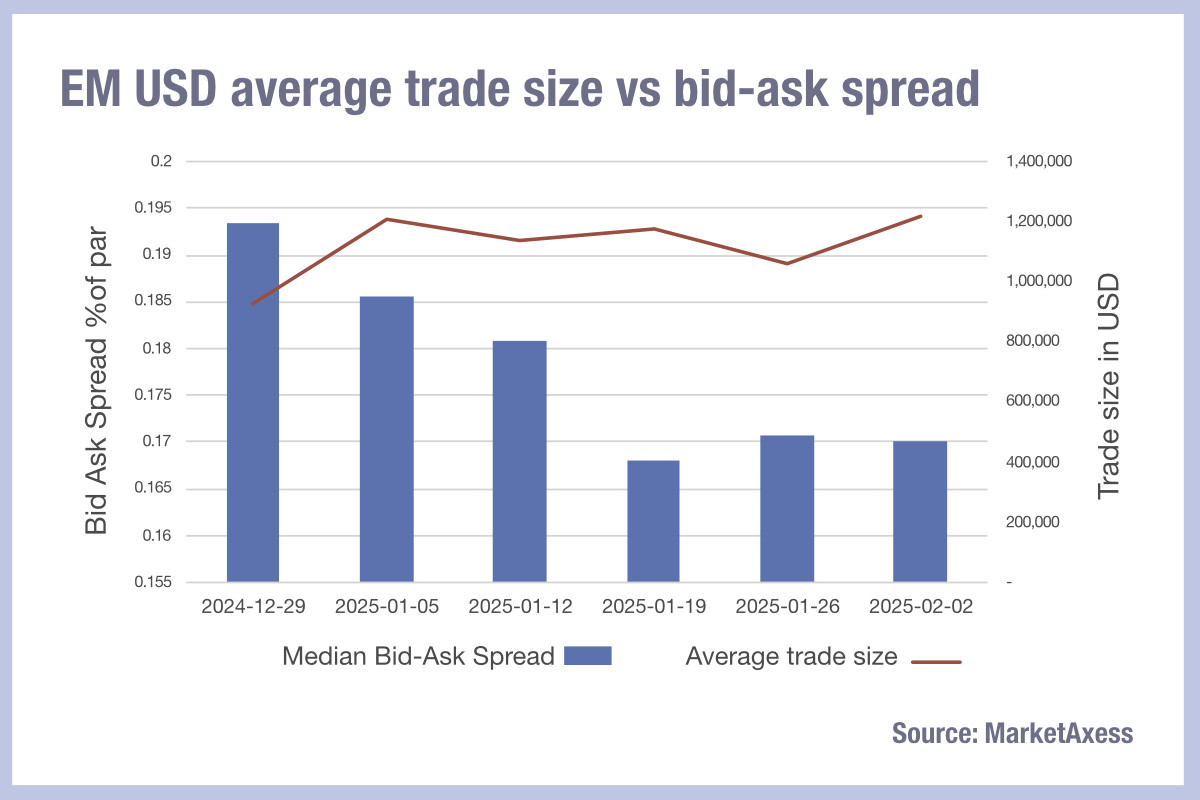

The cost of liquidity in emerging markets appears to be falling for fixed income traders. Looking at MarketAxess’s CP+ consolidated price feed, and cross-referencing with the MarketAxess TraX dataset, which tracks activity across multiple markets, there is a visible tightening of bid-ask spreads and an increasing average size of trades at the start of 2025.

