The firms who are part of this Bloomberg initiative discuss how it is benefitting investors and scoring goals in the governance space.

The DESK spoke with Derek Kleinbauer, global head, fixed income & equity E-Trading at Bloomberg, to learn how trading desks can support their clients’ governance goals around diversity, equity and inclusion through partnership with Bloomberg, and how firms can participate in this programme.

What can you tell us about Bloomberg’s DE&I liquidity offering?

Bloomberg has always maintained a strong culture of diversity, equity and inclusion (DE&I) and that extends to Bloomberg’s e-trading franchise which has had a programme in place to support diverse dealers since 2017. Recently we have expanded this programme with new asset classes to provide dealers with new opportunities.

How does this initiative support diverse dealers?

The e-trading solutions that Bloomberg provides not only enable its diverse dealers to reach a broader client base, many of whom will be new, but also provides the clients themselves with access to a greater pool of liquidity. As recent events have shown this is particularly important for US Treasuries.

How does the new programme expand what you previously had in place?

Most notable has been our very successful relationship with CastleOak Securities, a minority broker dealer and leading boutique investment banking firm, with whom we’ve partnered for a number of years to bring to market an all-to-all trading solution for corporate bonds. This offering, known as DirectPool, provides a reliable and cost-efficient source of liquidity and is accessed via Bloomberg’s award-winning Bid Offer List Trading (BOLT) technology.

Which firms are currently part of the Bloomberg’s diverse dealer initiative?

The latest iteration of this initiative involves expanding our minority broker dealer network for US Treasuries, including Mischler Financial, a Service-Disabled Veterans Business Enterprise and Tigress Financial, a Disabled and Woman-Owned Financial Services Firm, as well as CastleOak Securities. Additional firms are in the process of onboarding and integrating this solution, and we look forward to their launch in the weeks and months ahead.

What has the client response been to this programme?

It’s been exceptionally positive, as evidenced by the following feedback:

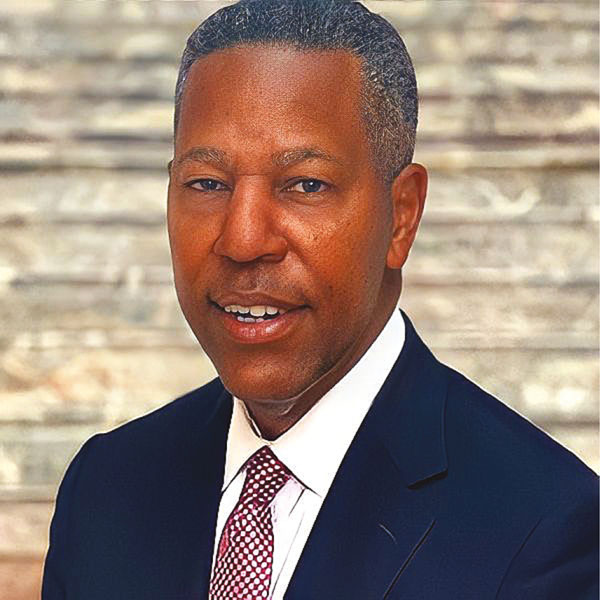

David Jones, president & CEO of CastleOak Securities: “We approached Bloomberg in 2016 about an innovative idea using Bloomberg’s BOLT platform that not only would help us provide liquidity to our clients but also level the playing field. The combination of Bloomberg’s technology prowess with our trading capabilities has resulted in a lower cost alternative for clients while still fulfilling best execution requirements. Our partnership with Bloomberg has helped us gain significant trading market share in fixed income trading, which in turn has meant measurable revenue growth. DirectPool’s trading volumes continue to grow year over year; the marketplace has realised that this is not only an efficient trading platform but also a transparent way to achieve their D&I goals. This is not a marketing gimmick, it’s a long-term partnership that provides real value. CastleOak have recently added on electronic US Treasury trading capabilities, and continue to work with Bloomberg to develop new solutions for our clients.”

