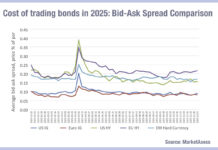

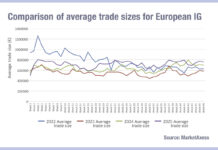

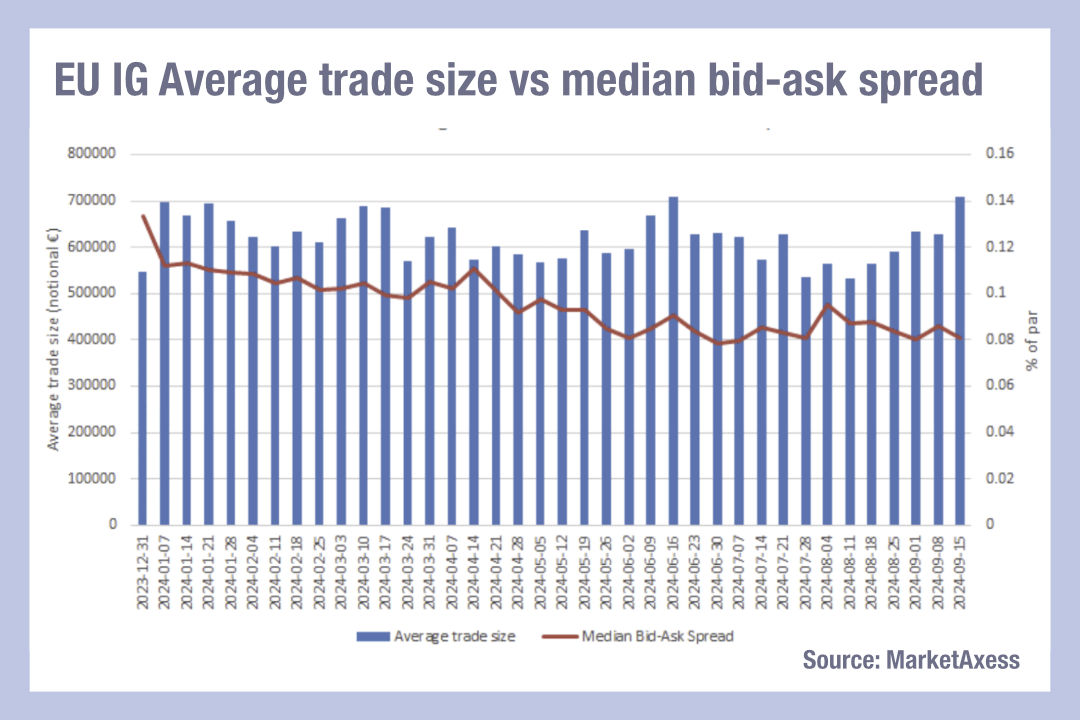

Looking at the average bid-ask spreads of European credit trades, and correlating them with the average trade sizes for the year to date based on data from MarketAxess’s TraX, which aggregates data from multiple bond platforms, and its CP+ pricing tool, it appears that liquidity in European corporate bond markets is becoming relentlessly cheaper.

Starting with investment grade debt, a sudden tightening of the bid-ask spread in January 2024 has been followed by a fairly consistent downward trajectory as it has reduced further. While occasional blips have interrupted this pattern, falling from €0.13 cents to €0.08 cents in nine months represents an intense tightening.

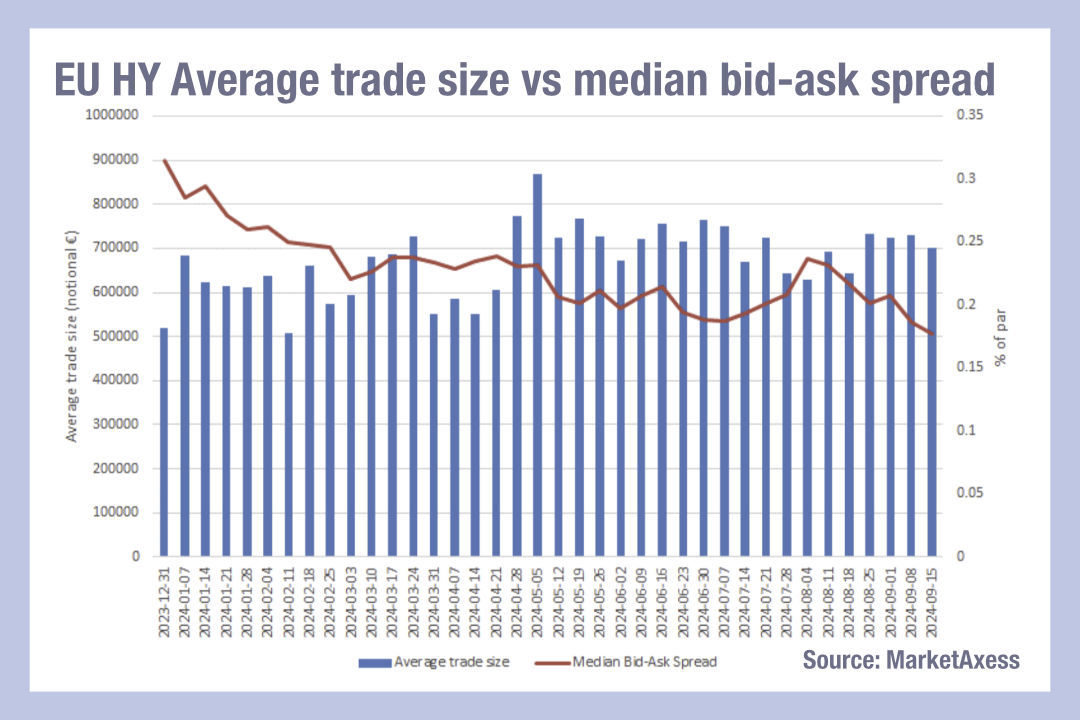

High yield shows a similar pattern, falling from €0.31 cents to €0.18 cents year to date.

In both cases, the average trade size has not followed a consistent pattern over the same period – high yield trades are now on average larger than they were at the start of the year, while IG trades are roughly back where they started, after dropping in the middle of the year.

With the bid-ask spread shrinking regardless of trade size, we have to conclude that market makers will find it increasingly tough to make the economics of liquidity provision viable. At the same time, we are seeing new market makers moving into this space. With one major European liquidity having stepped back from high yield trading as a result of a risk position incurred through portfolio trading, it is conceivable others may back out if they cannot make the costs work.

For buy-side desks, it seems positive to get access to liquidity at low cost, as long as the impact is not unhealthy. Clearly, bid-ask spreads will increase in times of market stress and desks will need to ensure that they are able to leverage relationships with dealers in these times to get continual access to liquidity.

©Markets Media Europe 2024

©Markets Media Europe 2025