Trending Now

MARKET NEWS

S&P Global Market Intelligence boosts muni market coverage

S&P Global Market Intelligence’s integrated market intelligence platform now covers almost 6 million securities in the municipal market.

The firm has added 4.6 million municipal...

Uncertainty on impact of US debt ceiling

Members of the Treasury Market Practices Group (TPMG) were unable to come to a consensus on the impact of the US debt limit being...

April Day leads AFME capital markets

AFME has named April Day as head of capital markets.

Based in London, she replaces Rick Watson, who announced his retirement in July 2024.

Day has...

CFTC Chair Behnam to Step Down Amid Regulatory Transition

Rostin Behnam, chairman of the Commodity Futures Trading Commission, has announced his departure after steering the agency through a transformative period in digital and...

Wellington targets US wealth clients with interval fund

Responding to growing interest in alternative solutions, Wellington Management has launched its first interval fund.

Through the Wellington Global Multi-Strategy Fund, Wellington aims to provide...

Finsight acquires Credit Flow Research

Capital markets technology and market data firm Finsight has expanded its US fixed income market provision with the acquisition of Credit Flow Research.

The acquisition...

FEATURES

Is electronic trading levelling out the year-end liquidity shortfall?

Concern about liquidity shortfalls at year end could be alleviated by electronic market makers say traders, and the data seems to back them up.

A...

Matt Howell: Building a centre of excellence for derivatives trading

Matt Howell reveals how T Rowe Price optimised its derivatives trading capabilities ahead of the expected boom in trading activity this year.

How are the...

US vs Europe: The transatlantic divide for corporate bond traders

The DESK examines the different sizes, protocols and feedback traders can use on each side of the Atlantic to execute corporate bond orders.

While US...

When not to use portfolio trading

Portfolio trading cannot please all of the people all of the time.

The success of portfolio trading (PT) as a protocol has taken bond markets...

The DESK: Systematic trading

The DESK discusses effective systematic trading, the benefits to end investors, and the skills needed to create and run systematic workflows with Chris Minck,...

Primary ignition – at both ends

Politics are being sidelined in the battle for efficiency in primary markets for buyers and for issuers

The top operational priority for buy-side traders in...

PROFILES

RESEARCH

Investor Demand: How Trump tariffs could affect investor appetite for dollar,...

UBS House View, published by Mark Haefele, Global Wealth Management chief investment officer; Brian Rose, senior US economist, CIO America; Jon Gordon, strategist, UBS...

FROM THE ARCHIVES

Technology: What large language models do to the trading desk

LLMs are already adding value to trading teams.

The advent of Open AI’s Chat Generative Pre-trained Transformer (ChatGPT) tool has generated as many column inches...

The good news on high yield trading

Two weeks ago we noted that high yield markets have seen trade sizes increase since the start of the year, running counter to the...

BondWave upgrades platform

BondWave, the financial technology firm focused on fixed income solutions, has upgraded its portfolio and transaction analytics suite of tools with the release of...

Odd-lot bond case alleges pressure on Bloomberg and collusion

In the US Southern District Court of New York, a class-action lawsuit has been brought against a group of banks, alleging that since 1...

Trading Intentions Survey 2017

The range of credit liquidity aggregation platforms used has increased, reducing demand for new connections.

About the survey

The DESK’s Trading Intentions Survey is global primary research...

Symphony keeps arms open for the right partners

Symphony, the capital markets communications platform, and Genesis the low-code application platform (LCAP) have partnered to support the development of interoperable technology and applications,...

ICE Bonds sees record notional volume for portfolio trading

Market operator, Intercontinental Exchange (ICE), has reported record volumes for fixed income portfolio trading during the fourth quarter of 2020.

Over US$1.9 billion in US-based...

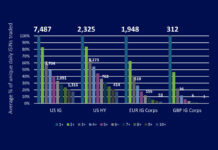

Comparing Corporate Bond Liquidity Across Regions

By Grant Lowensohn and Hidde Verholt.

Highlights

The US corporate bond market offers a significantly greater number of ISINs with high daily trade counts than other...

European Women in Finance Awards 2021 – The Shortlist

May we first express thanks to all of our readers who made nominations for this year’s awards. After the tribulations of the past year,...

Liontrust – The trading team built for growth

Matt McLoughlin, partner and head of trading at Liontrust Asset Management, explains why expanding trading capabilities to match AUM and asset class growth needs...

Warning on credit exposure

There are several cases to argue for reduced credit exposure, noted Stefan Hofrichter, global economist at Allianz Global Investors, speaking on Wednesday at the...

Euronext’s vision for European fixed income

An interview with Fabrizio Testa, Head of Fixed Income Trading at Euronext.

What are the components of Euronext’s fixed income offering today?

Following the acquisition of...