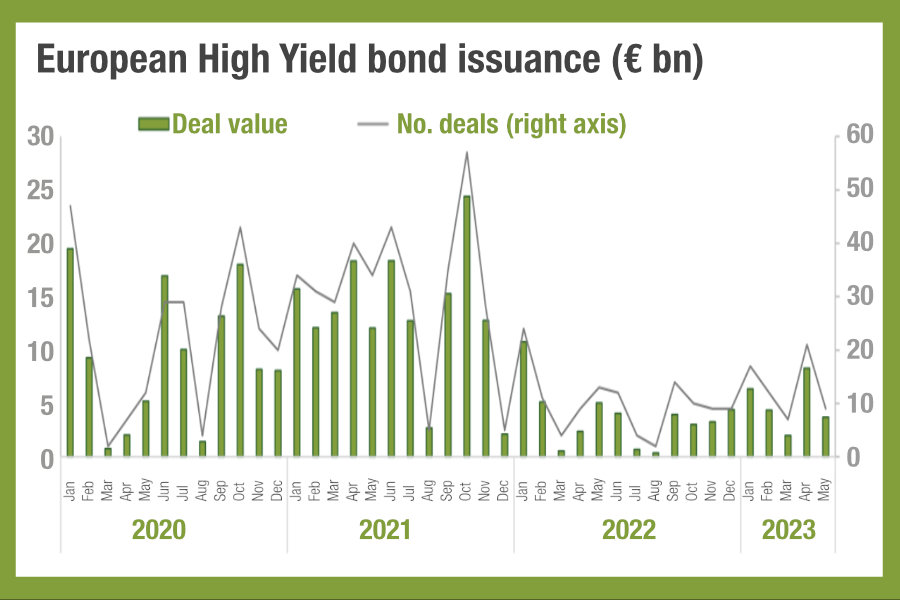

The data for Q1 bond issuance in European high yield (HY) markets shows that it fell 22.7% according to the Association for Financial Markets in Europe (AFME), which is hardly surprising given the massive increase in central bank rates that has taken place over the past year, and the challenges that creates for bond issuers seeking to finance their businesses.

Both Standard and Poor’s and Moody’s reported 11 bond defaults in the Q1 2023, resulting from missed principal payments and distressed exchange. Over a longer time period we see this is a big drop off in supply. There were €41.6 billion issued via 93 deals in Q1 2021, itself a 42.5% increase from €29.2 billion on 54 deals in 1Q’20. The €12.7 billion seen in 36 deals in Q1 2023 may be a near 23% drop off from the €16.5 billion issued via on 39 deals in Q1 2022, but it represents a fall of nearly 70% over two years. Nevertheless, there is some support for predictions made earlier in the year that issuance would see a rebound later in the year.

AFME notes that preliminary data for Q2 2023, as of the end of May, “shows that issuance of high yield bonds has recently increased with volumes already close to those issued in the entire first quarter, €8.3 billion in April and €3.7 billion in May, although below the monthly average observed in 2021 (€13 billion).

©Markets Media Europe 2023

©Markets Media Europe 2025