The use of distributed ledger technology (DLT) to issue bonds can tackle several concerns in the debt markets. Firstly, it reduces the fragmented information picture around debt which typically exists in any over-the-counter (OTC) market, by holding data about instruments within the contracts which can be transferred, checked and validated electronically between counterparties.

Secondly, certain post-trade activities are reduced as a result, as trading and settlement of the trade occur simultaneously and automatically, removing a secondary post-trade process.

Thirdly, this efficiency creates a far lower cos of trading for issuers, which supports those debt issuance teams who engage in primary market activity on a frequent basis.

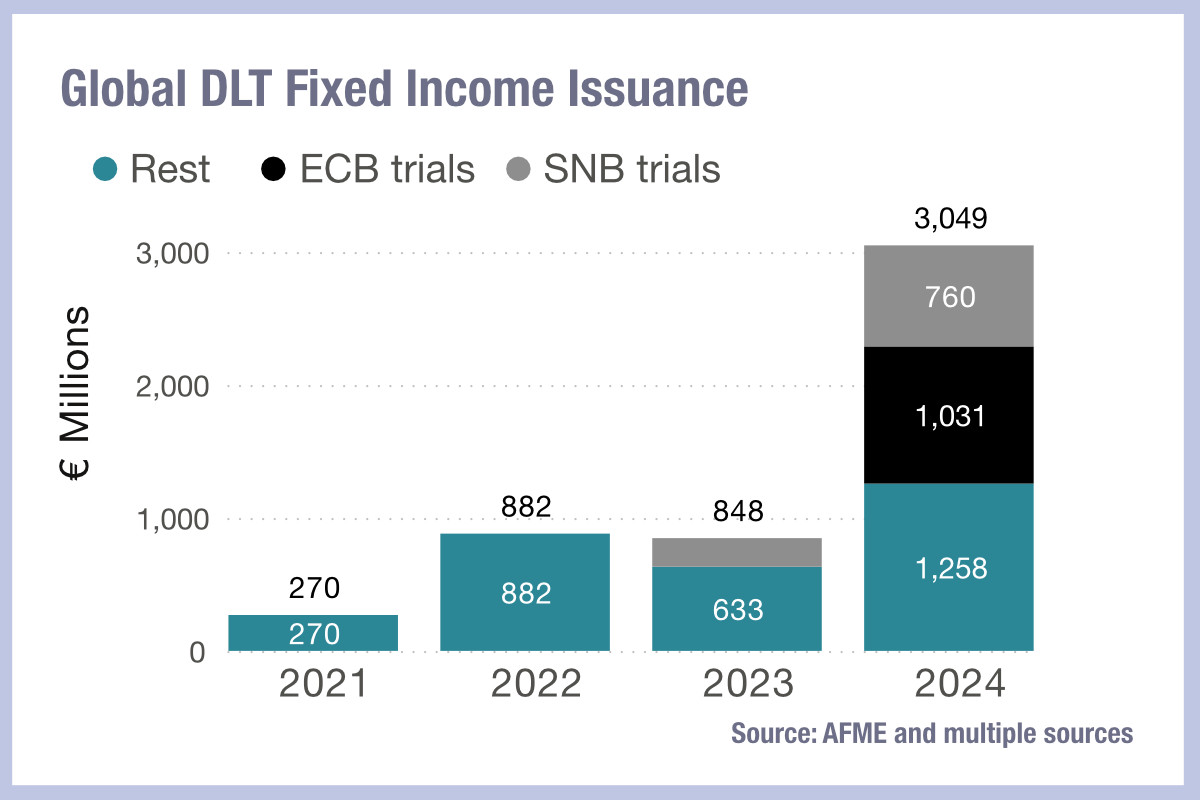

A new report by the Association of Financial Markets in Europe (AFME) found that €3 billion of DLT fixed income instruments were issued globally in 2024, which it tracks as a 260% increase from the volume issued in 2023, which stood at €848 million.

Within this space it is tracking a wide range of debt instruments, including bonds, bills, commercial paper, covered bonds, and structured notes.

“Issuers based in Europe and Asia led by issued amount in 2024, originating €1.7 billion and €1.1 billion respectively,” the report noted. “The European issued amount was strongly led by the DLT trials undertaken by the European Central Bank (ECB) and the Swiss National Bank (SNB), accumulating jointly a total of €1.8 billion in 2024. A total of €483 million was issued in the form of green DLT bonds, representing 16% of the global DLT fixed income amount issued in 2024. By platform of issuance, in 2024 SIX Digital Exchange (SDX) and HSBC Orion led by market share followed by D-FMI and SWIAT.”

Although €3 billion is a small amount of issued global debt in a year, the growth of these trials is indicative of an increased appetite and success for this model. Sub-sovereign, supra-national and agency (SSA) debt issuers are increasingly vocal about their interest in developing DLT models of issuance to underpin their frequent new issues, while a number of corporates have also tested – successfully – this approach.

If platforms can continue to grow at this pace, with €10 billion issued in 2025 and approximately €35-40 billion in 2026, primary markets could see something between a revolution and a rapid evolution in the next five years.

©Markets Media Europe 2025