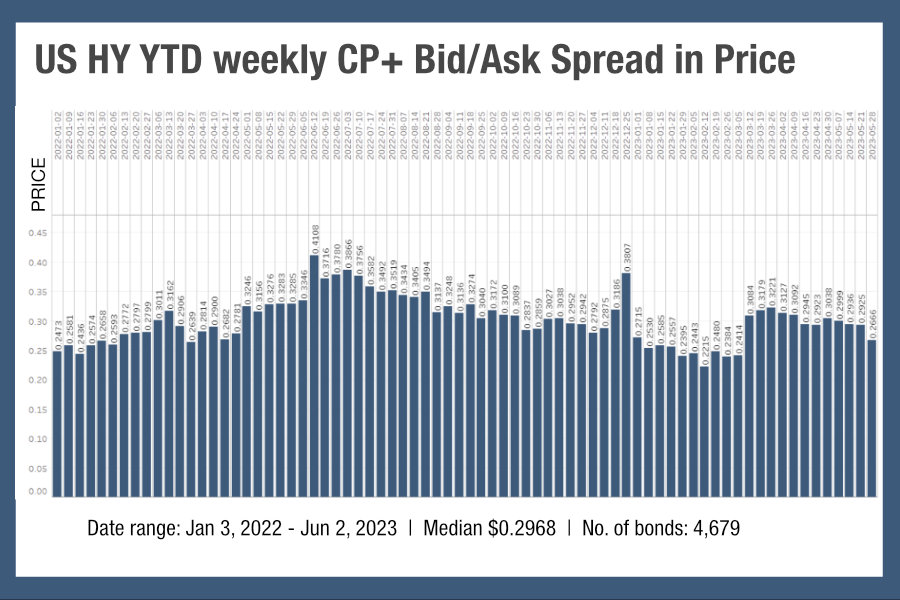

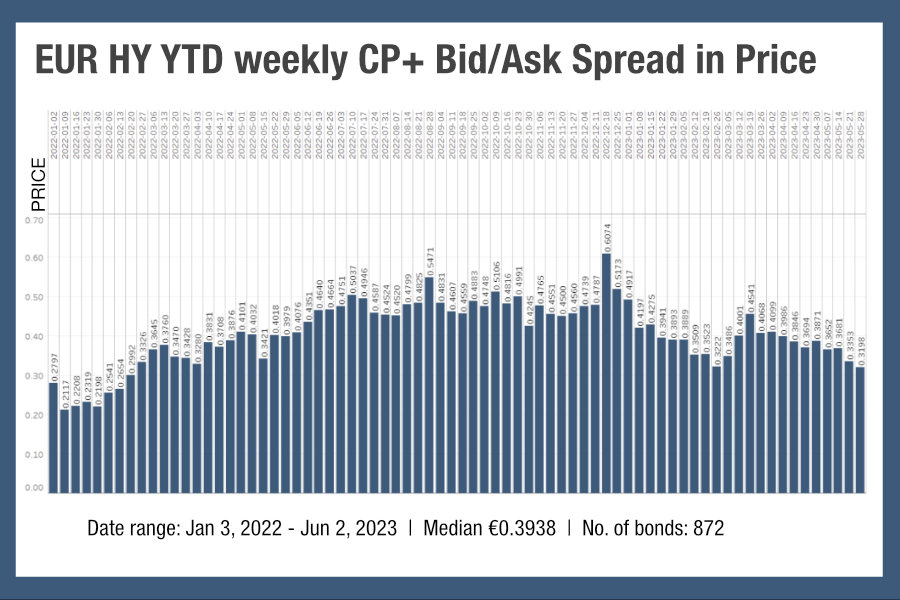

Trading costs for high yield bonds have been elevated on both sides of the Atlantic. The US saw a big jump in bid-ask spreads in March, around the time that financials started to look less safe, according to MarketAxess’s CP+.

It saw bid-ask spreads measured by price increase from a range of around US$0.24 cents in the week of 5 March to US$0.31 cents, and it stayed close to US$0.30 cents where it stayed there until late May when the final week saw a slight drop off to US$0.26. From January to end of May, the average bid-ask spread was priced at US$0.35 cents in 2022 from January to end of May, but US$0.4 cents for the same period in 2023.

European HY markets saw a similar jump in bid-ask spreads in March 2023, a week later than in the US, but overall they have seen the price of the spread hit €0.48 from January to May in 2023, where it had only been €0.4 cents in 2022 in that period.

Higher costs in the secondary markets for HY trading could prove particularly challenging if credit conditions worsen. Finding the other side to a trade in a market in which dealers may retreat from making bids will necessitate greater pre-trade awareness of where and how to offload large positions, not only for those investment firms with high yield portfolios, but potentially also for those investment firms who see downgrades in previously investment grade firms. With inventories on the sell side falling in size, traders in lower rated bonds in particular may struggle with liquidity in stressed conditions, making access to better data and analytics imperative.

©Markets Media Europe 2023

©Markets Media Europe 2025