We compare the very different all-to-all offerings provided by electronic trading platforms.

A good all-to-all offering can really support electronic liquidity provision, especially if traditional dealer-to-client liquidity levels have reduced.

Over the past year, buy-side traders reported they were searching all-to-all platforms for counterparties more than ever as bank capital commitment waned, particularly in volatile periods when banks find it harder to price bonds.

However, trading desks need to justify the costs of connectivity with platforms before they can access these all-to-all pools. To support this, we looked at eight different market operators’ all-to-all offerings.

It is notable how much growth many of these have seen, indicating that both dealers and buy-side firms have been making greater use of these tools in a challenging secondary market for fixed income.

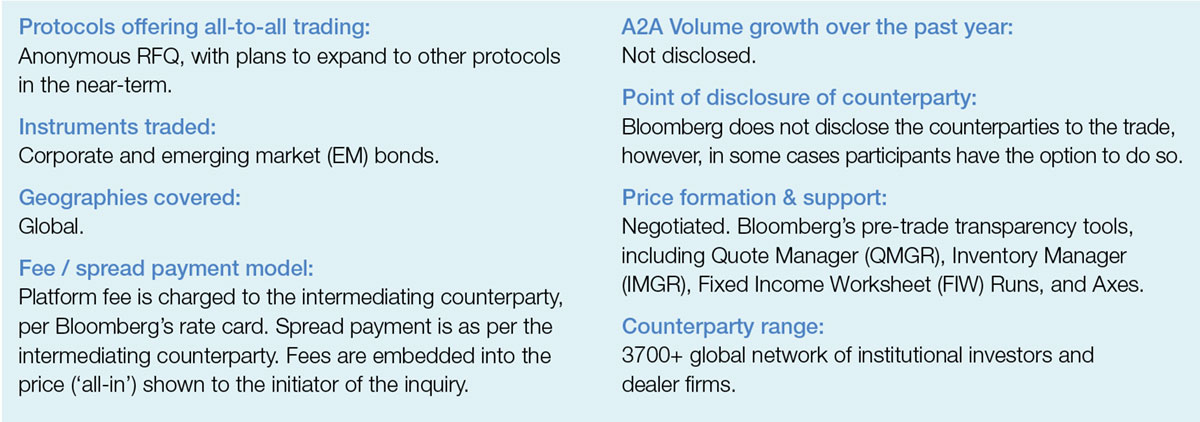

Bloomberg

Derek Kleinbauer, global head, fixed income & equity e-trading, Bloomberg:

Derek Kleinbauer, global head, fixed income & equity e-trading, Bloomberg:

As liquidity becomes more diverse, all-to-all trading enables market participants to access a broad matrix of counterparties in an efficient manner. We launched our all-to-all offering to provide clients with the necessary tools to unlock the broadest possible breadth and depth of liquidity in the market. This also helps to ensure participants don’t have to rely solely on bilateral relationships.

Bloomberg provides clients with data, analytics and communication tools, and when combined with our network, it delivers a powerful solution that can meaningfully improve their trading activities.

We continue to invest in our electronic trading solutions business and this is great example of our focus on enhancing our existing offerings while continuing to introduce innovative products that support the evolution of the markets.

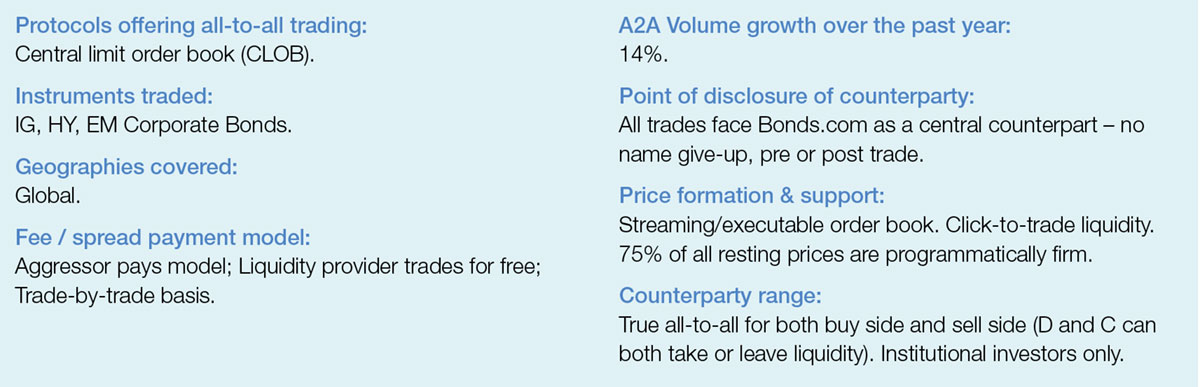

Bonds.com

David Parker, CEO, Bonds.com:

