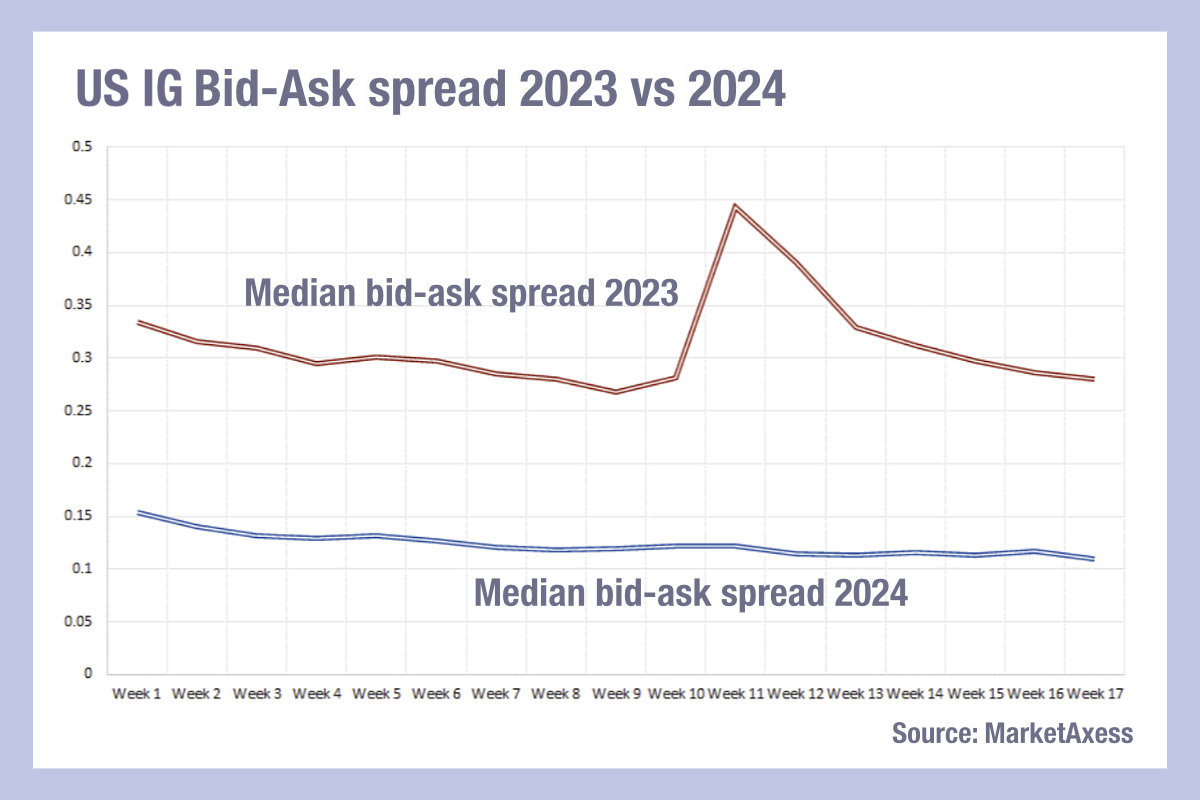

This year’s bid-ask spreads in US investment grade are half those of last year, prompting much celebration on the buy side, but clearly having an effect on dealers.

