The liquidity shortfall, expected at the end of the year, is traditionally triggered by dealers’ reluctance to make markets when their risk positions are under regulatory scrutiny.

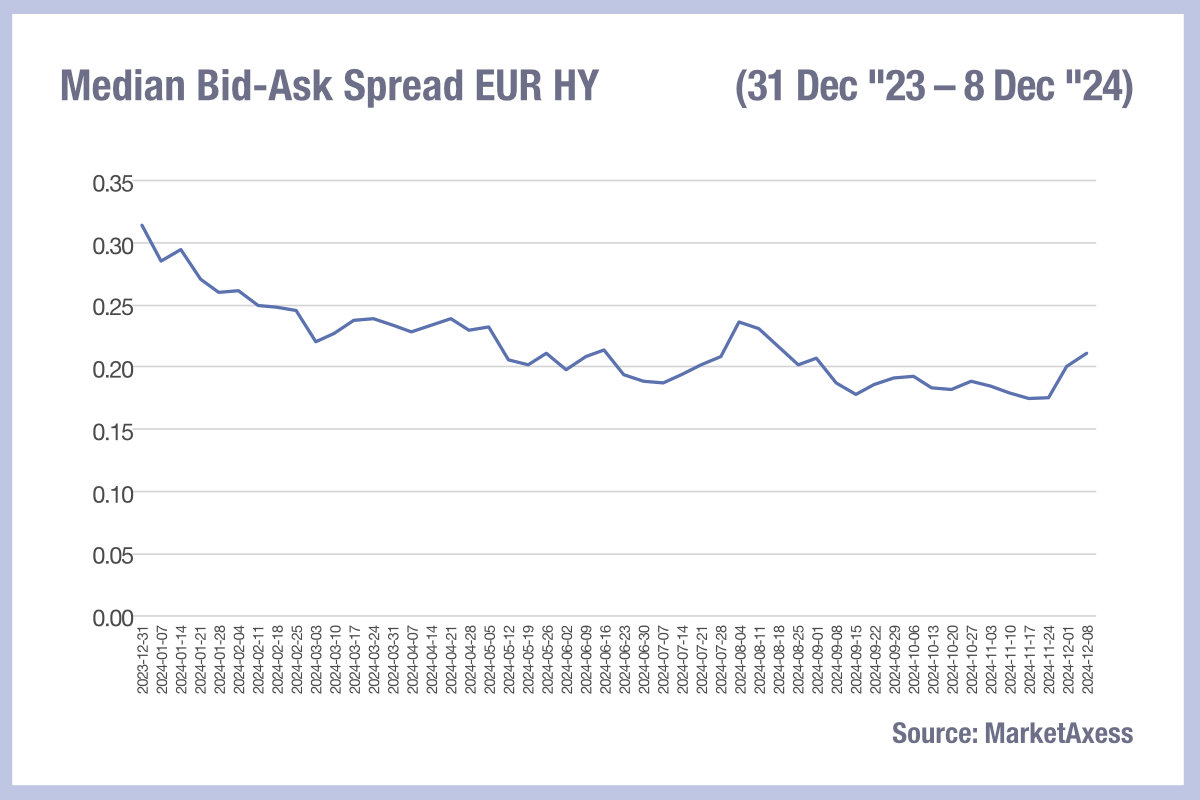

This stepping back from risk trading, known as ‘window dressing’ was not apparent two weeks ago. However, there are now signs that it is manifesting, but only in certain markets, according to data from MarketAxess.

In Europe, the average bid-ask spread for high yield trading has expanded rapidly at year end, indicating liquidity has become more expensive. Leaping from a range of 0.17-0.18 % price of par in November, to 0.21 in mid-December, it reflects a pattern that might be expected if dealers were to be more reluctant to take on risk.

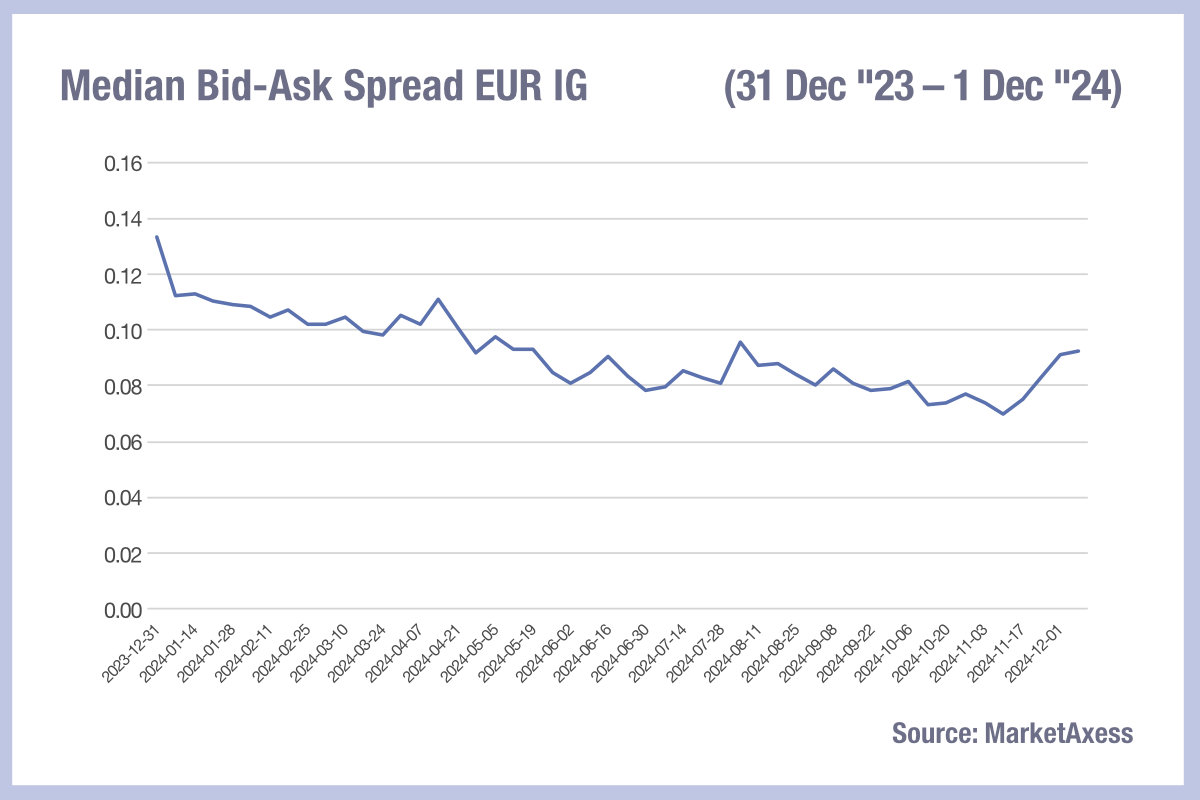

Europe IG trading has a similar profile, bucking the year-long declining bid-ask spread sizes in late November to jump to 0.09 % price of par from 0.07.

This is a phenomenon cited by numerous traders, and well-understood in the markets. What is curious about the trend this year is that the US appears to be avoiding it.

In both US HY and IG trading, there has been no increase in median bid-ask spreads, based on MarketAxess CP+ Pricing data.

This may reflect a similar trend to that seen in trade sizes which have increased in Europe and fallen in the US. Collectively, this may indicate that electronic trading is evolving more rapidly in the US – allowing higher volumes of smaller trades to be executed, with limited risk carried on each trade.

Certainly the lower volumes of larger trades indicates that this option is not available in Europe, which is suffering a greater end of year liquidity crunch as a result.

©Markets Media Europe 2024