Lee Foulger, director of financial stability, strategy and risk at the Bank of England, has said that higher interest rates, choppier market conditions and unreliable risk management data may upend the smooth functioning and reliability of private credit markets.

In a speech, ‘Non-bank risks, financial stability and the role of private credit’, Foulger said that in recent years, private credit has become an important source of funding for some corporates, and explored how the higher interest rate environment may impact private credit markets.

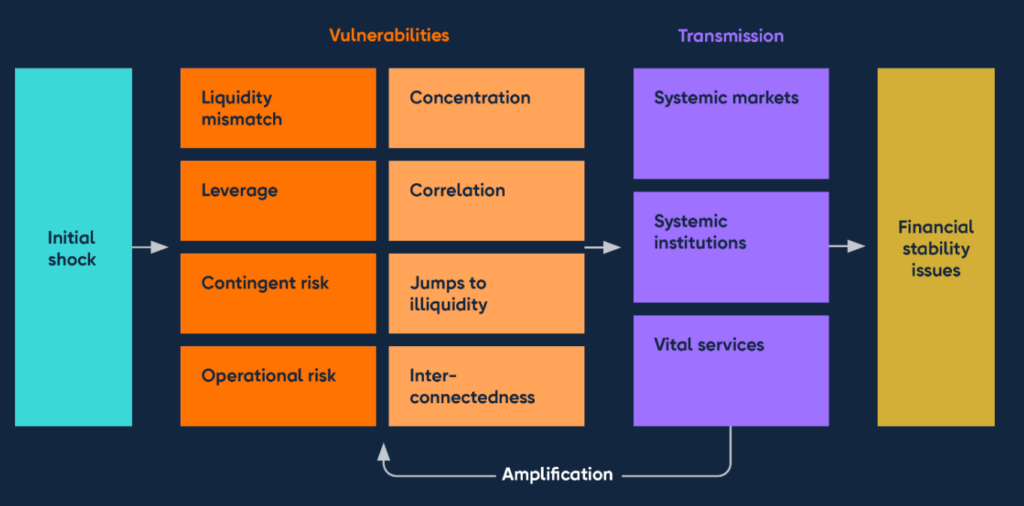

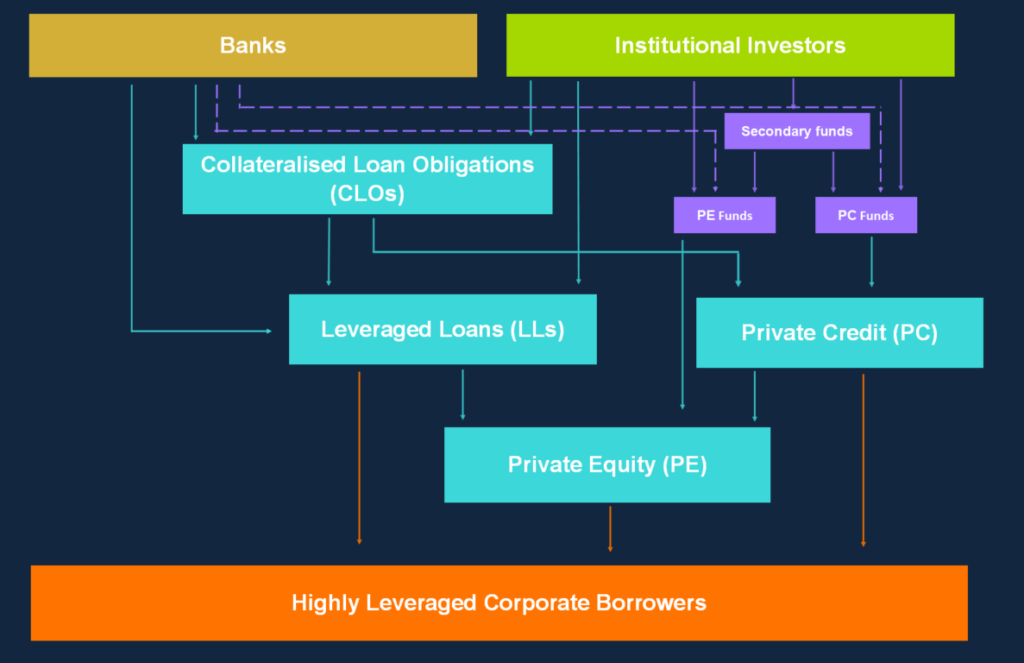

While the availability of private credit can be beneficial for the economy, Foulger noted, interconnectedness, when married with opacity, can result in losses transmitted to counterparties “in a sudden or surprising way”. In private markets, these interlinkages could include cross-investing between investors and funds, with some large fund managers exposed to other private credit and private equity funds. The significant interlinkages between private credit markets, leveraged lending, and private equity activity make them vulnerable to correlated stresses, Foulger noted.

But, in many ways, lending via private markets is likely to be lower risk from a financial stability perspective than had the lending been undertaken by the pre-GFC banking system, Foulger said.

Leveraged lending, high yield bond and private credit markets account for around a quarter of all market-based finance globally with leverage lending and private credit taken together having roughly doubled in size over the past decade.

“Within that, we estimate that private credit has grown even faster – four-fold since 2015 to around $1.8 trillion, though given the limited data available the true market size could be much larger,” Foulger said. Much of that growth has been during a sustained period of low interest rates. But since 2022 interest rates have increased “substantially”,Foulger said, with no change on the horizon.

As such, corporates that borrow through private credit markets, along with leveraged loan and high yield bond markets, are likely to be more challenged in a higher interest rate period.

Although private credit market participants have so far reported low default rates despite the tougher macro environment, over the past year highly leveraged borrowers have experienced a “significant decline” in their interest coverage ratios.

Foulger said that risk management of private credit investments may also be made more difficult by the illiquid nature of the asset class. Given the illiquidity of private credit assets, there is a possibility that investors may opt to sell other, comparatively more liquid assets, such as leveraged loans or high-yield bonds to reduce their credit exposures.

Wrapping up, Foulger looked at broader factors in the risk environment, pointing to geopolitical risks, more subdued economic growth, and tighter financing conditions, all of which will pose challenges to the non-bank sector and specific challenges to private credit markets. Gaining a clear picture of these risks is hampered by a lack of reliable data, Foulger said.

“Assessing the extent of the risks, or in which scenarios they might crystallise is easier said than done. There are significant challenges with obtaining reliable data to monitor the risks in private credit markets. We have so far used a combination of market intelligence and data analysis to inform our thinking – but welcome further engagement with market participants.”

Reacting to the speech, Brian Slattery, SVP, head of Northern Europe, Clearwater Analytics, said, “When it comes to producing accurate valuations in private markets, investors are largely able to produce fair value assessments in an ideal world. However, when it comes to determining the value of assets in situations like the ones outlined in this Bank of England speech, it can become much trickier.”

“Producing accurate valuations is dependent on being able to use whatever data is available across the business both efficiently and effectively, as well as factoring in liquidity challenges into valuations. On top of this, being able to conduct rigorous stress testing, based on historical and future scenarios, can aid firms in being able to produce fair value assessments of their private assets,” Slattery added.

© Markets Media Europe 2023

©Markets Media Europe 2025