David Parker, CEO, Bonds.com:

Bonds.com offers an institutional client network and trading platform for IG, HY, and EM corporate bonds. The BondsPro all-to-all order book is a major component of the US corporate bond market infrastructure and delivers robust liquidity, data, and connectivity to institutions globally, 22 hours per day. It supports trading and pre-trade data dissemination via a dedicated a web-based platform, direct API connections, and most major O/EMS providers. Bonds.com boasts over 600 institutional clients, contributing over $60bn of resting liquidity across some 20,000 bonds daily. The sum of these parts is executable liquidity and market data that is of the highest quality, making BondsPro a must-have tool for any institution active in the corporate bond space.

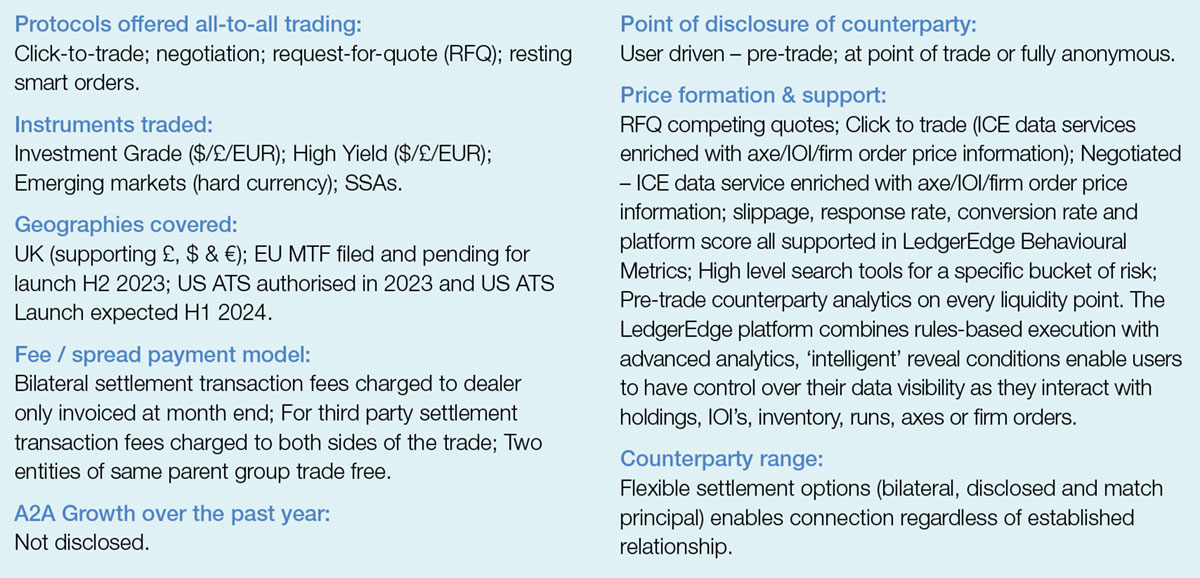

LedgerEdge

Kate Karimson, chief commercial officer, LedgerEdge:

Kate Karimson, chief commercial officer, LedgerEdge:

The development of fixed income trading is undergoing a unique shift as patterns advance to a new and exciting phase. Market participants are seeking more efficient ways to find liquidity and execute trades. That’s where LedgerEdge comes in. Our platform modernises fixed income trading by creating a powerful and efficient market appropriate for current and future execution styles. With LedgerEdge, users have control over how, when and what information to share with different parts of the market, resulting in a more liquid trading environment with differentiated liquidity. This unlocks new trading opportunities and creates a more efficient fixed income market. We’re excited about the future of execution and know this is just the beginning of a powerful leap and evolution of credit markets.

