As interest rates decline, credit fundamentals will improve in 2025 and defaults will ease, according to analysis from credit rating agency Moody’s.

“Investors will hunt for yield and private equity funds will need to deploy some US$9 trillion of global dry powder, boosting market liquidity and deal flow. Deal activity will be concentrated in North America and EMEA, where leveraged finance markets remain larger and demand stronger. Leveraged buyout (LBO) activity is gathering pace after a slow start to 2024, although much less so in APAC and LatAm. Investors will remain focused on higher-quality borrowers, while private equity sponsors will focus on financial flexibility and returns.”

The firm expects leveraged buyout deal momentum to be better supported in 2025, relying on borrowers’ convictions of falling interest rates and improving valuations.

“We expect more flexible credit protections as deal competition persists between direct and broadly syndicated loan (BSL) lenders. Leveraged loan issuers will also continue to pursue opportunistic repricings and refinancings, which dominated deal activity in 2024,” it writes.

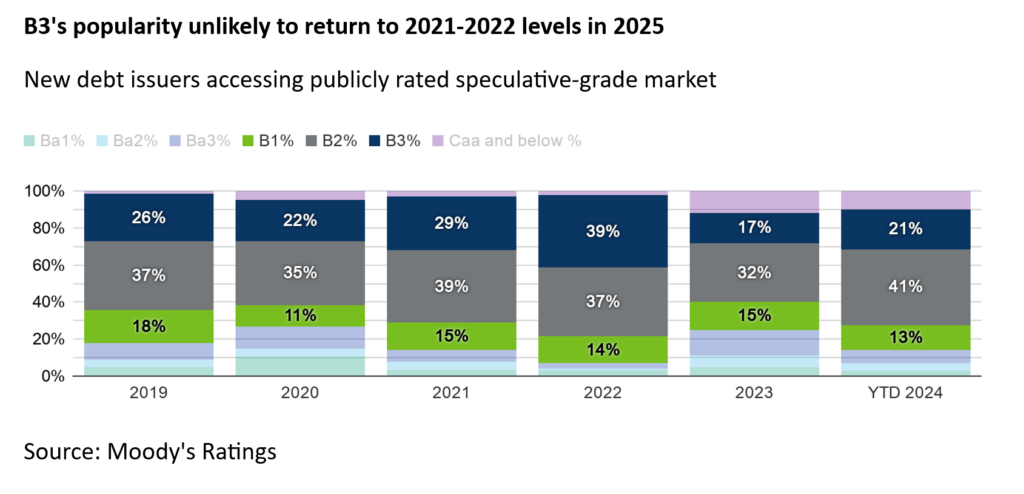

However, the firm’s analysts do note that investors will be more focused on high grade issuers, with lingering concerns about riskier borrowers.

“EMEA and North America investors will continue to favour B2 corporate family ratings over once-popular B3 companies, which have largely turned to private credit. But even as investors sidestep risk, hidden leverage risks are growing with the proliferation of instruments such as net asset value (NAV) loans and payment-in-kind (PIK) loans or preferred shares. Hidden leverage reflects instruments with debtlike characteristics that are outside the rated issuer in leveraged finance, or are not disclosed. Many low rated speculative grade issuers still need to refinance, including a high concentration of B3 negative and below rated companies.”

However, the Moody’s analyst team also warned, “At the same time, weaker covenant protections will remain pervasive, enabling companies to maintain excessive leverage and potentially hurt recoveries on defaulted debt. In addition, ongoing geopolitical risks could spur fresh volatility in financial markets, upending debt issuance and impacting our default rate projections.”