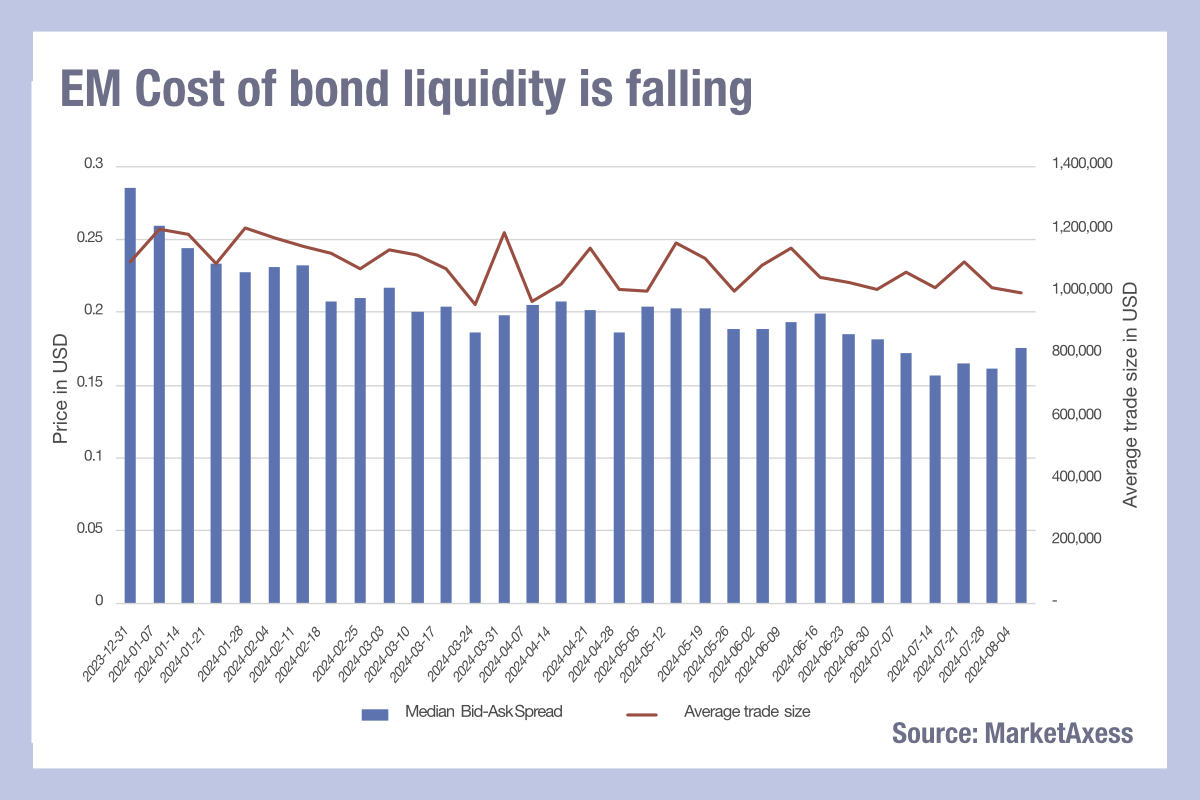

Traders in hard currency fixed income emerging markets have seen a decline in the costs of liquidity this year, according to data from MarketAxess’s CP+ pricing tool. The bid-ask spread for hard currency trades has fallen by nearly half from US$0.28 cents at the start of the year to US$0.16 cents in mid-July.

Things appear to have changed as concern about the Federal Reserve’s ability to manage inflation began to grow in late July and early August, with spreads beginning to tick up at this point.

Looking in detail at the data we can see that the initial decline in bid-ask spreads at the start of the year continued to March, when we began to see a pattern of spreads typically increasing during the middle of the month, and then dropping off in the final week of the month.

A decline in the end-of-month liquidity costs may well reflect the capacity to include EM bonds in portfolio trades, which are commonly being executed towards month end and deliver the capacity to iron out the cost of holding risk for dealers, as pricing for liquidity and illiquid instruments is included in the net portfolio trade price.

Alternative reasons may be the growing use of electronic trading by dealers for hard currency EM trades as market operators successfully expand their ability to reach deeper into the EM space with local as well as global dealers.

If we consider the trend of changing trade sizes in hard currency emerging markets using MarketAxess TraX data, which follows activity across marketplaces, we can see that trade sizes have been falling across the year, from the US$1.1-1.2 million range down to US$1-1.1 million range, with a notable flattening of size volatility towards the summer period.

Falling trade sizes are typically indicative of increased electronic trading activity, which allow higher numbers of smaller trades to be executed efficiently. It is not conclusive – portfolio trades are also reducing in size – but either way it seem likely that the increased efficiency of trading EM bonds from electronic platforms is materially and positively affecting trading costs.

©Markets Media Europe 2024

©Markets Media Europe 2025