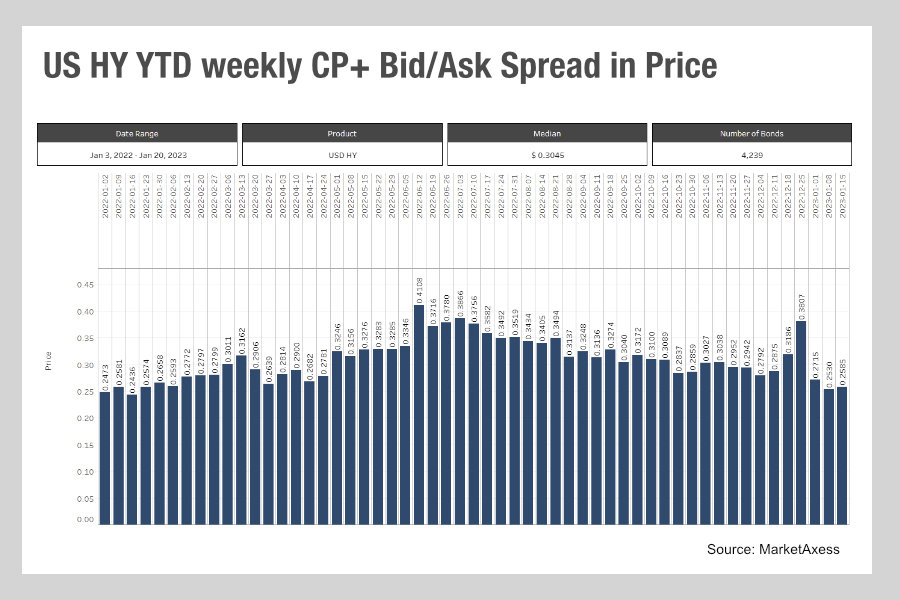

The bid-ask spread in US high yield trading is falling again having suffered an uptick in December, according to MarketAxess Trax, which tracks trading across multiple markets and counterparties. With the turning point having been in July, this is a positive for buy-side traders in the US market.

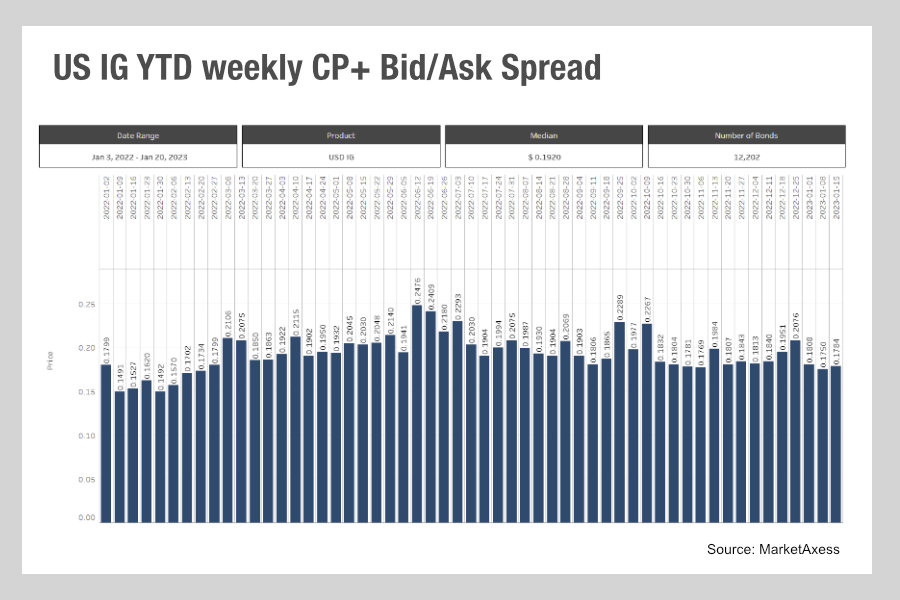

US investment grade is not seeing the same degree of decline, but nevertheless has fallen below the first week of January 2022, suggesting trading costs are steady in the less volatile and more liquid part of the American corporate bond market.

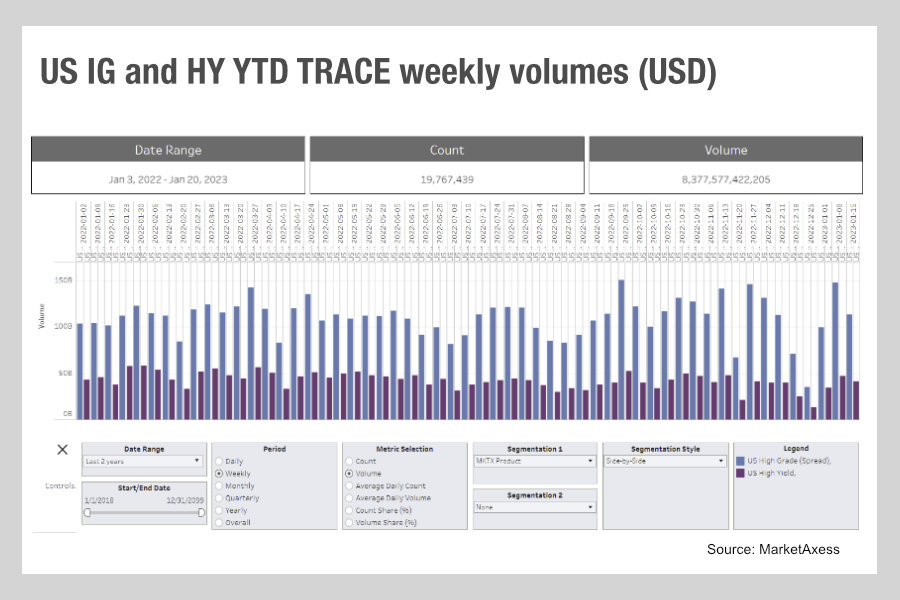

Trading volumes have been at elevated levels for IG and HY trading relative to January 2022, so the overall picture is a positive one, with lower costs and higher activity levels indicating access to liquidity is improving.

This is particularly valuable as issuance has been elevated in January soaking up hour of time for the trading team in primary markets where they can add little value.

It will also potentially allow trading teams to dedicate more time to strategic objectives, such as developing in-house technology and data projects, wedded with third party technology and services which can build a more efficient trading workflow for the desk.

Going into 2023 this work should not be overlooked; several regulatory and supervisory groups have warned that liquidity on the sell-side could be challenged, and leverage is a risk. Firstly, dealers’ ability to assess counterparty credit risk can be sub-par which may dampen engagement in trading fixed income assets with counterparties. Secondly, liquidity risk is heightened, which could lead dealers to commit fewer liquid assets to market as they shore up their own liquidity buffers.

We know that banks have had to strengthen their own collateral buffers, thanks to analysis by Cassini Systems, which found that a medium-sized bank had a €3 billion increase in cash collateral buffer in three years – an increase of 33% – and with 30 globally systemic important banks (G-SIBs) Cassini estimates €360 billion as the average cash collateral buffer for banks, with the overall increase being approximately €90 billion in three years. The advent of margin regulations in recent years suggests the cash collateral buffers were a fraction of this ten years ago.

The need to hold cash to underpin leveraged positions, and the pressure for buy-side firms to get access to that liquidity, will add to pressure on banks to support client liquidity more broadly.

Anything buy-side firms can proactively do to increase their ability to find liquidity pre-trade – be that data, partnerships, technology or skills-led – should invest in that during this period.

©Markets Media Europe, 2023

TOP OF PAGE