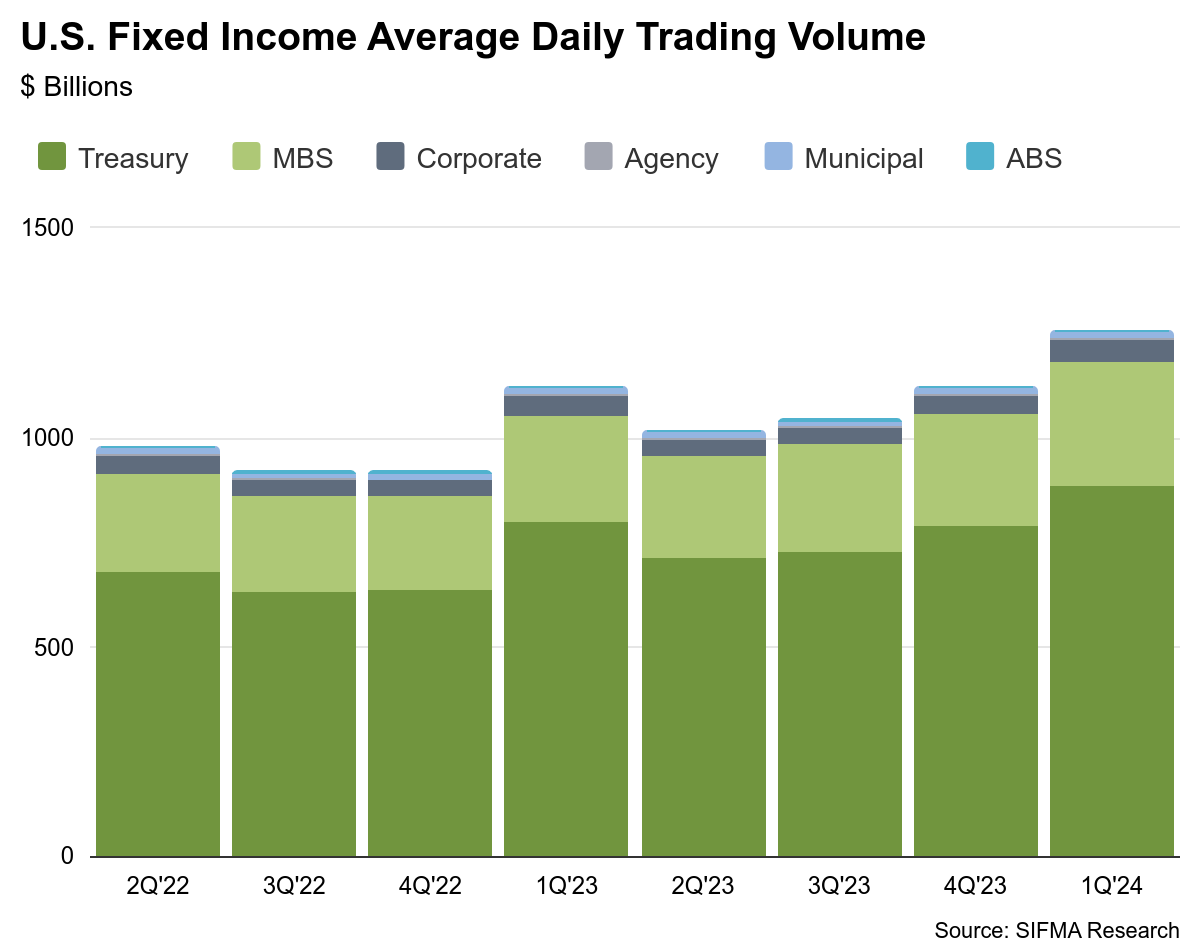

Looking at bid-ask spread data from MarketAxess’s CP+ pricing service, spreads have fallen nearly five percentage points since the start of the year in the most active credit market in the world, The first quarter has largely seen market revenues for banks falling across secondary fixed income, currency and commodities (FICC) trading, even as volumes have rise on the previous two years and issuance has supported primary market business.

Looking at markets globally, two of the biggest banks from Q1 2023 year saw returns drop year-on-year (YoY), with JP Morgan still leading the pack on FICC markets overall but down 7% YoY. Citi was down 10% YoY, which it attributed largely to fixed income trading performance, although it had been boosted by a 49% rise on debt underwriting revenue.

Looking at markets globally, two of the biggest banks from Q1 2023 year saw returns drop year-on-year (YoY), with JP Morgan still leading the pack on FICC markets overall but down 7% YoY. Citi was down 10% YoY, which it attributed largely to fixed income trading performance, although it had been boosted by a 49% rise on debt underwriting revenue.

This allowed Goldman Sachs to take second place, with revenues up 6%, attributed to “significantly higher net revenues in mortgages and higher net revenues in currencies and credit products.” Wells Fargo also saw an against the stream net YoY revenue increase, thanks to a combination of structured products, credit products, and foreign exchange. This implies that the overall trend of falling spreads will impact net bank revenues, but potentially not all, with some able to ride the market conditions to outperform their peers.

Although only a proxy for credit overall, as the largest corporate bond market, US IG is a good benchmark for overall trading in developed markets. A notable winner at present is Jane Street, which has spent ten years courting the buy side but is really coming into its own over the last two quarters. Its highly efficient risk transfer process is enabling it to use both electronic platforms and, in some cases direct connectivity, to deliver tighter prices to asset managers than ever before.

This downward pressure is potentially a major factor in the tightening bid-ask spreads seen in 2024, and along with electronification more broadly may prove to be a structural change that delivers lower bid-ask spreads for longer.

©Markets Media Europe 2024