A report by analyst firm Coalition Greenwich has set out the tough but potentially rewarding path for increased adoption of transaction cost analysis in the fixed income space.

“While the future of TCA seems bright, given improvements in data quality and accessibility, adoption is still moving more slowly in the fixed-income asset class relative to other areas, like equities and foreign exchange,” writes author Audrey Blater, senior analyst on the Market Structure & Technology team.

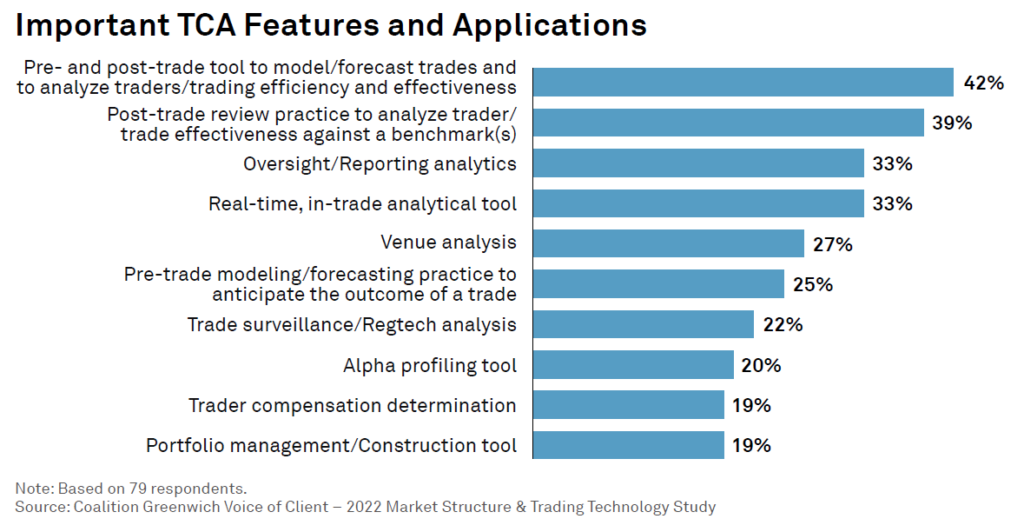

The report builds a good picture of system providers, the purposes for which it is used and the drivers for increased service provision and adoption. It notes that as trader reluctance to be measured reduces, regulation increases, data and its aggregation improves, the potential for making fixed income measurable by TCA systems is improving.

Only half of firms surveyed by Coalition Greenwich use TCA in the fixed income space currently, with third-party TCA solutions providers commonly used by the majority of study participants. However, a healthy amount of proprietary in-house systems and /or combination of vendor/broker/in-house technologies are also being relied upon reflecting the complexity of the instruments and nuances of individual trading workflows.

Blater also notes that the SECs proposal of Regulation Best Execution on 14 December 14, 2022, the intent of which is similar to the MiFID II Best Execution rules in Europe, in will demand the creation of “written best practices and review execution quality at least quarterly.”

“Sources of pre-trade information, including pre-trade TCA, are still leaning toward streaming dealer prices, axes and run lists, and even calls with counterparties, while more than one-quarter of respondents consume data delivered directly into their O/EMSs in relation to their fixed-income trading,” Blater notes. “According to one trader we spoke with, incorporating high-quality, real-time data with O/EMS data will eventually change the buy side’s cultural role of liquidity-taker. Being able to accurately measure and forecast trading costs is a key component of this shift.”

The report can be accessed here.

©Markets Media Europe 2023

©Markets Media Europe 2025