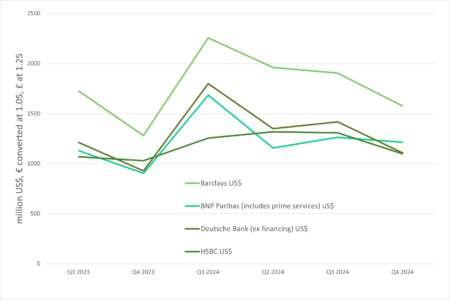

Barclays and HSBC both saw relatively subdued fixed income, currencies, and commodities (FICC) trading results in Q4 2024 compared to peers like BNP Paribas.

Barclays recorded FICC revenues of US$1,576.25 million in Q4 2024, up from US$1,281.25 million a year earlier (a year-on-year rise of roughly 23%) but down 17% from US$1,905 million in Q3 2024. HSBC’s FICC revenues came in at US$1,099 million for Q4 2024, representing a modest 6.8% increase over Q4 2023 (US$1,029 million) yet a 16% sequential drop from Q3 2024 (US$1,308 million).

By contrast, BNP Paribas rose to US$1,213.8 million in Q4 2024 from US$904.05 million in Q4 2023, while Deutsche Bank climbed to US$1,107.75 million in Q4 2024 from US$927.15 million in Q4 2023. BNP Paribas and Deutsche Bank also experienced seasonality with their Q4 over Q3 trading results declining 3.9% and 21.8% respectively.

Barclays attributed its year-on-year improvement to healthy activity in rates and credit trading.

Reflecting on the beginning of 2025, group CEO C.S. Venkatakrishnan said: “Within fixed income trading, we had a weaker start to the year in macro trading and European rates, but we have begun to see momentum in those businesses again.”

Meanwhile, HSBC’s FICC segment, which is heavily driven by foreign exchange trading, remained under pressure in rates and credit.

Group CEO Georges Elhedery remarked: “We saw resilience in macro trading and FX, but parts of the rates and credit businesses were impacted by lower spreads and reduced client risk appetite.”

©Markets Media Europe 2025