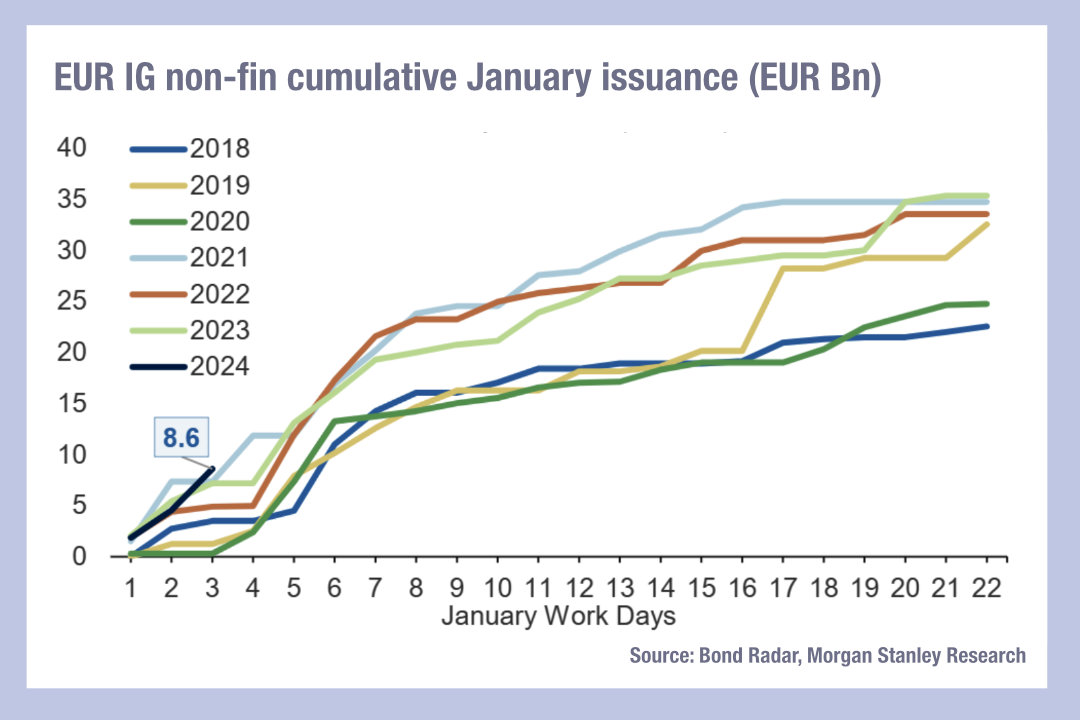

The new year has seen a flying start in bond issuance in Europe, with a strong start relative to recent years driving €8.6 billion out of the gates for non-financials by the 3rd work day, potentially punishing buy-side trading desks.

Analysis by Morgan Stanley has found that supply is geared towards shorter tenor bonds, with issuers aiming to reduce the length of time they will be paying out at higher rates. However, investors are happily taking on these assets, safe in the knowledge that widely predicted rate cuts in 2024 will create a seller’s market for higher return bonds in 12-24 months.

New issue maturity profiles reflect this, with Morgan Stanley analysts noting, “This trend has also been reflected in the shrinking size of the long-end market, with the size of the 10-year+ maturity cohort having shrunk by 20% from its peak in late 2021 to just €212 billion in December 2023.” A fifth of new bonds were in either utilities, consumers or autos, which raises questions around utilities – these are the traditionally the investor’s choice in uncertain times due to their steady cashflows and low risk profile. That does not seem to square with being a major debt issuer in a relatively high rate environment during a period of severe political uncertainty.

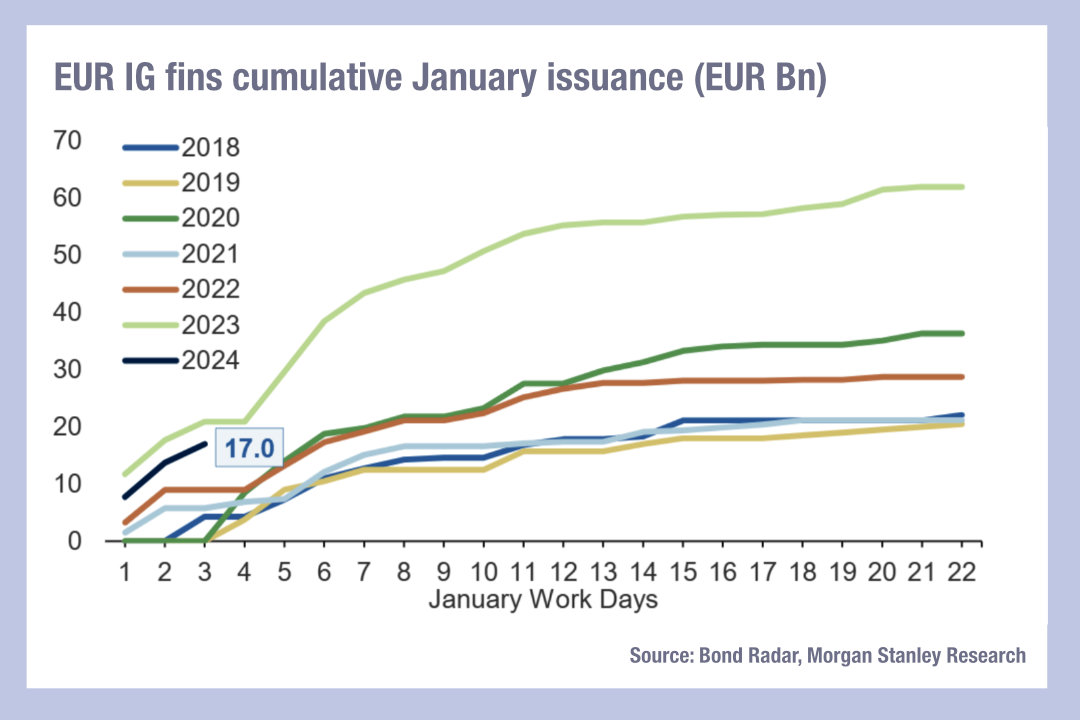

For financials, a lower level of senior debt issuance will lead to a drop off in 2024, which had hit €17 billion by the third working day in 2024. “We see issuance dropping back towards 2022 levels, with total issuance across regulatory capital and seniors reaching €352 billion by year-end, down 12%Y in gross terms versus 2023 or 45%Y in net terms versus 2023,” the analysts note. “EUR IG non-financial supply to total €270 billion in 2024, down 4% versus 2023.”

While the appetite for this debt may be high, buy-side desks that were not fully crewed out at the start of the year will have been struggling to cope with this level of issuance and to also manage secondary trading effectively. Using electronic platforms to manage this workflow would be a major advantage, but as The DESK has frequently noted, buy-side traders currently face a fragmented set of tools in primary markets.

However, where both buy- and sell-side are connecting using the same tools, the potential savings in time and the ability to rapidly trade a new issue in the secondary market could deliver significant returns.

©Markets Media Europe 2023

©Markets Media Europe 2025