 2024 activity for the same month. In the US, 799 deals for US$208 billion notional took place in January 2025 while, in Europe, 398 deals raised US$194billion.

Primary activity in the US was on par with the activity in January 2024 when 793 deals took place for US$ 212 billion notional.

Financial institutions raised US$47.3 billion in 522 deals. The notional amount raised decreased 11.5% compared to January 2024 while deals executed increased to 522 compared with 465 in January 2024.

Corporate deals raised US$65.2 billion in fifty deals, a decrease in value year on year of 13.8% in notional and of 25.4% in number of deals executed. Mortgage-Backed Securities (MBS) deals raised US$95 billion an increase of 14.3% in value compared to January 2024 in 227 deals compared to 261 in January 2024.

In Europe, activity was slower than in January 2024 when US$239 billion worth of deals were executed in 456 operations. In January 2025, 398 deals raised a total of US$ 194 billion, a decrease in capital raised of 18.6% and in activity of 12.7%.

Financial institutions raised 23.7% less than in January 2024 at US$125 billion, corporate raised US$58 billion, a decrease of 13.3% in the amount of capital raised while deal numbers increased 11.4% to 137. 20 MBS deals closed, compared to seventeen the year before raising US$10.7 billion an increase of 31% in notional raised year on year.

CUSIP data for January also points to a possible slower February tally. CUSIP requests happen before the public offering of any issue and foreshadow actual activity in the primary markets the following month. CUSIP requests for debt identifiers were down 32.6% in January 2025 compared to January 2024.

On the other hand, data provided by CUSIP International shows activity increased in the Munis markets in January 2025: Issuers requested 740 new identifiers versus 727 in January 2024.

Activity was especially large for long term municipal notes where thirty-seven new CUSIP were requested compared to eight only the year before and for municipal bonds where 610 CUSIP were requested versus 579 a year before.

©Markets Media Europe 2025