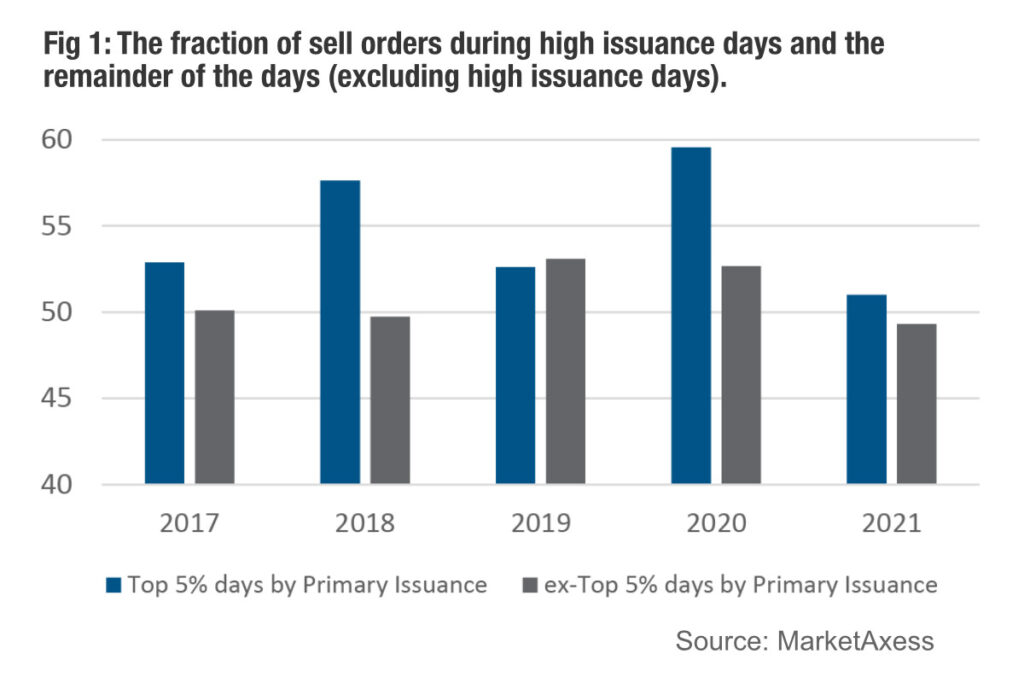

News that high yield (HY) issuance has fallen in Europe may be of little consolation to investment grade investors, as new data from MarketAxess show that selling pressure can increase by 8% on a busy day for IG issuance, which is still relatively high.

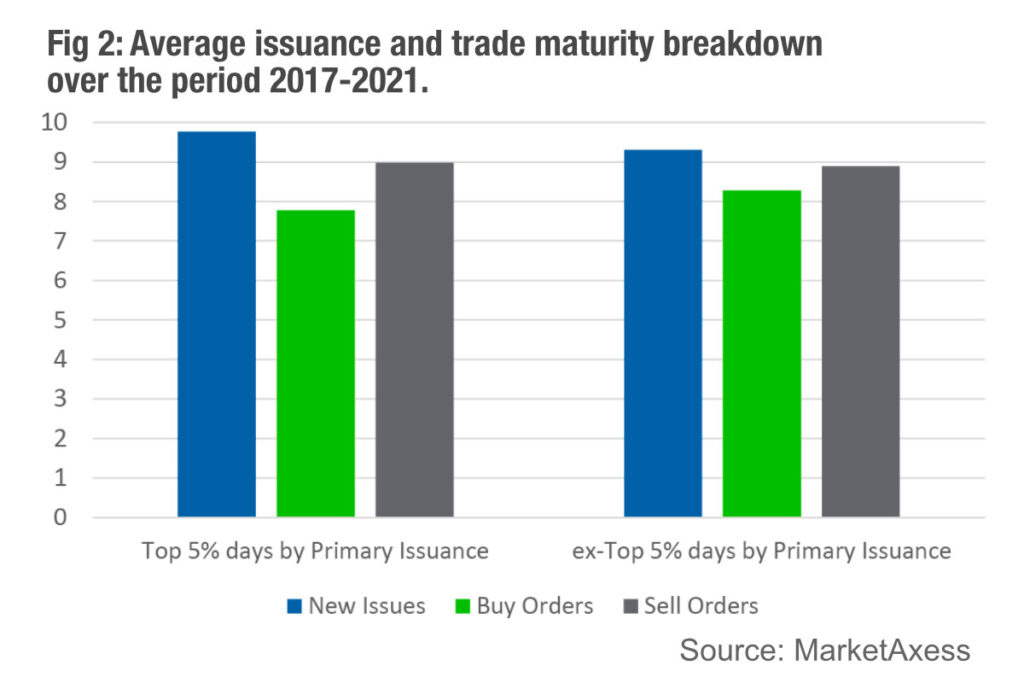

MarketAxess has investigated directional activity across the buy/sell divide during high issuance days between 2017 and 2021, and from its TraX data, identified the top 5% of high primary market issuance days. It then looked at the trading volume ratio on the MarketAxess platform, a proxy for secondary market activity. Specifically, it compared the fraction of sell orders during high issuance days (the top 5%) and the remainder of the days (excluding the top 5% of high issuance days). As presented in the first chart, for each year since 2017 and, on average, it found selling skew during high issuance days of approximately 55%, while the remainder of the year saw selling skewness at closer to 51%.

Consequently one can say that secondary markets have had more selling pressure on days of high primary market issuance in EUR IG since 2017.

“This phenomenon can be attributed to buy-side traders wanting to free capital in the secondary market to buy newly issued bonds in the primary market,” noted David Krein, global head of research at MarketAxess.

©Markets Media Europe 2025