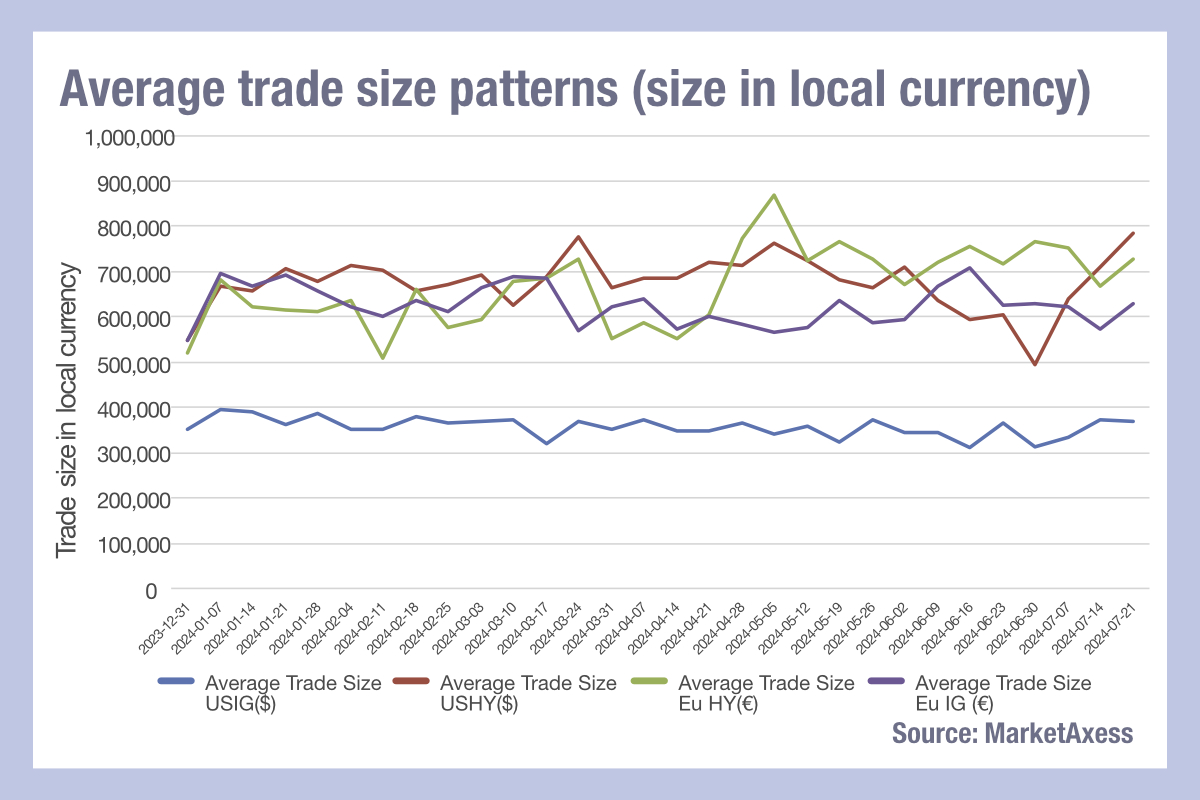

Looking at the average trade sizes for high yield and investment grade bonds, across Europe and the US in 2024, we can see considerable divergence in patterns, according to data from MarketAxess TraX, which measures activity across markets.

The outlier, US investment grade (IG), has been ticking downwards very gradually, as the proportion of trading executed electronically has been growing.

European investment grade has at times seen a more significant reduction than US IG, however, it has not followed a linear path and in June began to see average trade sizes rising again. While these began to drop heading into July, later in the month they picked up – as all markets barring US IG did – suggesting a cross-market decline in smaller trades.

High yield (HY) has seen far more volatility in trade size movements, with European HY average sizes jumping nearly 30% in late April/early May and despite a small drop continuing to remain elevated throughout the summer months.

US HY was on an upward path until May, when we saw average trade sizes begin to fall, reaching their lowest point of the year in the week of 30 June, when they went on a tear for three weeks, hitting their highest point of the year in late July.

Higher trade volumes tend to reduce the potential volatility of order sizes through a more continuous flow of liquidity, which explains the discrepancies between HY and IG. We do not see a direct correlation between weeks around month end either resulting in smaller or larger trades, and so there does not appear to be a consistent portfolio rebalancing impact, regardless of the effect that individual portfolio trades are delivering.

Interestingly, there is some mirroring between HY and IG trade sizes within individual markets, which implies that macro aspects are affecting trading activity levels in the market. Investment grade volume in the US is up 18% year-to-date (YTD) on 2023, US high yield volume has increased by 8% over the same period. Obviously interest rate expectations in both markets are different, as are corporate revenue profiles, and credit worthiness.

It seems clear that investment grade trading is delivering a more efficient and consistent order size profile, lending itself to systematic trading for both market makers and investors, but more reliably in the US.

HY trading, a smaller proportion of volume in both markets and clearly far less consistent in order size, will not only continue to be harder to systematise, but will also require a greater level of pre-trade data in order to assess liquidity conditions for traders, and in all likelihood need a better set of relationships for buy- and sell-side firms to trade across.

©Markets Media Europe 2024

©Markets Media Europe 2025