The cost of liquidity as measured by the bid-ask spread in bond trading has fallen by approximately 25% since the start of the year, according to data from MarketAxess’s CP+ pricing service.

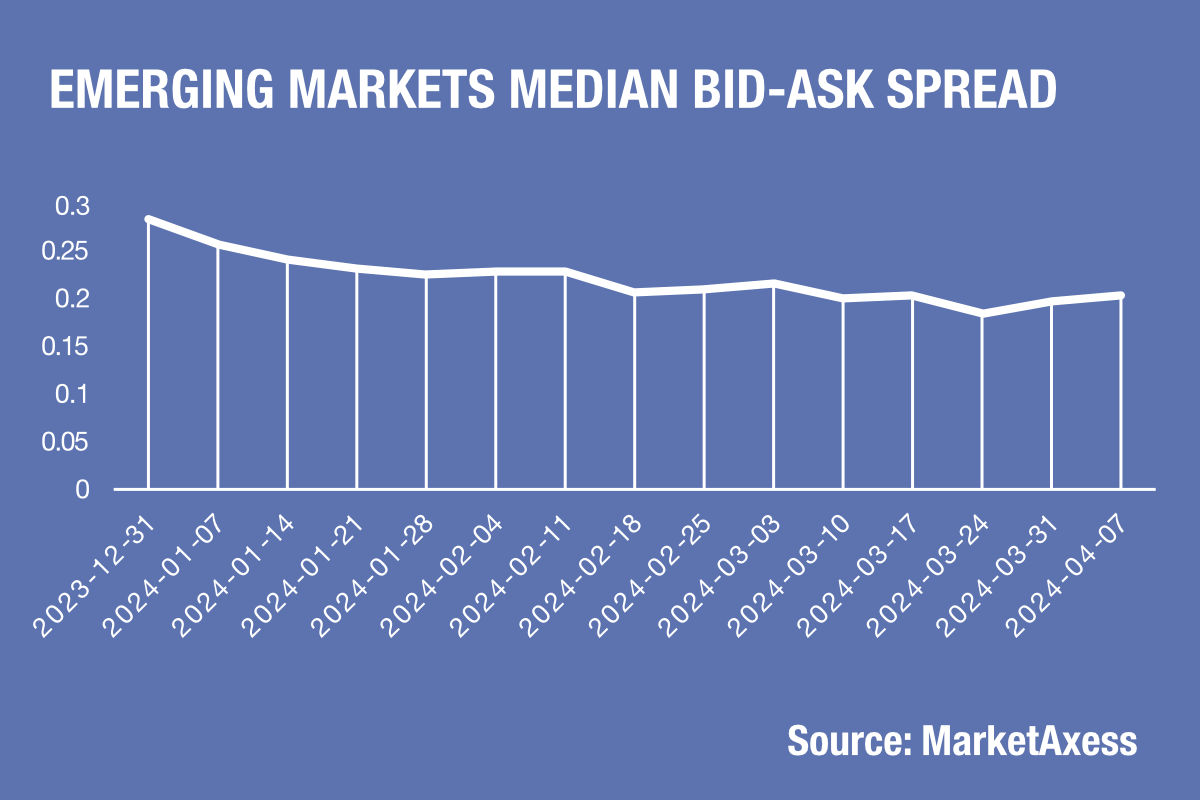

In real terms, the drops reflect falls of nearly ten basis points in several developed bond markets, and in dollar-denominated emerging markets, all of which already have bid-ask spreads in the low multiple basis points. Such a major drop in the space of a few months is putting pressure on dealers’ profitability in secondary trading, even as primary markets deliver outsized returns.

