Adam Gould, Head of Equities, Tradeweb.

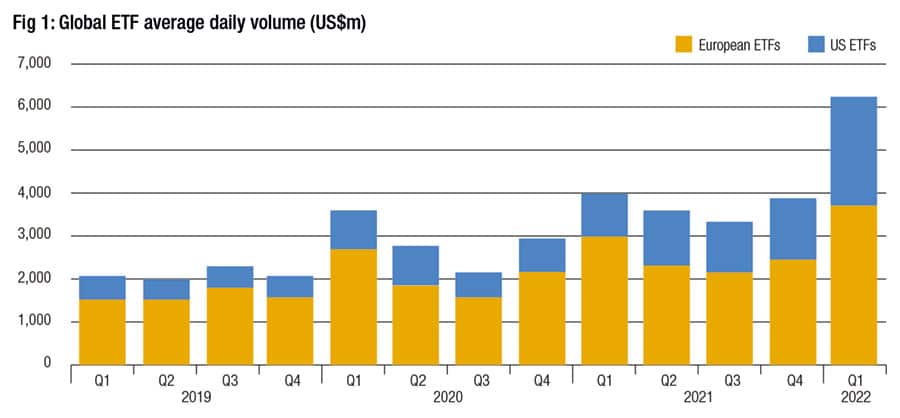

Institutional investors continue to embrace ETFs as a low cost, highly liquid, flexible answer to a wide range of market environments. Accordingly, in the first five years of ETF trading on Tradeweb, when volatility was relatively low and institutional investors were focused on efficiency, transparency and reducing trading costs, ETF volume on Tradeweb’s institutional platform amounted to over $650bn. In March 2020, when the world faced a global pandemic and massive volatility, US ETF average daily volumes (ADV) surged 226% year-over-year (YoY), and European ETF volume climbed 242% YoY. Now, as we stare down rising inflation and geopolitical tensions, ETF volume is still climbing, with ADVs on the Tradeweb platform in Europe increasing by 24% to $3.8bn and the US reaching a record high of $2.5bn in March of this year.

While many of the virtues that have driven the steady adoption of ETFs in institutional markets are similar to those that have helped ETFs become one of the most popular investment vehicles for retail investors, there is more to the institutional ETF phenomenon than just convenience and efficiency. A key innovation that has helped support the steady growth of ETF uptake in institutional markets has been the adoption of the request-for-quote (RFQ) trading protocol, which has applied lessons learned in institutional fixed income markets to the ETF space. RFQ has driven a change in the way institutional market participants trade, offering buy-side investors the ability to trade large amounts of risk, as well as access to the exposures and liquidity they need, while managing costs.

RFQ branches out

Developed initially to support electronic trading in fixed income markets, Tradeweb’s first RFQ for US Treasuries was launched in 1998 and quickly gained traction across the platform. Its combination of seamless integration into the trading workflow, flexibility, and instant access to the institutional marketplace of liquidity providers made it an attractive solution to drive better pricing, increased efficiency and immediate execution.

As the protocol developed over the years, many workflow enhancements were added such as straight-through processing, automated execution, as well as list and electronic portfolio trading capabilities. These enhancements set the stage for further expansion into the institutional ETF marketplace. In 2018, Tradeweb launched its first RFQ equities platform in Europe, paving the way for the global explosion in institutional ETF trading.

Rise of the ETF

Meanwhile, as the infrastructure to support large-scale institutional ETF trading was being refined, the ETF market itself was beginning to transform equity markets. Driven by a combination of easy access, low trading costs and strong liquidity, new ETF launches began to proliferate in the mid-2010s. In 2015, the number of new ETFs launched globally was about 750. By 2021, that number had more than doubled to 1,503*. Moreover, the ETF industry as a whole attracted more than $1tn in new investment in 2021, bringing total assets industry-wide to over $10tn.

The result has been a treasure trove of diversification and specialisation that allows institutional investors to tailor a strategy based on any number of attributes or themes without ever leaving the ETF ecosystem.

Changing trading behaviours

The combination of these two trends – the ability to instantly access institutional liquidity providers with a single RFQ and the emergence of additional risk options in the ETF marketplace – has driven a sea of change in institutional market participant behaviour. Most notably, the phenomenon has helped drive a steady increase in cross-asset trading, whereby ETF RFQs are being traded by both fixed income and equity trading desks.

That behaviour change is also starting to trickle into other equity-based asset classes, such as equity derivatives, options, converts, single stocks and ADRs which have been gaining traction in RFQ trading volumes in recent years.

Looking ahead, we believe that trend shows signs of continuing into the current period of rising inflation and beyond. As equity products continue to offer institutional investors highly targeted ways to express risk and electronic RFQ trading continues to deliver streamlined efficiency, we believe ETFs will become increasingly important tools in the institutional workflow. Ultimately, as the sell-side continues to get more sophisticated at managing risk and the buy-side looks to use ETFs more frequently, both fixed income and equity ETFs are being managed in the same risk book, allowing a seamless interplay between two silos that never used to cross paths. The end-result of all of this, of course, is delivering a better price to the end user, more liquidity in the marketplace and optionality for desks that take an omni-asset approach.

*Source: Morningstar