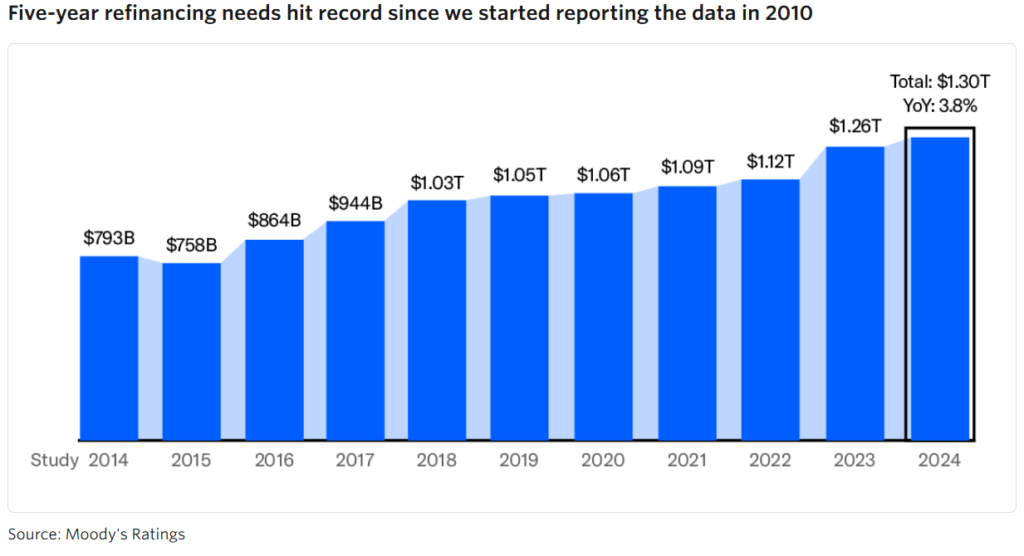

A report from rating agency Moody’s, has found that the proportion of US non-financial investment-grade corporate bonds needing refinancing within five years has grown 4%, with maturities concentrated in the first three years of that period, while cash piles at corporates fall.

Although issuance in 2024 has been elevated, with US investment grade (IG) bond issuance growing 31% by September 2024 versus the same period in 2023 according to Moody’s, and the average tenor increased to 13.9 years, compared with 12.5 years a year ago, these levels of cash raising have been balanced by increased capital expenditures and acquisitions.

“Liquidity positions remain solid for investment-grade issuers, which provides good flexibility to reinvest and address maturities,” the firm writes. “About US$1.303 trillion of investment-grade notes come due between 2025 and 2029. The proportion of maturities within the first three years of our five-year scope increases to 64%, compared with 61% last year, pushing refinancing needs earlier.”

Moody’s economics team’s has forecast that the Federal Reserve will reduce the rate to 3.25%-3.5% over time next year, and with rates expected to fall under the new US administration in 2025 and a continuation of lower inflation, funding costs should also fall, supporting those companies who are looking to refinance next year.

Costs of financing have also favoured borrowers as year-to-date average IG credit spreads tightened by roughly 33 basis points, as of September 2024, compared with the 2023 average, reflecting investors’ confidence in investment-grade credits as well as a less uncertain macroeconomic environment.

For context, the rating agency has estimated the US will experience “Modest economic growth … with Fed likely to continue to cut rates amid tamer inflation. US real GDP is forecast to grow 2.4% this year and 1.8% in 2025, after growing 2.5% in 2023,” according to Moody’s Global Macro Outlook 2023-24. “All of our industry outlooks are stable or positive, compared with 75% in last year’s study, reflecting the steady macroeconomic growth environment.”