Primary debt markets are likely to be a major revenue earner for dealers facing tighter margins in secondary bond markets. Issuance has started strongly in 2025 with “heavy” primary market activity.

Over fifty issuers have issued bonds in US investment grade debt so far, with Morgan Stanley estimating that US$75 billion of debt has come to market.

“Despite the heavy issuance, average new issue concessions YTD, at 2.9bp, remain low versus history,” the bank reported this week, noting also that average subscription levels are lower year to date, but still “healthy”.

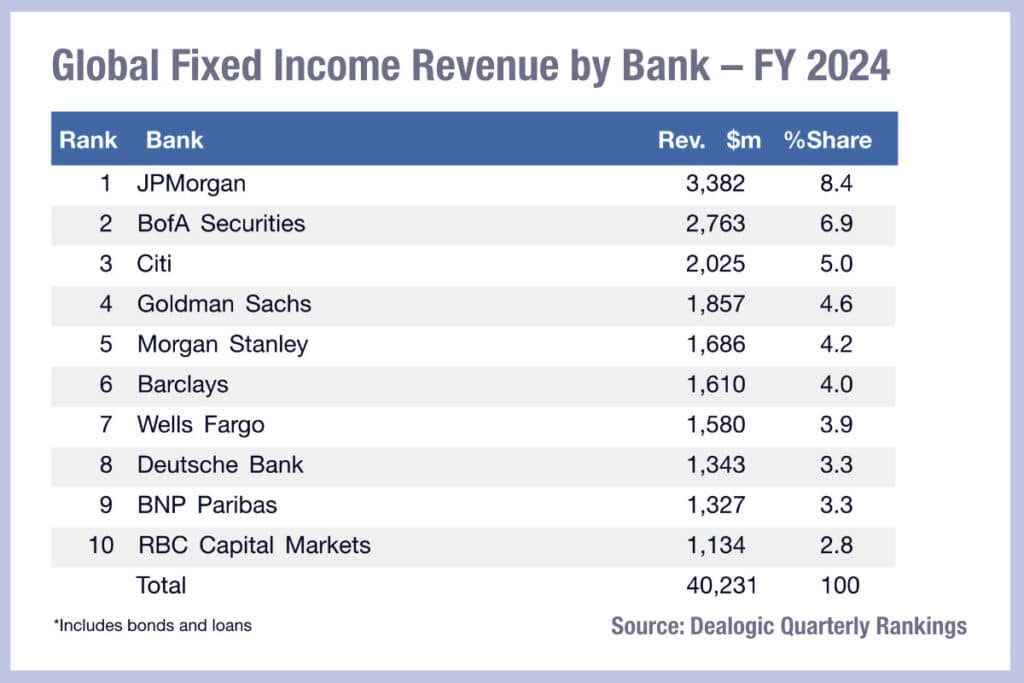

Dealogic’s latest rankings for debt capital markets indicate that the top ten banks globally have largely retained their positions in supporting bond issuance through a record 2024, suggesting the model of engagement with clients is proving successful if highly competitive.

JP Morgan, Citi, Bank of America (BofA), Morgan Stanley and Barclays were the top five deal makers by volume, and in that order only Morgan Stanley and Barclays had exchanged positions from the previous year.

In the investment grade global market, JP Morgan was also the leader followed by BofA and Citi to make up the top three. After that BNP Paribas and Mizuho made up the fourth and fifth spots, whilst in high yield, Goldman and Deutsche Bank were number three and number five globally.

With such a high volume of activity expected at the start of 2025 as issuers try to get ahead of any volatility or rate hikes triggered by a changing political agenda, dealers are likely to step up in their issuer relationships to secure revenues, notably challenged in secondary trading.

©Markets Media Europe 2025