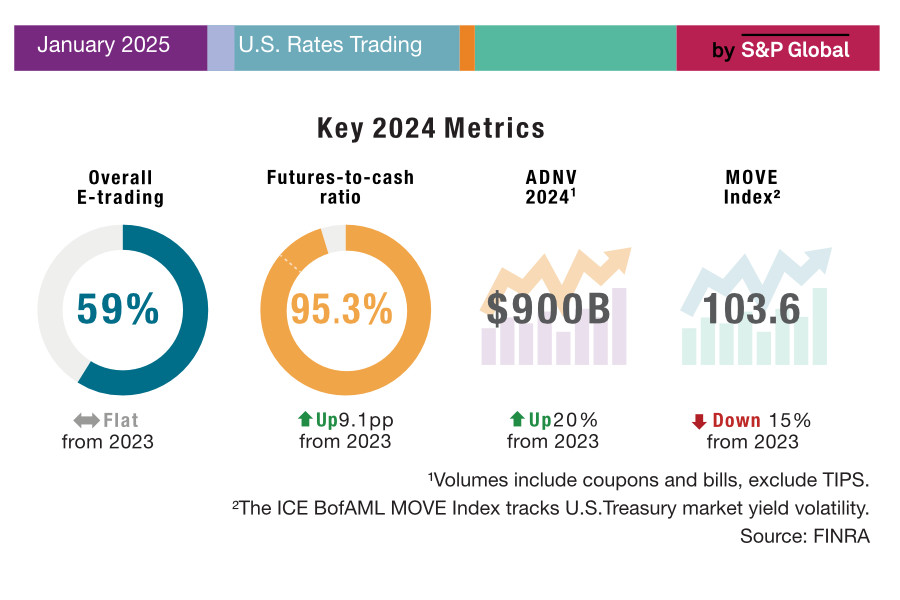

Although US rates trading volumes were up 20% year-on-year, the proportion of that volume e-traded remained static. “We don’t expect this metric to move materially in any given year,” Coalition Greenwich stated.

Despite this percentage stagnation, competition in e-trading is increasing, the report said. Competition This is highlighted by declining dealer revenues; although dealer-to-client trading volumes were up 35% YoY, dealer revenue in US flow products fell by 20% to around US$7.5 billion in 2024.

Bloomberg, Tradeweb, Dealerweb and CME BrokerTec each hold approximately 20% of the market (with Bloomberg edging ahead at 23%). In 2024, Tradeweb and Dealerweb combined saw a 45% growth in volumes YoY, double the rate of total market growth, while FMX UST (formerly Fenics) recorded a 32% hike.

The boost in US rates trading volume was driven by increased efficiency in electronic trading, Coalition Greenwich said, along with macroeconomic uncertainty and volatility. However, the main source of growth was buy-side trading in on-the-runs. Volumes have been steadily increasing in the space since 2021, but saw a larger spike in 2024 to US$336 billion – up 20% year-on-year (YoY), and up 1.4 percentage points as a proportion of overall Treasury trading volumes.

By contrast, 11% YoY growth in T-bills trading volumes represented a 1.4 percentage point drop proportionally.

Between 2020 and 2024, the compound average growth rate (CAGR) for Treasury volumes was 11.3%. For Treasury debt outstanding, which Coalition Greenwich noted has the most important correlation with long-term growth, this rate was 9.4%. The disparity between these figures indicates that more of the market is turning over on any given day, the report stated, with average daily notional values (ADNV) increasing from 3% to 3.3% and 3.6% of total debt outstanding in 2022, 2023 and 2024 respectively.

Overall, ADNV growth was consistent over 2024, Coalition Greenwich said. On a YoY basis, the number of days on which more than US$1 trillion of US Treasuries were traded was up from 7% to 27%.

Each month, excluding New Year’s Eve, more than US$1 trillion was traded on the final trading day. Month-end volumes were higher than the month’s ADNV by 43% in 2024, with the two only aligning in November – thanks to the US election. This marked a slight decrease from 2023, when month-end volumes were 48% above ADNV.

Treasury volatility continued its downward path in 2024, with the CME volatility index (CVOL) falling by 15% YoY and the MOVE index by 15%. The volatility of 2 and 5-year bonds, which have been notably higher than their 10-year counterparts, have begun to realign with the longer-term Treasuries.

In the dealer-to-client market, dominated by Bloomberg and Tradeweb, the majority of ADNV remains executed by voice. Direct stream trading was up three percentage points, pulling share from RFQ and CLOB. Most dealers are using auto-quoting to simultaneously respond to RFQs and steam prices continuously, Coalition Greenwich reported, which is blurring the line between the two protocols. Combined, the proportion of trading ADNV executed with these methods remained static YoY.

Looking to the year ahead, Coalition Greenwich expects the link between Treasury bond and derivatives markets to increase. Already, in 2024, Treasury futures volumes at CME were equal to 95% of notional volume traded in the bond market, while interest rate contract volume grew by 10%.

Also in 2025, Coalition Greenwich anticipates higher trading volume, further e-trading development and continued volatility. Mandatory clearing deadlines will likely be delayed, the firm said, which along with the governmental focus on deregulation should reduce pressure on market participants. The impact will at best improve liquidity and at worst leave it stable, it predicted.

©Markets Media Europe 2024

©Markets Media Europe 2025