The end of 2024 indicates is seeing quite different changes to trade sizes in the corporate bond markets of Europe and the US, according to data from MarketAxess’s TraX data source, which tracks activity across multiple markets.

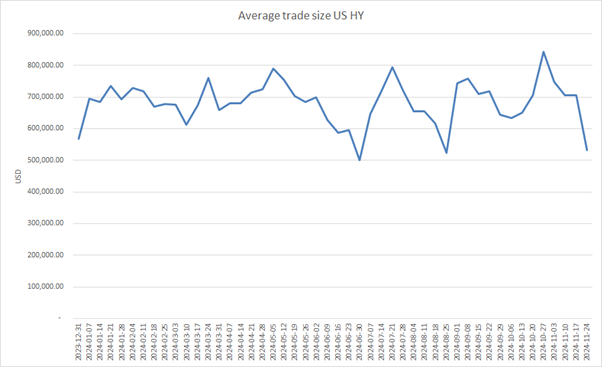

US high yield (HY) average trading sizes have plummeted in Q4, having spiked past US$800k in late October and dropped closer to US$500k in late November. Since the start of the year this represents a slight decline of 6% but after a very volatile year, bouncing between a US$300k range of US$500k to US$800k and back, within as little time as a three-month window.

That the year is close to ending with no significant directional change in trade sizes is interesting, especially as investment grade (IG) has shown a more linear trend.

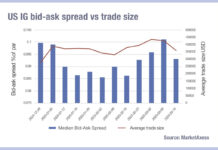

IG trading started the year at US$363k average trade size and had fallen 11% to US$323k by the last week of November. Volatility was mostly tight within a US$100k range of US$300k-400k.

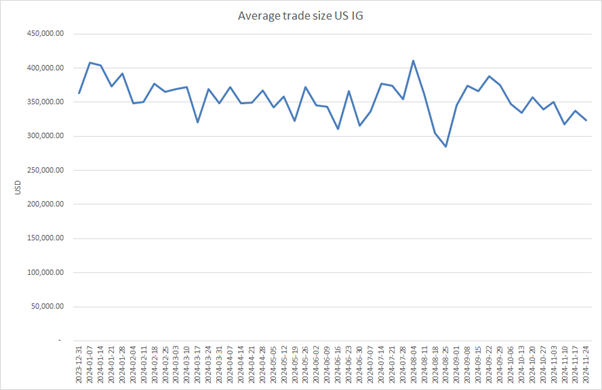

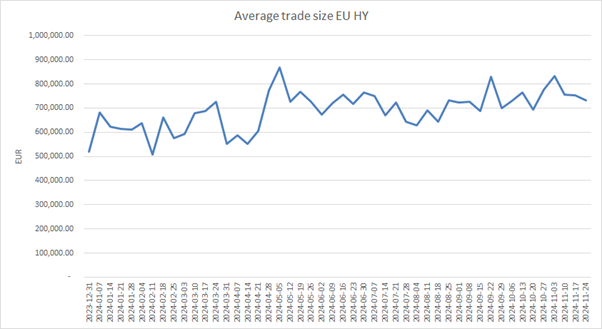

European trading saw an entirely different trend. While high yield was also mostly range bond €500k-800k it was moving in the opposite direction, up 41% by the end of the year, as it hit an average trade size of €733k. It lacked the dramatic peaks and troughs of US trading, and was not showing significant trade-size vol at the end of November.

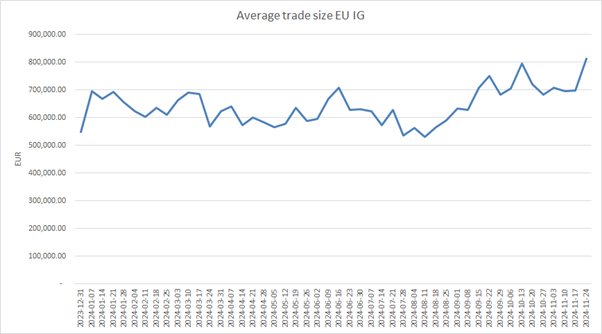

Investment grade trading in Europe has seen trade sizes increase 48% from the first week of the year to the last week of November, with a trend that was less linear – trade sizes were failing up into Q3 – but is still fairly well-defined from September onwards.

This enormous upward tick in average trade sizes in Europe is curious, not least because volumes are rising in IG and falling in HY.

There might be an expected decrease in risk trading by market makers at year end, as they ‘window dress’ their risk books, which leads to a drop off in large trades. In fact there are more trades of larger size in IG.

HY sees a reduction in trades but these are net larger than the rest of the year, indicating more risk/capital intensive trades.

One real possibility is that larger trades are being conducted electronically and that is facilitating less risk to be taken by dealers, potentially including electronic market makers, while helping them to service clients more effectively.

©Markets Media Europe 2025