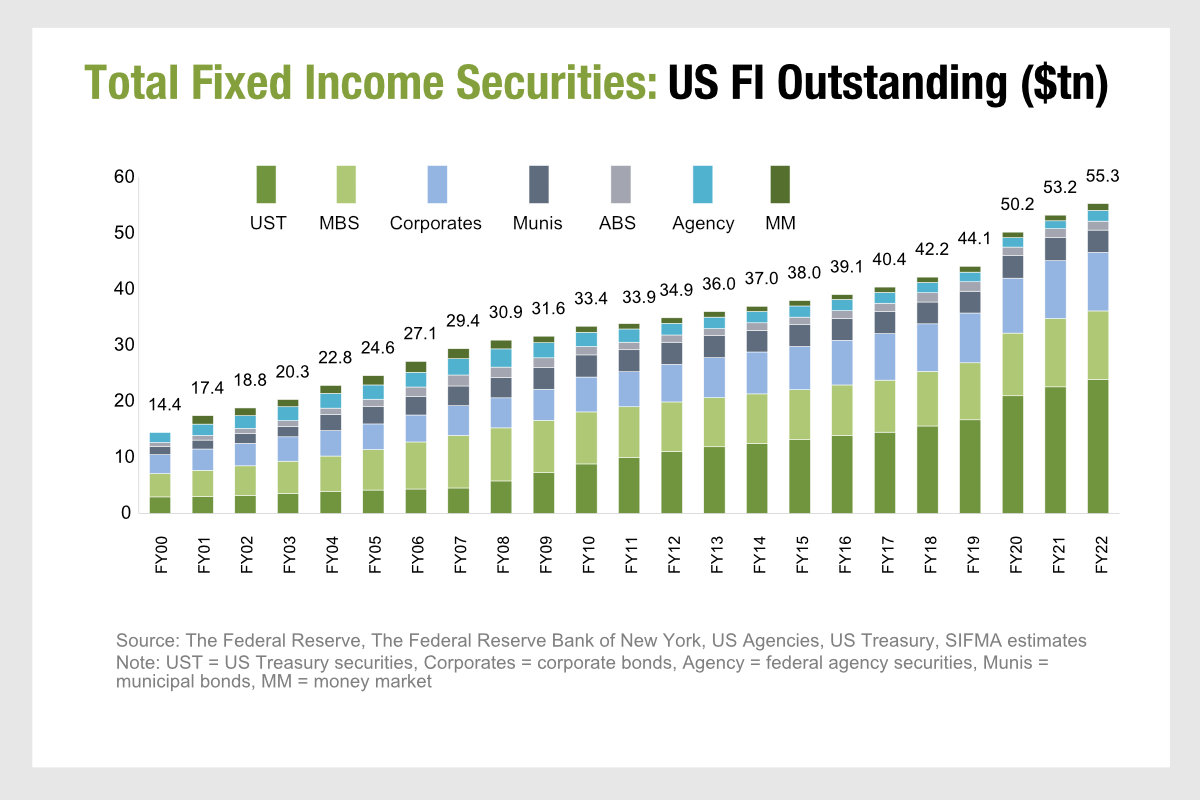

The rising level of outstanding debt in the US markets is remarkable – it hit 144% of gross domestic product (GDP) in 2022 according to the Organisation for Economic Co-operation and Development (OECD).

The Institute of International Finance (IIF) reported in September that global debt reached US$307 trillion in Q2 of 2023, with 80% of the growth driven by developed markets like Japan – whose indebtedness was 255% of GDP last year – and the US, signalling an increase of US$10 trillion in H1 2023.

When debt increases the greatest risks typically sit within developing countries, however, it must be noted that in the five years to end of 2022 the level of total debt in the US had increased by 31% according to Federal Reserve data. US GDP annual growth has averaged in the low single digits over the same period.

The risk associated with the debt – in terms of default and value – is tied to the wider economic circumstances and central bank responses to them. Recent talk of a bond ‘rout’ reflects the higher coupons offered for newly issued debt in a raising rate environment, and the conversely downward pressure on the price of existing debt held on portfolios. That can create problems for existing debt holders, if they have to mark to market on their assets or to sell them, less if they are able to hold to maturity. Recession is the other big risk.

It has been widely predicted that the US is not going to see a recession until 2024, following its failure to collapse this year. The Federal Reserve is expected by many to hold rates steady in the near term, rather than continuing to hike them. That might ease the pressure on borrowers somewhat.

On the other side, the holding rates ‘higher’ for ’longer’ is a recipe for the rolling debt mountain to look increasingly precarious. “Should inflationary pressures persist in mature markets, the health of household balance sheets, particularly in the US, would provide a cushion for against further rate hikes,” wrote the IIF.

Consequently it may be that this large pile of higher coupon debt is sustainable, and investable In the near term at least.

©Markets Media Europe 2023