A new paper from Bank of America’s credit strategist Neha Khoda and Adam Vogel has found that bond issuers are facing a significant increase in costs due to the scale of outstanding debt and the notable changes in interest rates over the past three years.

“The resulting impact [is] more pronounced in high yield (HY) than investment grade (IG),” they write. “Loans being floating rate, will not see any significant coupon impact overall. That said, on the issuer level, refi[nancing]-related jump risk is the highest for loans due to the composition of near-term maturities, largely CCCs. So, while the amount that needs to be refinanced is comparatively lower in loans vs HY, jump risk per issuer is higher.”

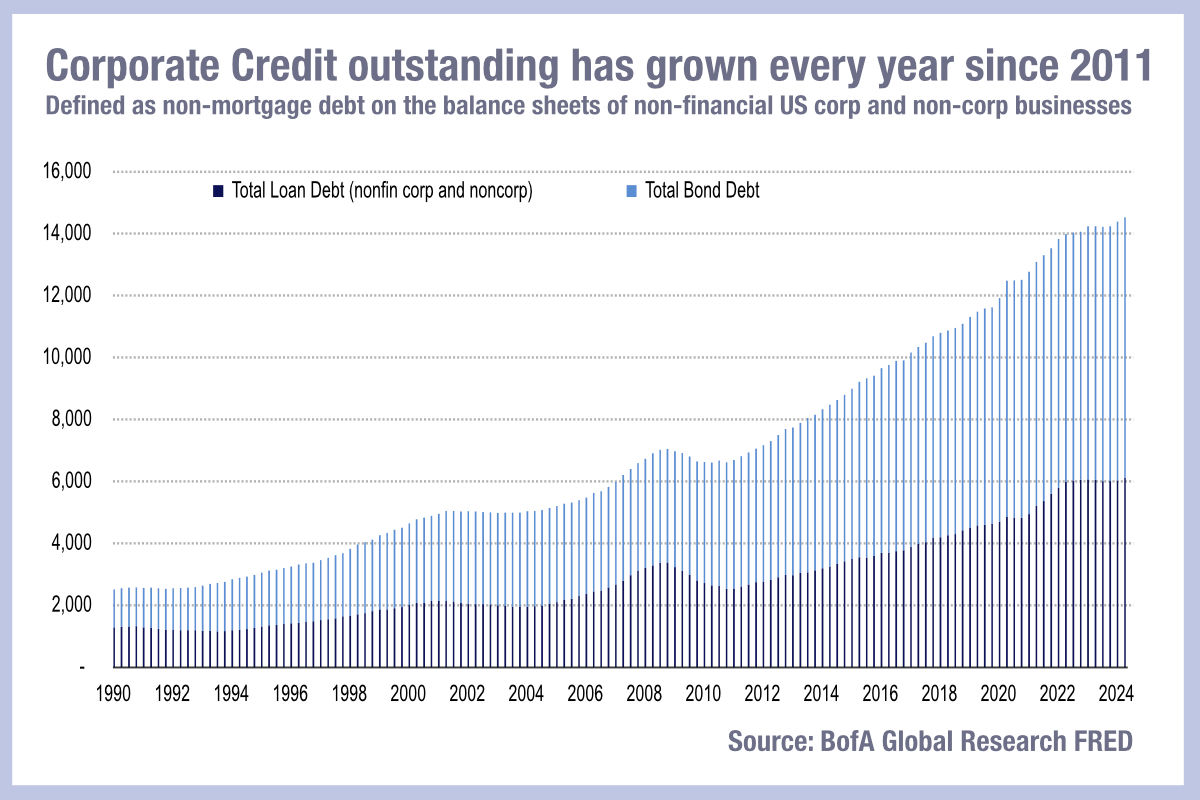

BofA’s assessment is that the current level of US$14.6 trillion outstanding in credit consists of US$6 trillion in US IG bonds, another US$1.2 trillion in US HY, US$2.8 trillion in IG loans and US$3.3 trillion in below-IG loans including private credit, with positive conditions in place for financing.

“Issuance has remained in good shape across credit. IG saw 25% YoY increase in ’24, exceeding US$1.5 trillion,” they write. “HY has seen a ~60% YoY growth consecutive years, most recently reaching US$290 billion. Institutional loan new money issuance jumped to US$500 billion, representing 110% increase.”

There was also a record level of loan repricing in 2024, the bank reported, with US$760 billion repriced over the year.

Using spreads for debt as a measure of market appetite, the bank describes capacity as ‘voracious’.

To calculate refinancing risk, they used ‘proportion coming due’ and ‘coupon gap’ measured for IG, HY and loan markets.

While they found the highest impact from projected refinancings would be in investment grade on this basis, the IG issuers have greater balance sheet protection and lower leverage than firms with lower rated debt, which the bank asserted could be a buffer to that risk. The higher earnings growth associated with IG issuers relative to smaller market cap firms who typically issue HY and loan debt.

“To put this in perspective, given the earnings power of HY issuers today, a 30% jump in coupon equates to erosion of one turn of coverage, all things equal,” they noted. “Combined with historically elevated proportion of bonds coming due in HY, means the asset class faces the elevated refi risk on a market level.”

©Markets Media Europe 2024