“Hold me now,

Whoa, warm my heart,

Stay with me!”

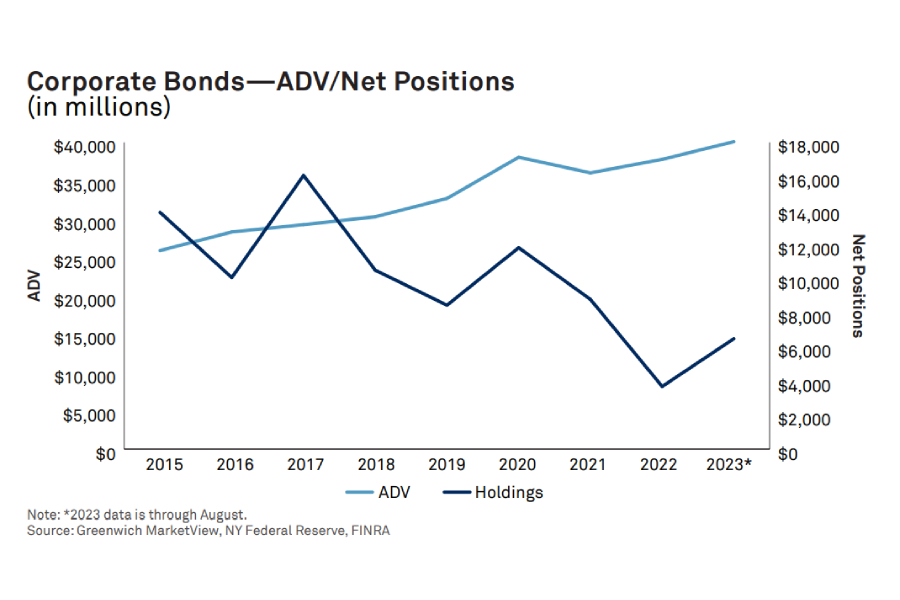

This Thompson Twins’ classic could be sung by corporate bonds to the sell-side community, who saw their holdings of credit fall by about 75% in the five years between 2017 and 2022, according to analysis by Coalition Greenwich.

Bond holdings reflect the cost of inventory for traditional US sell-side banks, and their ability or appetite to make price in a traditional manner.

Interestingly US average daily volume has increased consistently over the same time from just over US$25 billion to around US$40 billion.

The ‘how’ of that is driven by the use of non-bond-holding market makers and market operators who are able to facilitate liquidity transfer electronically. This also accommodates the buy-and-hold nature of long-only investment managers keen to acquire big positions of these higher yielding assets.

Bond holdings do create another dynamic – being able to find the bonds when they are needed. If bonds are largely traded on an agency basis, they are frequently in motion if they are not held by investors. This potentially makes liquidity formation harder, and reduces the typical size traded because banks are less able to facilitate block trades.

In secondary markets we see smaller trade sizes becoming more common – at least in the US markets – and that allows buy-side traders to spend more time on those block trades.

However, the changing model of intermediation reflected by lower bond holdings can potentially change the liquidity risk profile of the market.

© Markets Media Europe 2023