For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source of information.

For investors, the derivatives market is a potentially a rich source for investment returns and risk management. It can also be a valuable source of information.

The key inputs that traders assess ahead of engaging in the market – price, liquidity and activity measures – can all be guided through information gleaned from derivatives trading activity.

In the credit space, single name derivative instruments have fallen out of favour due to the increased costs of trading and clearing credit default swaps (CDS).

In their place are credit default swap indices (CDX) and new credit index futures, built on the index models that support exchange traded funds (ETFs), creating a more liquid set if instruments.

Not only can these instruments be used to support pricing and liquidity formation, they can be accessed in order to supplement trading and investment objectives typically access via investment grade and high yield

Although trading levels in futures are still relatively nascent, using credit futures instead of cash bonds can reduce the tracking error relative to other instruments, when trying to match the benchmarks of corporate bond portfolios. Credit futures that are total return index futures give exposure to credit spread risk and interest rate risk, rather than only credit risk as with CDS.

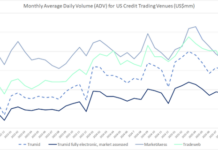

Market structure also creates new ways of expressing trading and investment ideas into the market. Exchange traded futures and exchange traded funds are supported by both bank and non-bank liquidity providers, meaning the electronification of cash and credit derivatives is delivering far better liquidity opportunities as corporate bonds see the advantages of enhanced trading models such as portfolio trading, automated trading and all-to-all markets.

Trading platforms that support both cash and derivative instruments can also offer models for trading both more efficiently, to further maximise the effectiveness of their utility.

While not all mandates are supportive of the use of derivatives to trade and invest, they can create a more nuanced method for engaging in credit markets, support the end investor, the trader, and the portfolio manager.

©Markets Media Europe 2024

©Markets Media Europe 2025