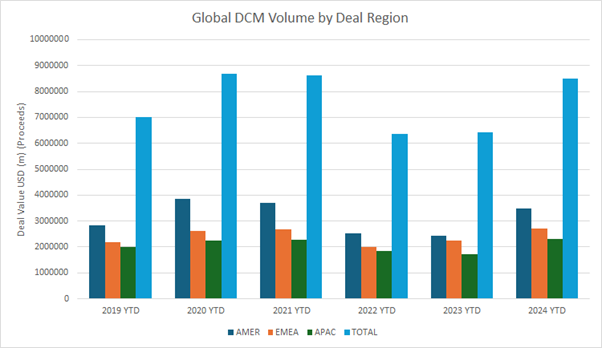

Total deal size volume for debt capital markets, year-to-date is up 32% on 2023, according to data from Dealogic.

The trend in regional deals has seen the US pull away from Asia Pacific and Europe relative to 2023, up 43% on the previous year, where APAC saw a 33% increase and EMEA a 20% increase.

Given the return to 2021 levels, which were prior to the inflation ramp and subsequent central bank rate rises, this in theory potentially puts strain on the ability of issuers to support repayments, however we are seeing few concerns on this due to the capacity of the market to support new debt and relatively benign credit conditions as assessed by ratings agencies. For investors this new issuance signals a considerable opportunity to take well-rated debt at higher yields, if they can move out of their existing positions with lower yielding debt via relative value trades.

The tail risks are still uncertainty around inflation and geo-political issues which, if they move the wrong way, would trigger higher rates and clearly put a strain on borrowers.

Private credit may allow investment firms to negotiate better terms to support their investment in lower rated issuers, but these represent the greater concern for lenders at the moment and the market’s secondary illiquidity is clearly a challenge if things go awry.

Debt capital market teams seem largely positive about the prospects for financing programmes next year, given the expected trajectory of interest rates, with levels of financing predicted to be maintained or to drop slightly

©Markets Media Europe 2025