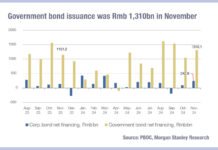

Bond markets typically see increased liquidity around a bond shortly after it is issued. However, this does not mean that markets are automatically more liquid during period of high bond issuance.

It also does not always reflect a batter environment for buy-side trading desks who are trying to access liquidity at a fair price point.

The issue is more nuanced. A first point to consider is that the access to primary markets takes time up in the day of the trader, but the negotiation around a newly issued bond is not always productive for the investment process.

Dealing with issuance can be a time suck that delivers no value at the end of the process. This problem is being increased by ‘credit tourists’, investors from funds who do not normally trade corporate bonds but who are increasingly buying bonds so in order to benefit from higher rates.

These tourist investors are easier for syndicate banks to negotiate with, as their expectations are not as honed as professional credit traders and investors. In effect, syndicate banks are able to cut any new issue premium that was expected down, which means investors engage in deals but then have to step back as they lose value.

It also potentially throws off expected pricing for more experienced investors. From an issuer perspective this increased appetite simply improves the costs of their financing programme.

Another potential problem is the refinancing of existing debt which does not present new liquidity as such.

“It doesn’t really drive secondary trades,” noted one trader. “It’s simply a roll to the new issue.”

Where lots of bonds are being issued – and Q1 2024 has been a record – a large amount of refinancing really hurts. Managing those trades represents time that traders could be spending on managing complex secondary market orders which need to careful work to reduce market impact and information leakage.

If it is not adding liquidity to the market, such a high volume of activity is net negative.

However, there is a potential plus. New issues help to clarify pricing – whether you like the price or not – and greater transparency increases pre-trade assessments of how to place a trades.

Primary activity does create a tail of secondary trading which can be tapped to access more liquidity and to support investment and trading ideas more effectively. Having more information on a frequent basis is a net benefit to traders.

Trading in the grey market – shortly after issuance – is a big draw for some types of asset manager, notably hedge funds, and that also supports liquidity for on-the-run bonds.

However, the net outcome of record issuance is more a con than a pro for buy-side traders; most senior traders note that time spent on deals, and the risk created by the slow progress of straight-through-processing in primary markets, adds up to a headache in periods of peak activity.

©Markets Media Europe 2024