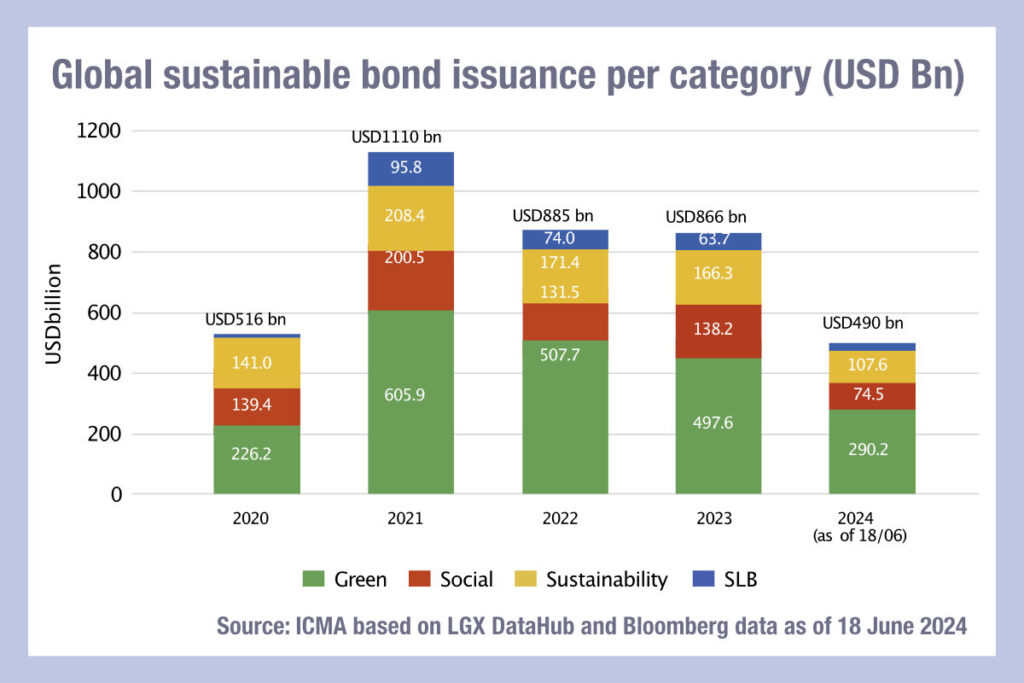

A report co-authored by Nicholas Pfaff, Valérie Guillaumin, Simone Utermarck, Ozgur Altun and Stanislav Egorov of the International Capital Markets Association (ICMA), has found that ‘sustainable’ bond issuance reached US$490 billion by mid-June, representing a 10% increase year-on-year and accounting for 12% of the overall bond market.

The report also noted that 52% of the total European issuance is in sustainable debt, making it the largest sustainable debt market, with sustainable bond issuance making up 18% of supranational institutional issuance, 17% issuance in Asia and 10% of and 10% of North American bonds.

“’Green’ bond issuance surpassed US$290 billion, a 12% increase year-on-year, and accounted for 59% of sustainable bond issuance year-to-date,” they wrote. “New entrants to the green bond market include Australia selling an AUS$7 billion (US$4.7 billion) 10-year bond and Qatar completing a dual-tranche transaction, issuing US$1 billion 5-year and US$1.5 billion 10- year bonds. In addition, Bank of Cyprus issued its inaugural green bond, €300 million 5-year, and National Bank of Kuwait became the country’s first sustainable bond issuer by selling a US$500 million 6-year bond. Moreover, Saint-Gobain completed its first green bond sale, issuing two €1 billion bonds with 6-year and 10-year maturities.”

‘Social’ bond issuance topped US$75 billion, making up 15% of the sustainable bond issuance so far this year, while ‘sustainability’ bond issuance exceeded US$107 billion, which represented a 21% increase year-on-year. ‘Sustainability’-linked bond (SLB) issuance reached US$18 billion, accounting for 4% of the sustainable bond market year-to-date, its smallest share since 2020, according to the report authors.

©Markets Media Europe 2024

©Markets Media Europe 2025