European fund managers are increasingly bullish on the US economy, with 42% of respondents to an October Bank of America survey expecting a robust US economy over the coming months.

That figure is up from 18% last month, following a positive US jobs report. The proportion of respondents who expect an immediate US slowdown has dropped from 78% to 45%.

Renewed optimism was also reflected on China, with 27% now expecting a growth boost, up from 5% last month, following stimulus announcements. Views on the Euro area were not so rosy with 52% expecting a weaker economy there, down from 65% last September, and 46% thinking growth will remain resilient, up from 10%.

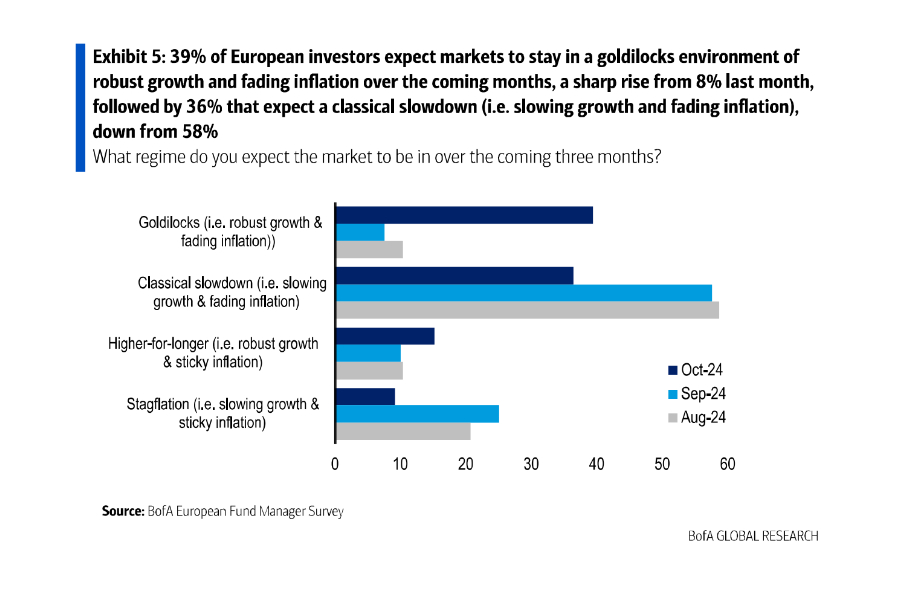

Optimism towards the US and China reflect increasing anticipation of a ‘Goldilocks’ environment of robust growth and fading inflation over the coming months, with 39% expecting these tailwinds, up from 8%. However, 36% of respondents are still cautious, expecting a classical slowdown, albeit down from 58% last month.

A net 18% of participants expect near-term upside for European equities, while a net 20% were expecting downside in September. A net 58% project upside over the coming twelve months, up from 43%, and 40% expecting gains of 5 to 10%.

Nearly half of respondents (48%) think upside will be driven by earnings upgrades, while 42% see central bank easing as the most likely driver. A net 27% see upside for European cyclicals relative to defensives, the highest share since June. Reducing equity exposure by too much and subsequently missing out on a rally is seen as the key portfolio risk by investors.

A total of 231 respondents, with US$574 billion assets under management, participated in the Bank of America European Fund Manager Survey, which was conducted between 4 October and 10 October.

©Markets Media Europe 2024