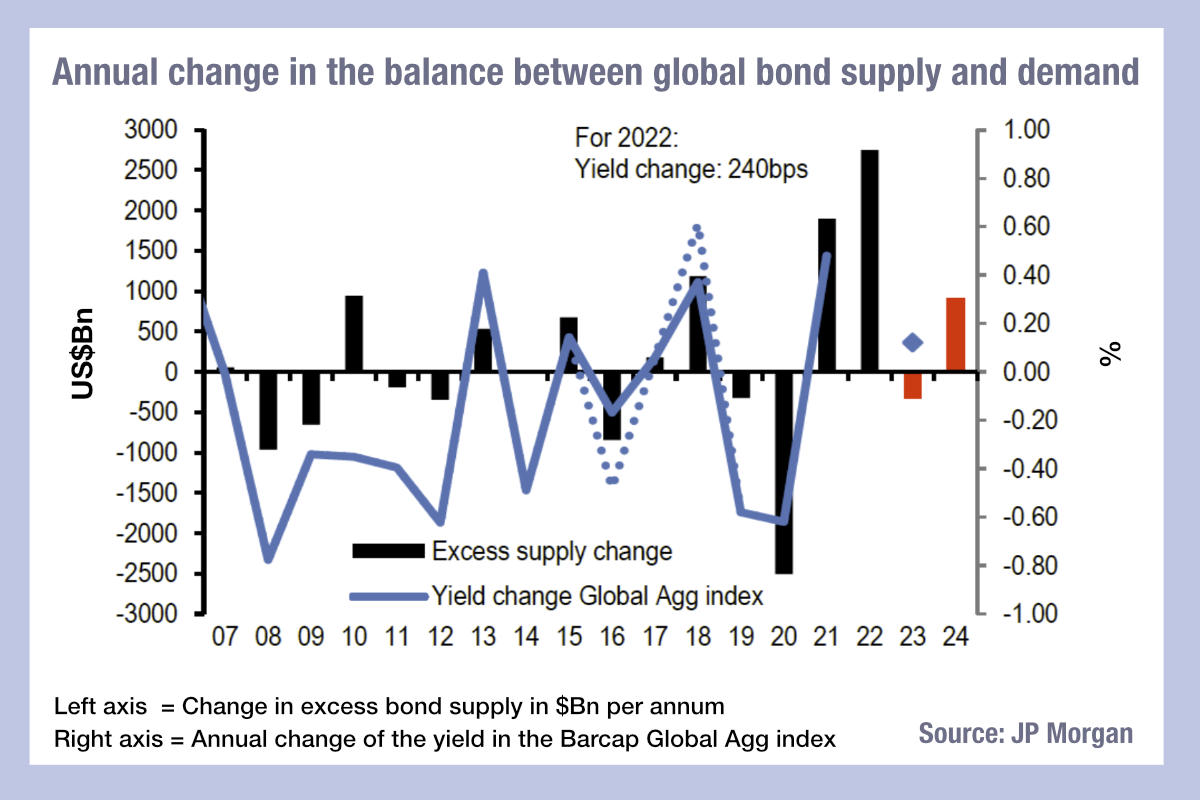

Analysis by JP Morgan’s Global Markets Strategy team, Nikos Panigirtzoglou, Mika Inkinen and Mayur Yeole has cast an interesting light on the prospects for absorption of bond issuance in the market next year.

Left axis = Change in excess bond supply in $Bn per annum calculated as the difference between changes in global bond supply and changes in global bond demand. It includes 2023 and 2024 projections.

Right axis = The annual change of the yield in the Barcap Global Agg index in % (Jan-Oct in dotted lines for 2016 and 2018).

Net-net they project a potential fall in demand of just under US$1 trillion. While that has implications for spreads – upward pressure of about 25bps is estimated – it also has implications for market activity. The need for fewer bonds will firstly be affected net selling of bonds by central banks the US, the UK, the Euro area and Japan (G4 countries) unwinding their historical bond purchases.

These are expected to amount to US$1.2 trillion in 2024 against nearly US$1 trillion in 2023, which would be an annual drop in bond demand of about US$250 billion compared to the massive deterioration of around US$1.4 trillion this year vs 2022. Commercial banks in the G4 are expected to need US$200 billion fewer bonds, while the pension fund appetite is estimated to increase slightly to US$600 billion and retail appetite to stay flat at US$500 billion. This collectively drops appetite by about US$150 billion and added to increased supply of US$0.8 trillion this pushes overall demand down by roughly US$0.95 trillion.

The effect on falling appetite for issuers could be positive for investors. Increased spreads and higher than needed issuance should make it more of a buyers’ market, and combined with higher rates – relatively to recent historical norms – should help bond funds support their investment goals.

At the same time, although overall pension funds may be increasing demands, the net reduction with fewer forced buyers in the market may reduce the strain on buy-side desks, giving more time to spend on secondary market trading; given the efficiency gains being made by Bloomberg, DirectBooks, Liquidnet and S&P Global Market Intelligence through automating the bond issuance process, 2024 may at last see buy-side desks find the pressure from primary activity reduced.

©Markets Media Europe 2023