Trading in the less liquid parts of the fixed income market has remained relatively untouched by electronification.

Loans and securitised products backed by loans can deliver attractive returns for investors, and institutional investors can either buy corporate loans and collateralised loan obligations (CLOs) directly, or access retail debt such as credit card debt and car loans, after they have been securitised into asset backed securities (ABS).

In report ‘Understanding Fixed Income Markets in 2023’ research analyst Coalition Greenwich and SIFMA Insights wrote, “These securitised loans, packaged and sold as bonds, are easily traded and held by institutional investors, allowing retail consumers to get reduced-cost access to the credit they need They also offer institutional investors the opportunity to diversify their portfolios beyond traditional corporate and government bonds.”

However, while they can potentially be traded like bonds, in reality these markets lack liquidity which makes trading very challenging and drives investment firms to seek greater efficiency via electronification.

Rebecca Willey, vice president and fixed income trader at T. Rowe Price says, “The loan market is antiquated and very nuanced. While onboarding new tech initiatives for high yield, it made sense to look into how we could replicate some of those initiatives with bank loans and that’s where things evolved.”

One buy-side trader, speaking on condition of anonymity, said, “ABS is quite a buy-and-hold market, and is largely accessed via newly issued securities. Most ABS purchases have been agreed by portfolio managers before they hit the secondary market. On the loan side, there is a bit more liquidity, which has a similar profile to high yield.”

To illustrate the liquidity profile of ABS, in 2022 Coalition Greenwich reported that the US saw new ABS issuance of US$238 billion, but an average daily volume (ADV) of just US$832 million, while the more liquid mortgage-backed security (MBS) market had only US$2.7 billion of new issuance but ADV was US$240 billion. When instruments trade so infrequently, price formation is far harder to achieve.

To illustrate the liquidity profile of ABS, in 2022 Coalition Greenwich reported that the US saw new ABS issuance of US$238 billion, but an average daily volume (ADV) of just US$832 million, while the more liquid mortgage-backed security (MBS) market had only US$2.7 billion of new issuance but ADV was US$240 billion. When instruments trade so infrequently, price formation is far harder to achieve.

“The loan market is a relationship dependent asset class, there’s little to no transparency into pricing so you really need to rely on your partners and relationships with the sell side,” says Willey.

Another trader speaking anonymously noted, “You can see backwardation [where the futures prices is lower than the spot price for the loan] and you have to take the dealer’s word that the price is right. A loan might be on your blotter for weeks before it trades, because if dealers will struggle to offload it they will be more reluctant to take it.”

Path to progress

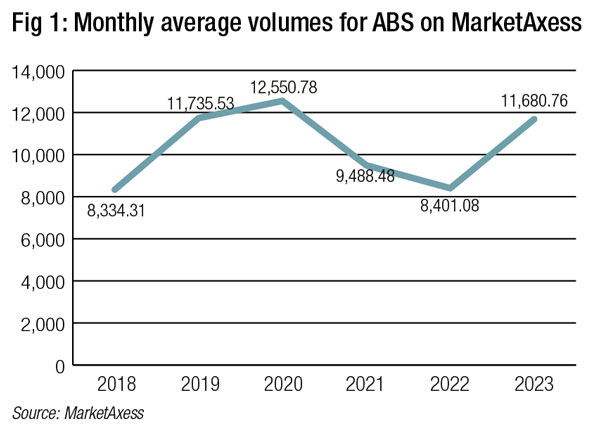

Fixed income market operator MarketAxess offers trading in ABS and loans, while dealer consortium backed Octaura, provides electronic trading in the loans space, both trying to facilitate easier price and liquidity discovery.

“Leveraging off of our strength in high yield trading we have focused on loan trading for institutional clients trading with the dealers who make markets in this space,” says Rich Schiffman, global head of trading solutions, MarketAxess. “We use a similar protocol to bond trading, with single and list request for quotes (RFQs).”

Brian Bejile, CEO of Octaura says, “We are releasing some initial protocols that people are familiar with, such as single loan RFQ with negotiation, LIST or auction trading functionality which has proven to be popular with investors such as 40-Act Funds facing redemptions and thereby needing to sell positions quickly. By moving from the telephone to the platform there are significant benefits, particularly workflow, straight through processing (STP) and dealers being able to upload directly onto clients’ Octaura screens via FIX APIs instead of sending IB chats on Bloomberg.”

Their support is creating a path for buy-side firms to engage with, albeit at a reduced level to other markets.

“Our options for platforms are limited compared to high yield so we really utilise all platforms available and have continuous dialogue with platforms and data providers,” Willey says. “Our relationship with Bank of America led us to be heavily involved in the beta testing process with Octaura. Both sides of the market want to get to a place of efficiency, working together to make sure the platform was well positioned for all of our needs sets the market up for further efficiencies and liquidity.”

No fast changes

The platforms themselves face several barriers to evolving the market, in the loans space particularly because loans are not classified as securities which prevents them from being traded in a more conventional framework.

“The settlement process is really where the difficulty lies,” says Schiffman. “A regular way settlement time for loans is T+20. There’s no DTCC, no central clearing house to handle settlement issues. All settlement has to go through the agent’s bank.”

As a result he notes that this creates challenges for trading protocols which support liquidity in other debt markets, such as all-to-all trading.

“We can’t stand in the middle of those trades because loans are not securities, so all trading is between institutional investors and the liquidity provider on our platform” he says. “Yet harking back to the early days of Open Trading [MarketAxess’ all-to-all protocol] we do give investor clients the ability to make an inquiry public, so they can show their inquiry as a single item or list, to the entire group of participants on our platform.”

As the firm had done for all-to-all trading prior to 2013, firms can respond to these enquiries, by putting an order through a dealer who received the enquiry directly.

“It’s a reasonable way to try to get clients some extra liquidity in a constrained market beyond just the dealers, but to be very clear, it is predominantly a dealer provided liquidity market,” he says

Further innovation could support activity in the loans market even further says Bejile. “In our next phase, which is coming in 2024, we will address the needs of traders in the CLO space to run complex models before they even start trading . That’s a significant difference to what traders have to do in the corporate bond markets.”

By bringing analytics onto the platform to tackle the complexities of loans trading he believes execution can be turbocharged.

“Our path is to go further into portfolio trading, with exchange traded funds (ETFs) creations/redemptions being executed on the platform by partnering with ETF liquidity providers,” he says. “Portfolio trading for CLOs is an important part of the ecosystem, so leaning into that as a partner to the dealers that have created incredible optimisation algos to serve clients directly on the platform. So when buyside traders are on Octaura, they will not only be able to launch RFQs and LISTs, but could also execute optimisations, and other portfolio trades.”

©Markets Media Europe 2023

©Markets Media Europe 2025