Applying innovation from corporate bond markets to credit derivatives trading could boost liquidity at a point of market stress.

Single-name credit default swaps (CDSs) provide protection for the holder against the impact of a default by a company or sovereign bond issuer. As rates rise and the risk of defaults increase, interest in the contracts is increasing amongst investors.

The question this year will be whether the single name market will be liquid enough to support investors as credit conditions worsen, driven by recession-baiting central bank policy.

“When it is able to operate efficiently a single name CDS is built to pool the liquidity on an issuer across all the bonds of that issuer,” says Daniel Leon, global head of trading at HSBC Asset Management. “And when it does that it’s a very valuable tool that enhances liquidity. My view is that it’s helpful for long term institutions because it can be an efficient way of providing protection and it can be very helpful tool for investors.”

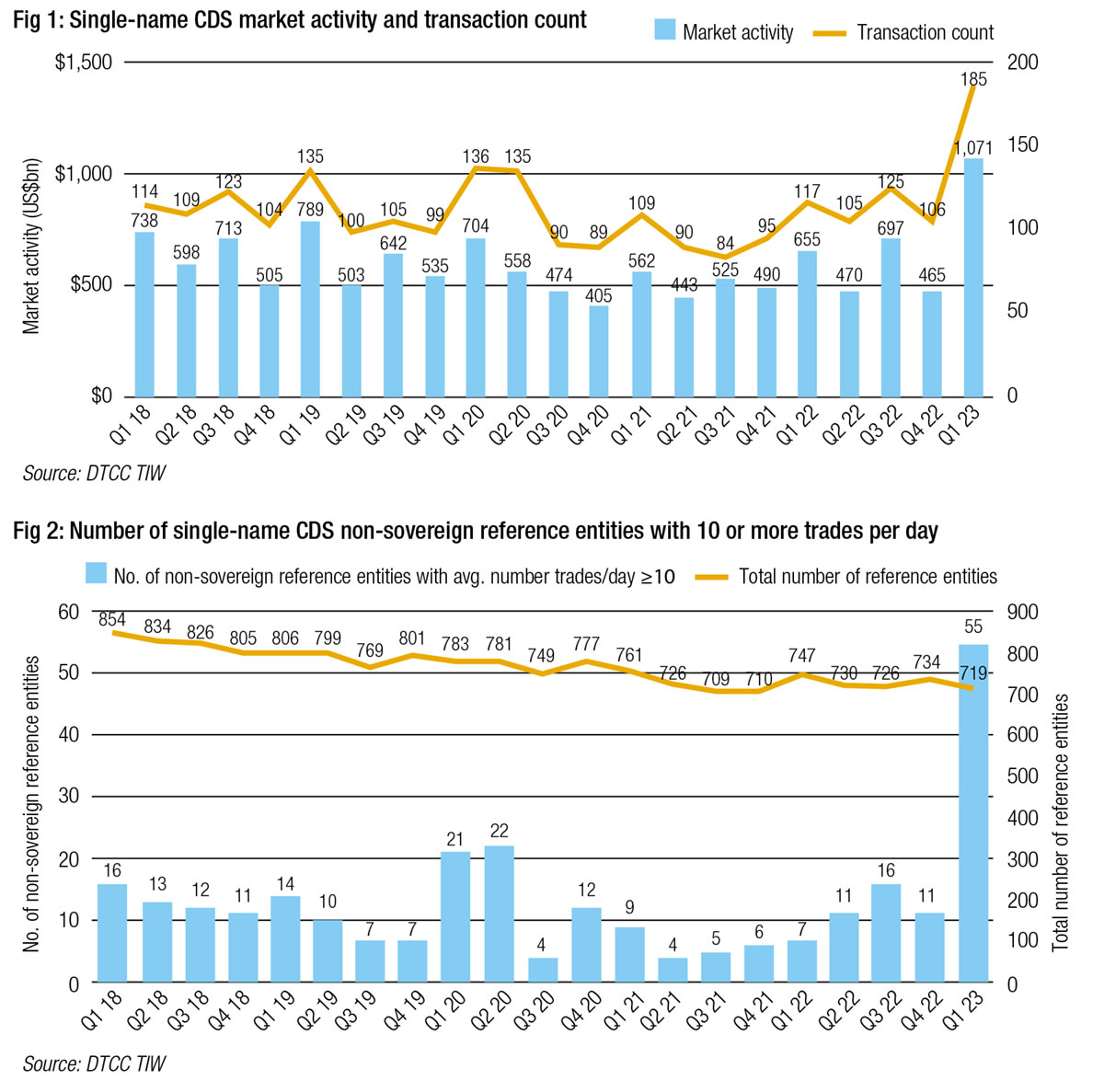

Trading in CDS reached a five-year peak of US$1.1 trillion in Q1 2023 (Fig 1) according to the International Swaps and Derivatives Association (ISDA), and the number of non-sovereign names averaging ten or more trades per day – deemed ‘liquid’ by the European Securities and Market Authority – increased significantly (Fig 2), which as ISDA observed indicates the “episodic nature of CDS liquidity in response to heightened credit concerns.”

Liquidity in the credit derivative market also ties directly to liquidity in the cash credit market.