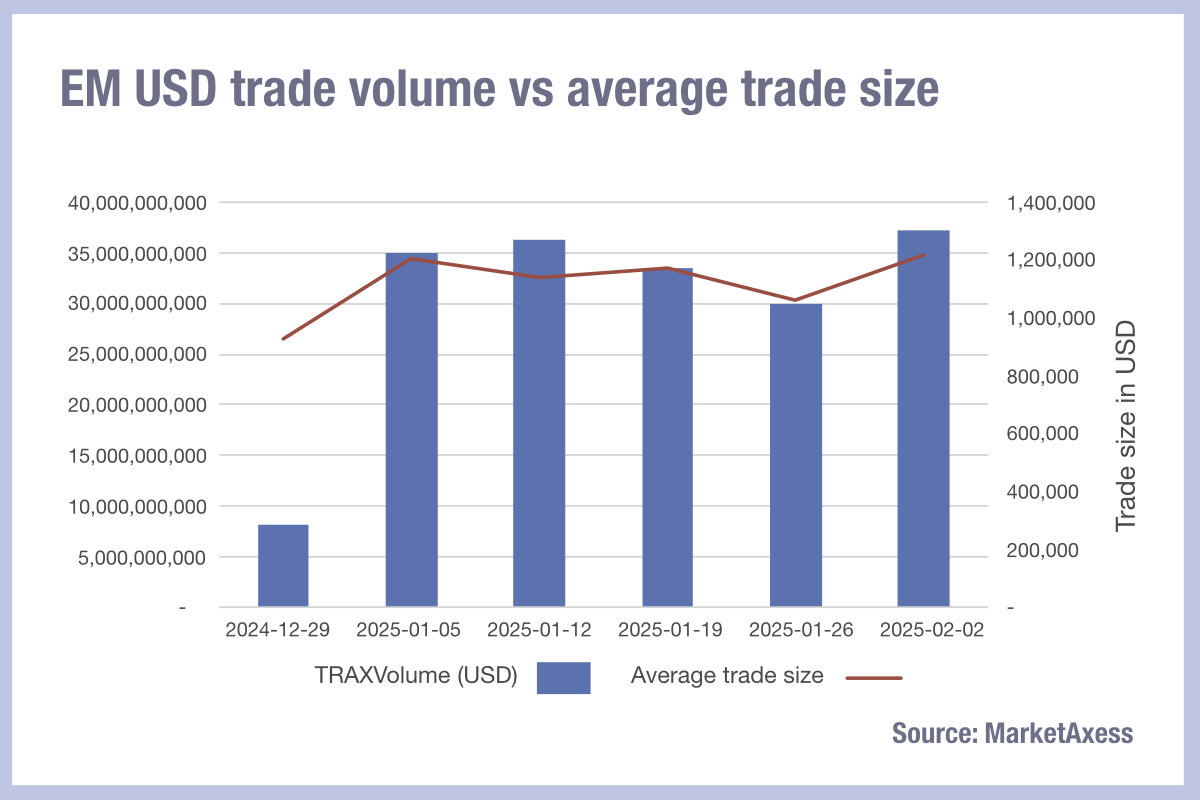

Trading volume and trade count are both closely tied to changes in the average trade size, with a close correlation between the two.

Curiously, the bid-ask spread has a negative correlation with the average trade size, tightening as volumes but also trade sizes increase.

One implication here is that the cost of liquidity, measured by using the bid-ask spread as a proxy, is falling as volumes, trade count and trade size increase.

The increased level of activity would typically be a crude proxy for liquidity availability, and here it appears that there is increased availability of liquidity lowering the costs of access, as dealers are better able – or more willing – to provide prices.

For the bid-ask spread to drop 14% since the start of the year, as it has in 2025, hitting 17 basis points (bps) in early February, either competition has become fierce, or risk transfer has radically improved.

In emerging markets it is challenging to draw specific conclusions about the make up of sell-side actors, due to the diverse nature of the markets which collectively make-up EM.

There are major macro and political dynamics affecting forward views of EM markets this year, which are likely to impact investor appetite for EM debt in both directions, and the safe take here is that this activity, combined with greater electronification of market hubs, and access to improved pre-trade data, is enabling trading desks to make prices and take prices more efficiently, reducing the net cost of trading while activity levels increase.

©Markets Media Europe 2025