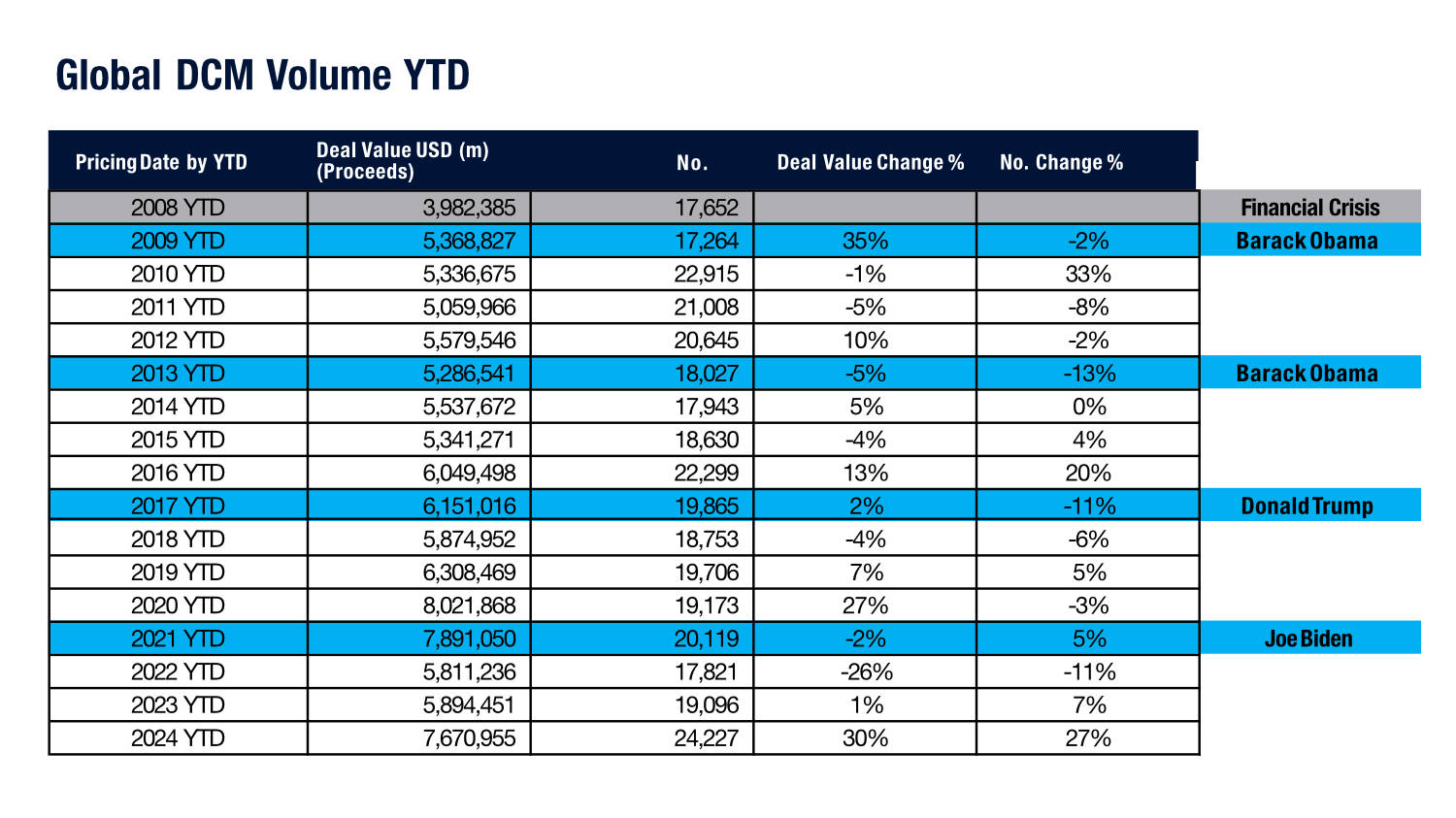

Looking at Dealogic data for debt issuance over the past four year tenures of US presidents, it is notable how much the macro picture, and not the political landscape, is the driver of issuance. The data looks at debt issuance year to date of the election in 2024, in the US.

Politics has very little to do with economic growth, relative to the activity of business itself, and the macro picture is evident in the data. Starting with Barack Obama’s first tenure, starting in 2009 following the 2008 election, reflects the post-financial crisis level of appetite for debt absorption, credit risk concerns and sell-side activity, with tepid growth and occasional declines in deal volume and numbers.

The very low rates of interest being charged on debt during the next eight years, capturing both of Obama’s terms, are indicative of the continuing low rates associated with the post-crisis period, alongside the slowly growing return of confidence in the markets and the increased rigor found amongst dealers as regulation bedded down and new operational costs were bedded in, securing a greater amount of capital as a buffer against risk and underwriting.

Naturally the highest growth at this point was seen in the final year of an Obama administration, ten years after the crisis in 2016, when deal value and number both hit double figures.

The Donald Trump tenure in 2017 saw those higher level maintained falteringly until 2020 when this upward trajectory of low rates and higher confidence really took off supported by a far greater need for debt capital as the Covid pandemic took hold and businesses struggled to generate revenue over the short term.

Although this dropped off a year into Joe Biden’s term in office in 2022, as the pandemic gradually receded, the third highest year to date for deal volume was 2024 year to date, which many attributed to the need to issue debt ahead of the uncertainty that the US election might bring.

We can see that election years typically have higher issuance levels than non-election years, barring financial crisis, however Trump’s first year did see a higher volume, but lower number, of deals.

Tomorrow is an unknown, but it will be interesting to see if a Trump victory drives higher volumes in 2025, or a Harris victory sees volumes drop, but only slightly, following the pattern to date.

©Markets Media Europe 2024