“As an example of how the CDS market supports liquidity, late into the financial crisis, we were asked to sell large size in a single bond. We looked at the axes, and found CDS axes on behalf of a basis trade investor that needed to buy bonds, they didn’t mind buying the bond from us, so we were able to sell a credit name, in large size in a credit crisis. By create relative value possibilities the CDS created an improvement.”

Limited market

Recent spikes in volume are indicative of increased liquidity, but the market is typically illiquid, due to the restrictions placed on their use after the global financial crisis in 2007-8, after a multi-year chaotic flurry to sell securitised debt derivatives and default protection created massive leveraged exposure to subprime mortgages. The largest buy-side casualty of the crisis, AIG, then America’s largest insurer, went bust when the size of a margin call it had to pay to support a CDS it underwrote exploded in size as the underlying debt plummeted in quality.

Following the 2009 Pittsburgh meeting of the G10, it was agreed that swaps should be pushed onto electronic trading venues, have their trading centrally recorded and trades should be centrally cleared to limit the systemic impact of a default. Activity declined significantly as the costs of participating in the market increased. The gross market exposure of credit derivatives was US$247 billion at the end of June 2022 versus US$5.4 trillion at the end of 2008.

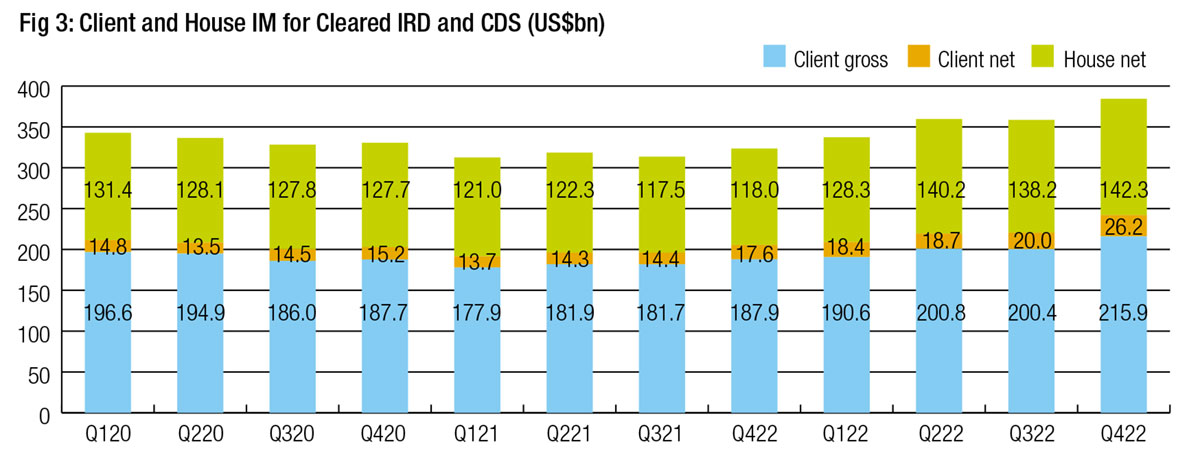

Since the financial crisis collateral has to be posted with either the counterparty or a central counterparty in a cleared trade in to be used as security against one party defaulting. It is clear from looking at ISDA’s numbers (Fig 3) that higher margins do not correlate with periods of illiquidity in the cash market – such as in March 2020 – indicating that higher levels of CDS trading do not draw significant amounts of cash or highly quality liquid assets (HQLA) from the credit market.