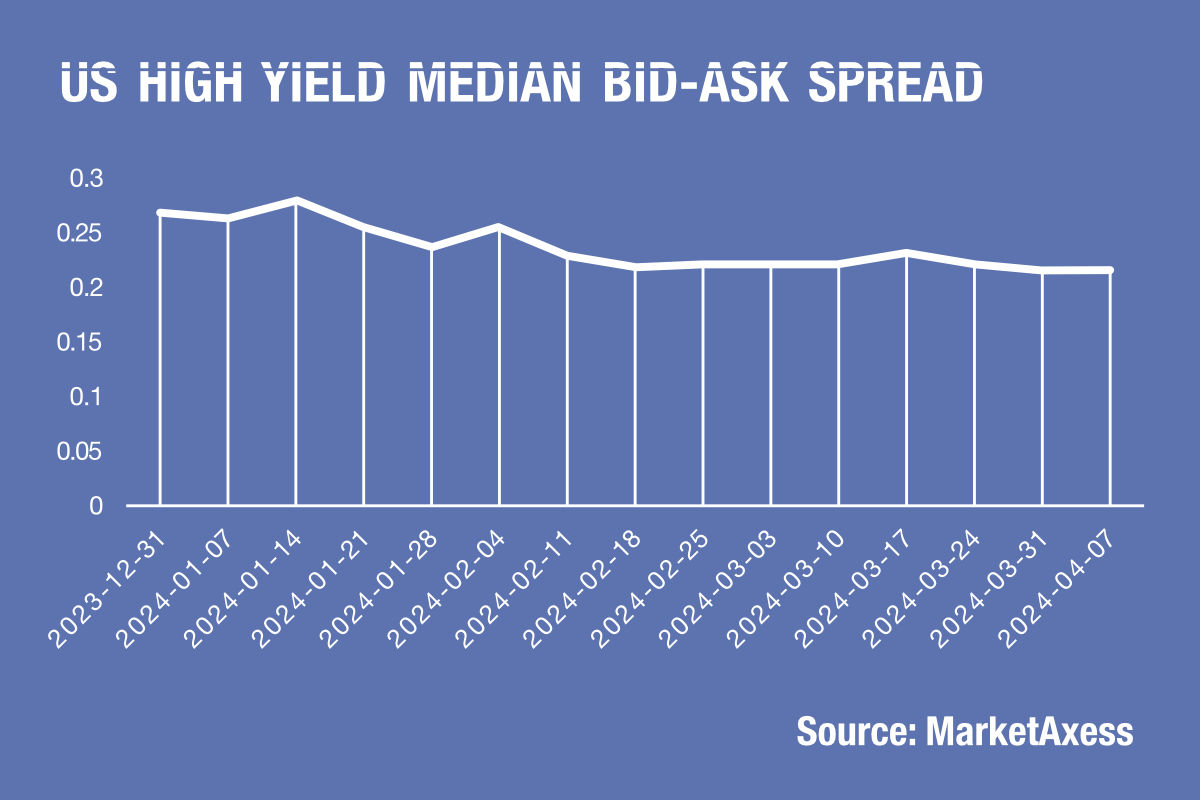

The smallest decline has been in US high yield markets where bid-ask spreads have dropped 19% since the start of the year. Having started the year with a tighter spread than European high yield and emerging markets bonds at 27 basis points, it has now been overtaken by EM, and has a bid-ask spread at 22 bps. The largest tightening has been in dollar denominated emerging markets debt, with a drop of 28%, from 29 bps to 21 bps since the start of the year.

There is not a clear correlation between volumes and bid-ask spread activity. Although investment grade in both European and the US has seen trade count break higher than the corresponding notional volume – indicating a reduction in average trade size – that is not the case for European high yield, which at 23 bps bid-ask spread is now the widest of the five groups being assessed, but has seen a 27% drop since the start of the year.

One possible reason could be the growth of e-trading, which has seen a year-on-year drop off in US high yield to sub 30%, even as US IG, emerging market and European IG and HY e-trading volumes grow. Another is the level of competition between market makers in each market. The significance of the relative decline depends on the level to which structural factors are at play, which might affect future flexibility on spreads. With US and European HY bond bid-ask spreads within a basis point of each other, as indeed are US and European IG markets, one perspective is that markets have corrected an imbalance of expensive liquidity in European HY.

If US markets are able to drive down costs further, either due to increased competition, it may prove challenging for dealers’ profitability but could significantly reduce trading costs for investors. If e-trading is increased – reducing costs for market makers and buy-side traders – we could see a sustainable reduction in the costs of trading.

©Markets Media Europe 2024