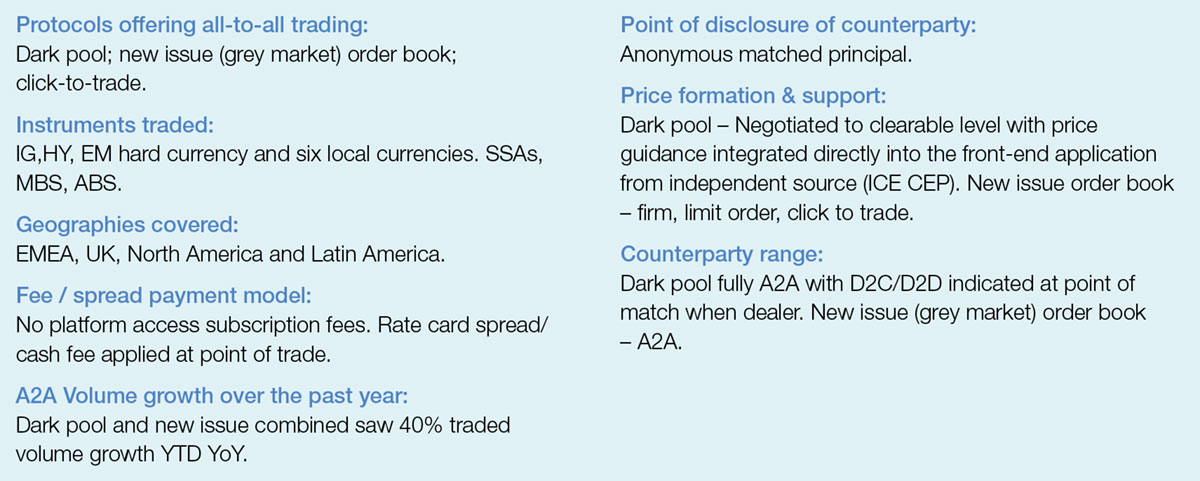

Liquidnet

Mark Russell, global head of fixed income, Liquidnet:

Liquidnet’s goal is to facilitate the most optimal trading conditions, based upon the participant mix and the liquidity profile of the bond. Our multi-protocol approach includes D2C, C2C, as well as all-to-all trading which are configured based on the trader’s need and preference.

We believe that one size doesn’t fit all and that market conditions will favour specific participant combinations based on managing information leakage requirements while maintaining trading relationships.

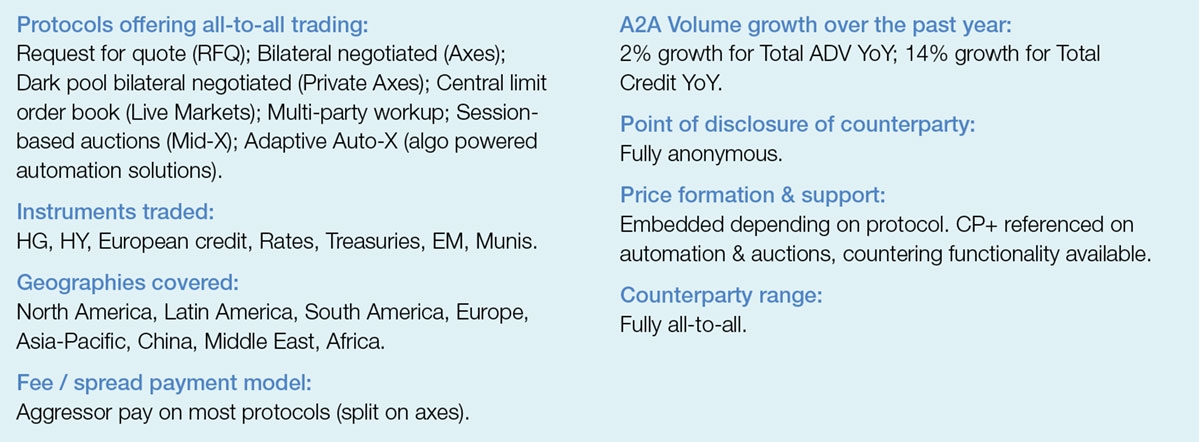

MarketAxess

Rich Schiffman, head of open trading, MarketAxess:

Rich Schiffman, head of open trading, MarketAxess:

MarketAxess Open Trading participants have broader and more diverse liquidity options compared to the traditional model of bilateral trading with a limited set of dealer counterparties.

The expanded pool of liquidity providers includes investment managers, global dealers, regional dealers and specialist market making and proprietary trading firms all available on an anonymous basis.

During 2022, over 1,700 firms participated in Open Trading, which improved the ability of both dealers and institutional investors to find natural and opportunistic matches, move orders more efficiently, and achieve significant increases in execution quality and price improvement.

Tradeweb

Izzy Conlin, managing director, head of US institutional credit, Tradeweb:

Izzy Conlin, managing director, head of US institutional credit, Tradeweb:

Tradeweb AllTrade allows clients to trade anonymously with thousands of participants by leveraging the liquidity of Tradeweb’s robust institutional, wholesale and retail markets.

Tradeweb AllTrade offers more flexibility – responders can cross and/or spot trades based on their own schedule, access to deeper electronic liquidity and an expanded set of protocols including Multi-Client Net Spotting (MCNS), RFQ and Rematch, an exclusive Tradeweb AllTrade liquidity event that gives clients access to hundreds of millions in unmatched dealer risk.

In Q123, Tradeweb AllTrade produced a record quarter with over $130 billion in volume, as clients continued to utilise Tradeweb AllTrade in their trading strategies.

