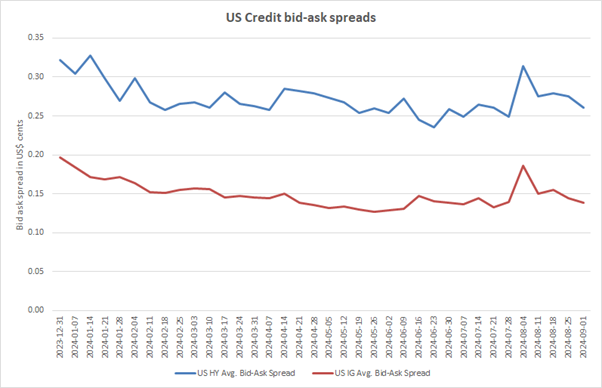

The bid-ask spread for corporate bond markets has continued on a downward trajectory in September, after a bump in August, according to data from MarketAxess CP+ pricing tool. As a proxy for the cost of liquidity, this suggests that the growth of electronic trading models is continuing to deliver efficiencies that are benefitting the market

In the US credit market, early August saw a big spike in the weekly average for bid-ask spreads across both high yield and investment grade corporate bonds, taking high yield to a 29-week high in the first week of August, and investment grade to its highest point since December 2023. Both recovered and began to drop rapidly, more so as September trading began, although not yet reaching pre-summer lows.

In Europe, the impact of volatility in August was far less pronounced, with the first week of August taking high yield and investment grade bid-ask spreads to 13- and seven-week highs respectively. The reduced peak also allowed each to see lower costs continue, reaching late July levels of €0.23 cents and €0.11 cents in the first week.

Behind the trading costs we see a big drop in volumes in US markets that correspond with the spike in costs for the US, but have no parallel in European trading, which continue at positive levels though August.

The impact could be a direct withdrawal of dealer risk appetite in August when concern around a sudden Federal Reserve move raised its head, due to expectations that the central bank had underestimated the need to cut rates aggressively.

This would also explain why European markets, which have seen earlier rate cuts than the US, reacted more mildly.

If US markets continue to see this bid-ask spread volatility, buy-side traders would do well to ensure that they are getting good support across both e-trading and voice block-trading; the markets’ depth will allow dealers to find effective way to hedge trading but clearly uncertainty is directly impacting bid-ask spreads and risk provision.