Risk warning lights flashing on buy-side trading desks could be assuaged thanks to industry collaboration on primary markets.

Risk warning lights flashing on buy-side trading desks could be assuaged thanks to industry collaboration on primary markets.

It seems incongruous that the 50-year old ‘copy and paste’ function, designed by Larry Tesler in 1974, constitutes the height of efficiency in 2024’s bond issuance processes.

If every large mortgage transaction required 20 clerks to manually re-key details accurately between several banks, buying a house would be unnecessarily nerve-wracking. Yet in capital markets, investment managers see their biggest bond transactions conducted manually because there has been no straight-through-processing (STP) for transacting newly issued bonds. Now, an STP solution has emerged thanks to industry collaboration between technology providers, and buy-side firms are keen for banks to get onboard.

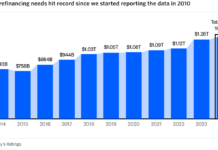

In January 2024, US$221.7 billion of corporate debt was issued via the US primary market. While secondary volumes are higher, with average daily volume of US$40.1 billion for the same month, the operational risk exposure of the primary trades was far greater.

“In fixed income, governments are issuing more debt this year than ever before,” says Gregg Dalley, global head of trading at Schroders. “Issuance of corporate debt continues to be strong, and the volumes are enormous.”

Trading in secondary markets can be completed using a fully electronic straight-through-process, even for voice trades, which electronic platforms can capture and submit. Primary markets lack this ability.

“Some of the single biggest orders are sent in an arcane, manual manner,” says Adam Conn, head of trading at Baillie Gifford. “It’s as simple as that. We need to replicate the order-placing process in the secondary market and replace the current manual process. The goal is to remove the risk of error in transmission, and of any misinterpretation by the receiver of those placed orders.”

Investment banks clearly understand the importance of making the process electronic – Goldman Sachs and Morgan Stanley historically both developed their own proprietary platforms, and a consortium of banks have collectively developed DirectBooks, a tool to support electronification and ultimately some degree of automation. Many banks also already use S&P Global’s Investor Access and/or Bloomberg to electronify new issuance, while block-trading specialist Liquidnet has also developed a primary market offering for the buy and sell side.

“People are ready to make these changes, the technology is there, everyone’s now ready to embrace this new change for the benefits of the end investor,” says Conn.

The only barrier is consensus. While dealers almost universally engage with all of the major secondary trading platforms, they are selective about which primary platforms they work with.

“We have several vendors providing innovative solutions to these problems, but we need buy in from the sell side and the key bookbuilding vendors to make any progress,” says Dalley. “If people still want to send orders manually then that is fine, but we need a choice, and this has taken far too long to progress.”

Breaking the mould

The most commonly used platforms in the space are Bloomberg, S&P Global’s Investor Access, and DirectBooks. The DESK’s research indicates the latter two are used by between 30-40% of the market, but Bloomberg’s IB chat is in use as a manual part of the process by nearly 100%.

Once engaged, platforms become heavily used. A quick straw poll of asset managers, conducted for this article, found that 40% used a platform for 90-100% of new issues, while 50% used a platform for 0-10% of new issues, employing chat, email and phone for 90-100% of new issues at most firms. Only one firm balanced manual vs platform use exactly 50/50.

That indicates firms are bifurcated between non-users and massive users of these platforms, when they can be accessed. However, the impact of using these can still be limited if firms are not able to deliver an STP process for taking information from the issuance platform and stream it straight into internal systems.

“We have three processes that we are looking to improve: order creation, order placement and order allocation,” says Dalley. “We are vendor agnostic about who we use to electronify those. What we need to see is engagement. Depending on your order or execution management system, (O/EMS) providers the order creation process may be solved by a different IT solution to the placement and allocation process.”

Bloomberg has received considerable praise in the first quarter of 2024 from buy-side firms, for demonstrating the capability to deliver a connection from the O/EMS – either Bloomberg AIM or Charles River Development (CRD) currently – to any sell-side systems, thus bridging the existing gaps in workflow.

“This is essentially the first time a buy-side OMS has been connected directly to the bank’s bookbuild system,” says Nick Hall, head of fixed income primary markets, Bloomberg. “That’s never happened before. Previously, the buy side have had to go to a website to place their electronic order. For firms using an OMS, that moves the manual, error-prone order re-keying piece from the sell-side salesperson, to the buy-side trader. In that workflow that manual element is still there. And that’s why you’ve seen limited adoption [of systems to date].”

Its Financial Instrument Global Identifier (FIGI) has already been adopted across platforms –DirectBooks cites itself as the exception – so that newly issued securities can have a consistent identity tag in an OMS at the point of issuance. Historically the ISIN or CUSIP identifier had relied upon dealers to issue them, which might happen hours after issuance. As well as Bloomberg, Investor Access and Liquidnet Primary Markets also generate FIGIs, and they are interoperating with Bloomberg to eliminate the risks that fragmented systems create by reducing efficiency.

In providing an identifier, and the straight through connectivity to buy-side systems, users hope that the operational risks that currently exist can be eliminated.

“With the Bloomberg solution, there is no manual rekeying at any point in the process, so the demand is generated by the portfolio managers in the OMS and that flows down into the TSOX EMS,” says Hall. “Buy-side traders can aggregate that demand in TSOX, send that order directly down into the banks’ bookbuilding systems and get an allocation back. That’s the STP element, there’s no rekeying at all. While AIM, Bloomberg’s OMS, is fully integrated into this flow, any OMS platform that can handle or utilise a FIGI can also connect.”

Allocation of risk

Reducing the risks seen in the process have clear advantages for dealer syndicate banks, as evidenced by their own development of electronic solutions.

A concern for those banks is the extent to which the allocation process is intermediated. Allocation gives banks power over buy-side firms according to US market regulator, the Securities and Exchange Commission (SEC).

“Buy-side participants with whom we have spoken worry that if they complain about information availability, or back out of an offering after submitting an order, dealers will retaliate by giving a smaller allocation in a subsequent offering,” noted the SEC in a 2020 report.

From the issuance side – and issuers are the clients of the bank in the primary markets – the allocation decision-making process itself is more an art than a science. At a recent conference held by trade body, the Association of Financial Markets Europe (AFME), Jürgen Klaus, principal team lead for the Derivatives and Market Intelligence team in Funding and Investor Relations at the European Stability Mechanism (ESM), noted that as an issuer, its application of artificial intelligence (AI) to support allocation had limited value.

“Feedback from our desk was that [allocation] is very individual,“ he said. “You can use [the output from the AI] as an additional information point, to paraphrase a famous quote ‘artificial intelligence can be very intelligent but very artificial’. It is helpful but it doesn’t do the job.”

For buy-side traders, the key element is not the decision-making around allocation but the risk carried by the buy-side desk from an inefficient allocation process – hence the excitement around new STP delivery mechanisms.

“This process is incredibly flimsy, it needs to be more robust,” says Conn.

©Markets Media Europe 2023