Trumid

Justine Robertson, head of client strategy, Trumid:

Justine Robertson, head of client strategy, Trumid:

When Trumid launched in 2015, we identified a gap in the market to bring buyers and sellers together to trade round lots anonymously and electronically – our anonymous all-to-all protocol. The protocol is designed to maximise liquidity on a specific security or list of securities, bringing together a diverse network of users at a particular point in time. It has proven valuable for topical capital structures, such as new issue, which actively trade in the market.

We are one of the leading venues for electronic new issue trading, in part driven by our unique ability to provide trading and pricing transparency in grey markets.

Trumid’s market share in new issue bonds was 35.4% in April, up 34% year-over-year. Plus, our Anonymous all-to-all protocol is not a standalone protocol on the Trumid platform. It is part of an integrated ecosystem of protocols and trading solutions. Based upon their credit trading goals and preferred workflows, clients can access a full network of peers and counterparties, seamlessly moving between our Anonymous, Attributed, Portfolio, and RFQ protocols all within one Trading application.

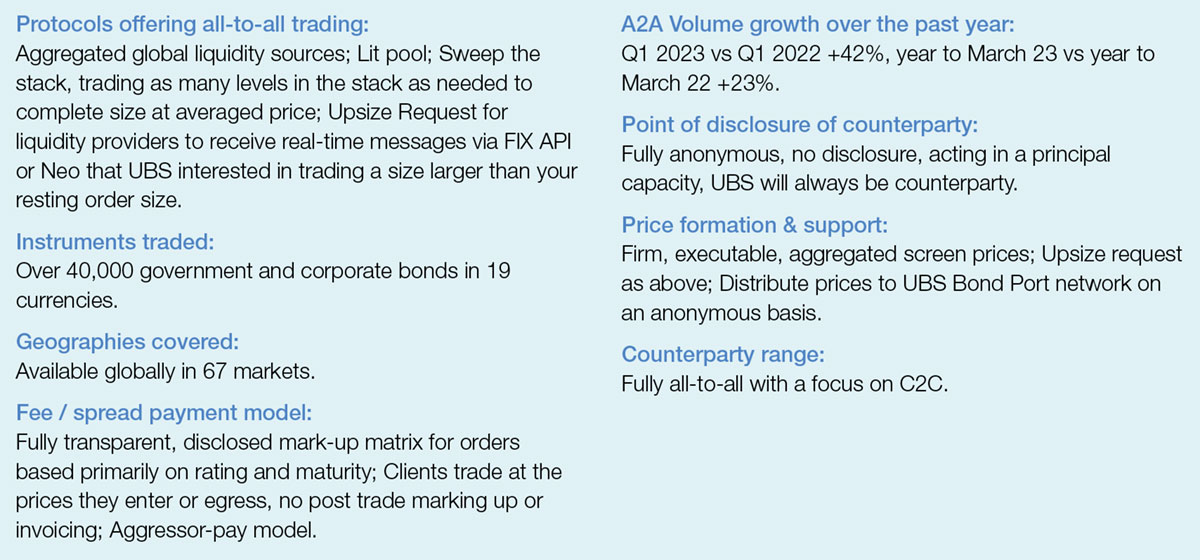

UBS Bond Port

Graham Cox & Nicolas Masso, co-heads of UBS Bond Port:

Bond Port, a UBS Investment Bank business for over a decade, connects clients to a global network of liquidity across thousands of bonds and multiple currencies. Throughout the years we have incorporated a wide range of voice and electronic execution tools, allowing clients to integrate the trade flow seamlessly to their day to day processes and systems.

Bond Port, a UBS Investment Bank business for over a decade, connects clients to a global network of liquidity across thousands of bonds and multiple currencies. Throughout the years we have incorporated a wide range of voice and electronic execution tools, allowing clients to integrate the trade flow seamlessly to their day to day processes and systems.

Bond Port’s extensive venue integration catalogue encompasses all major ECNs, ATSs, OMSs, EMSs, Exchanges, as well as hundreds of direct client point to point connections globally. Bond Port seamlessly integrates client liquidity as well as external liquidity from venues, traditional dealers and alternative providers to give clients an aggregated view of the market.

Bond Port’s extensive venue integration catalogue encompasses all major ECNs, ATSs, OMSs, EMSs, Exchanges, as well as hundreds of direct client point to point connections globally. Bond Port seamlessly integrates client liquidity as well as external liquidity from venues, traditional dealers and alternative providers to give clients an aggregated view of the market.

The anonymous lit order book, displays fully firm live and executable liquidity, giving clients a unique single portal access to global liquidity. This aggregation simplifies price discovery as well as access to firm executable levels, while reducing market fragmentation with seamless integration to the clients’ current workflows.

©Markets Media Europe 2023