David Jones, president & CEO of CastleOak Securities: “We approached Bloomberg in 2016 about an innovative idea using Bloomberg’s BOLT platform that not only would help us provide liquidity to our clients but also level the playing field. The combination of Bloomberg’s technology prowess with our trading capabilities has resulted in a lower cost alternative for clients while still fulfilling best execution requirements. Our partnership with Bloomberg has helped us gain significant trading market share in fixed income trading, which in turn has meant measurable revenue growth. DirectPool’s trading volumes continue to grow year over year; the marketplace has realised that this is not only an efficient trading platform but also a transparent way to achieve their D&I goals. This is not a marketing gimmick, it’s a long-term partnership that provides real value. CastleOak have recently added on electronic US Treasury trading capabilities, and continue to work with Bloomberg to develop new solutions for our clients.”

Michael Lindley, head of fixed income trading, Tigress Financial Partners: “The UST white label solution developed in partnership between Tigress and Bloomberg is an innovative offering that solves problems posed by many buy-side firms; how to meet and enhance their fiduciary requirements of Best Ex while also looking to expand their ESG footprint by engaging with Diversity and Inclusion broker dealers.

Michael Lindley, head of fixed income trading, Tigress Financial Partners: “The UST white label solution developed in partnership between Tigress and Bloomberg is an innovative offering that solves problems posed by many buy-side firms; how to meet and enhance their fiduciary requirements of Best Ex while also looking to expand their ESG footprint by engaging with Diversity and Inclusion broker dealers.

“Creating this solution would not have been possible for Tigress if not for Bloomberg’s commitment and resources to affect a development project of this magnitude. Using Bloomberg’s Technology, Tigress have been able to provide clients with a solution to the above challenge as it offers meaningful value-add to their business whilst fitting seamlessly into their workflow. Without such a solution it would not be possible for Tigress to typically engage such firms in this capacity and as such has allowed us to open doors with some of the largest money managers in the world. Working with the Bloomberg team, who have prioritised the democratisation of their overall offerings, has been first class throughout and we look forward to partnering on more innovative solutions in the future.”

Glen Capelo head of rates, Mischler Financial Group: “We’re excited to be a part of the Bloomberg initiative, as it will allow Mischler Financial Group and our trading partners the ability to deliver a true, ‘best in class’ solution that meets the needs of our asset manager and fixed income clients, each of whom relies on us to address both their ‘better execution’ needs, as well as their respective diversity goals and mandates.

Glen Capelo head of rates, Mischler Financial Group: “We’re excited to be a part of the Bloomberg initiative, as it will allow Mischler Financial Group and our trading partners the ability to deliver a true, ‘best in class’ solution that meets the needs of our asset manager and fixed income clients, each of whom relies on us to address both their ‘better execution’ needs, as well as their respective diversity goals and mandates.

“With over US$10 trillion in AUM already signed up on the platform, we are extremely excited to be at the forefront of the electronic trading revolution in the diversity broker dealer space. This platform will give us the ability to be competitive every day and to deliver an STP streaming experience to all of our counterparties. It’s crucial to have robust partners like Bloomberg, who share our ambition to excel and our vision of creating a comprehensive solution for the everyday transaction requirements of our clients.”

We’re very proud to be helping such members of the financial community build their networks and operations, whilst simultaneously helping their clients meet their own internal targets concerning DE&I.

Disclaimer: This communication is directed only to market professionals and is communicated, as applicable, by Bloomberg Finance L.P. and its affiliates including Bloomberg Tradebook LLC. Bloomberg Tradebook LLC, a Securities and Exchange Commission (“SEC”) registered broker-dealer, is a member of the Financial Industry Regulatory Authority (“FINRA”) and the Municipal Securities Rulemaking Board (“MSRB”).

©Markets Media Europe 2023

©Markets Media Europe 2025