Analysing year-to-date volume and trade number data from MarketAxess’s TraX database for US credit, and correlating it with the weekly average MarketAxess CP+ bid-ask spread data for the same markets, we can see that the volatility of volume appears to be more correlated to volatility in bid-ask spread movements, than volatility in trade count.

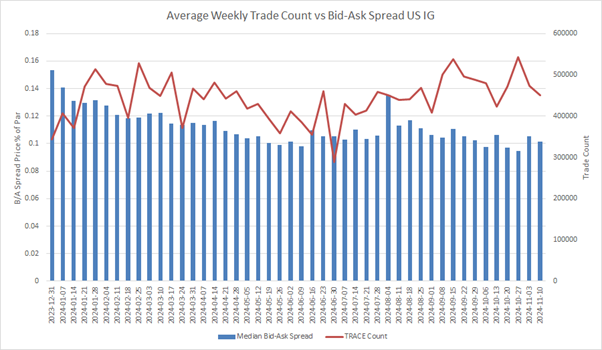

Looking at the US investment grade trade count, while count has been rising since the summer, and bid-ask spread has ben falling. There is a clear potential negative correlation, with a causal relationship as a greater number of smaller trades could potentially drive down trading costs. However, the correlation is far from certain as both trades and bid-ask spreads were falling together ahead of summer.

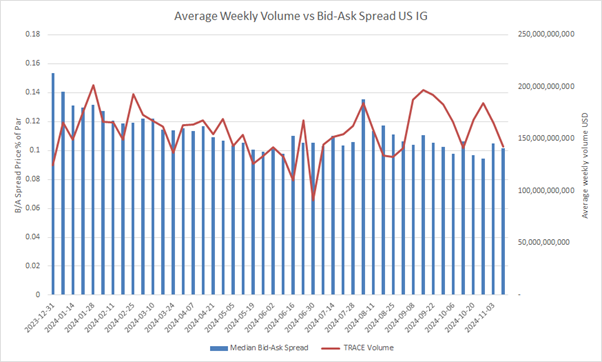

When we look at the volume of trades and bid-ask spread, there are distinct positive corelations, with greater volume correlating with higher bid-ask spreads, which as a proxy to cost of trading indicate costs increase as larger value trades are executed. While the volatility of trade count is close to that of volume, volume has not steepened in the same way.

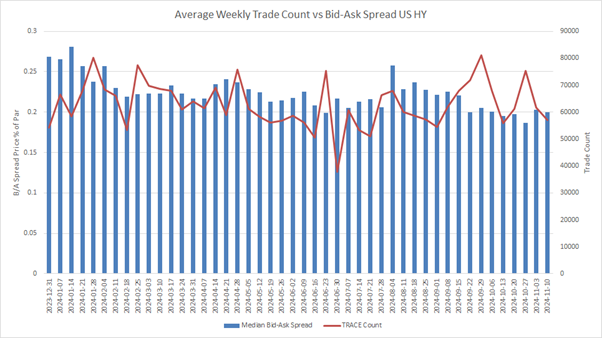

In high yield trading, the trade count and bid-ask spread do not show the same split seen in high yield – there is not a drop off in number of trades during the year, and a tightening of bid-ask spreads. There also seems a limited correlation between the two.

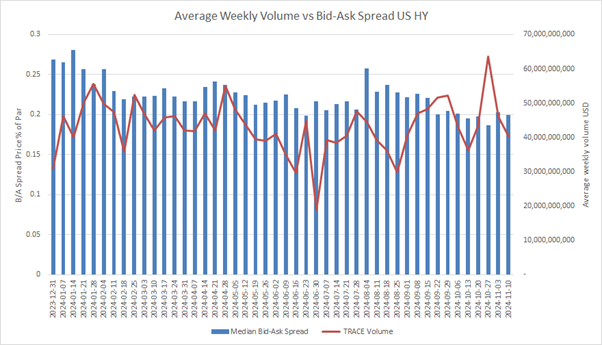

In volume terms, there is far more limited correlation either positive or negative with volatility of average weekly volume and average bid-ask spread; while TRACE volume has been relatively volatile, bid-ask spread has not.

Absent a strong correlation been the level of activity in the market and pricing of bond trades, another dynamic – pricing competition – looks a likely candidate, especially in electronic trading.

Investment grade’s increasing trade count/falling trade size and tightening bid-ask spreads would seem to support that, as it is has a greater proportion of electronic trading on market venues and directly streamed.

In summary, although trading costs can correlate with activity levels, most closely with volume in investment grade markets, it seems that highly aggressive pricing in credit markets is the greater determinant of bid-ask spreads currently, and should be factored into pre-trade analysis by buy-side trading desks, using appropriate data.

©Markets Media Europe 2025