While credit default swap indices (CDX) present an exchange-traded alternative financial product, giving investors broader exposure to multiple CDSs in a more efficiently traded wrapper than a single name CDS, the same challenges for investors in using them as seen with swaps versus futures, namely that greater trading efficiency leads to less tailored risk management capabilities.

“If you need to protect a specific single name, I believe it’s hard to find an alternative,” says Leon. “The question is always how you can source the liquidity; that is the question more than considering the tool itself. At a technical level the tool is quite organised, with clearing, standard docs so, everybody is really working hard on making the tool efficient across all aspects.”

The electronic boost to CDS

As in the corporate bond space, the growth of electronic trading is allowing new trading protocols to develop which could potentially enhance liquidity.

“We are seeing increased electronification in the global CDS market, as clients continue to utilise electronic trading tools like click-to-trade, request for quote (RFQ), voice processing and more recently request-for-market (RFM) to improve their trading workflow,” says Ted Husveth, managing director, US Credit, Tradeweb. “The most recent innovation, RFM, was introduced this year specifically for the single name CDS space, and allows clients to trade more efficiently in this market because it offers transparency while simultaneously preserving client intent, preventing potentially sensitive or strategically valuable information from being revealed.”

That is a pressing development of the CDS space if it is to continue to support the market efficiently, few buy-side funds have mandates to trade structured products than can trade cash instruments, making the need for improved trading mechanisms a greater assistance as additional natural liquidity is harder to develop.

“The pool of people buying and selling corporate bonds is much wider than the pool of people that are allowed to use CDS which explains sometimes the difference in liquidity,” says Leon. “Liquidity in CDS is affected by the variety of market participants. The more you have of them with different interest, the more you have liquidity. So, I don’t think of the market in terms of efficiency, but more in terms of the diversity of potential investors. We typically know the traders, they come from different areas. Within the market are different desks intervening in CDS: the CVAs Bank desk which manage the credit risk, loan desks, credit index traders, and we have investors, which can be long term or short term, and as well basis trades investors. The more you have of these varied investors the better the potential liquidity.”

There is increasing transparency in the CDS market for both public and regulatory levels, with real-time public reporting of single-name CDS transactions starting in the US in February 2022 and even longer for CDS index trades. This could potentially encourage the space to grow.

“In the US, they’re starting to create more disclosure on CDS,” says Leon. “So it’s going to be interesting to see if, more people seeing volumes and price leads them to realise there is liquidity in the market and consider it.”

Now capital market participants are seeking to enhance both transparency and liquidity in an effort to support trading of CDS.

Byron Cooper-Fogarty, COO of axe distribution platform, Neptune Networks, says, “We’re looking to replicate what we’ve done in the cash credit market, with corporates and financials, which allows active dealers of single name CDSs to distribute their axes through our network and leverage that connectivity. One bank has soft launched and we’re still working the functionality, including getting a lot of feedback from clients. But the interesting thing about single name CDSs is that we’re not trying to bring on 50+ dealers, It’s a group of eight to 10 and those are very specialised.”

Innovation in trading

By applying the latest models from the cash market to the swaps landscape, firms will be able to use tried and tested models to better find liquidity and pricing.

Tradeweb is engaging with clients on low-touch trading models that better support technical rules-based trading approaches as well as faster and lower cost execution.

“We are also seeing more and more clients embrace automation and API integration into their existing workflow,” says Husveth. “For example, we are seeing a growing trend toward automation using our Automated Intelligent Execution (AiEX) tool. Clients looking for a more efficient way to trade will integrate AiEX into their existing RFQ workflow, leveraging the protocol flexibly across their trading desks. In addition, clients have also become increasingly comfortable harnessing API connectivity throughout their trading strategies, boosting their ability to be systematic in how they execute and consume trading and market data.”

Cooper Fogarty says, “One of the benefits of single-name CDS axes will be the support it gives OTC trading, the way it is done in that particular asset class. This will give the sell side a safe way to distribute fairly sensitive information, to a tier of the client base, while from that client base’s perspective, they will be able to get that data into their workflow tools to allow them to make more intelligent investment decisions. Having a small contribution to that safe transparency in the asset class could have a knock-on effect to people being able to use it more frequently.”

©Markets Media Europe 2023