MARKET NEWS

S&P Global Market Intelligence boosts muni market coverage

S&P Global Market Intelligence’s integrated market intelligence platform now covers almost 6 million securities in the municipal market.

The firm has added 4.6 million municipal...

Uncertainty on impact of US debt ceiling

Members of the Treasury Market Practices Group (TPMG) were unable to come to a consensus on the impact of the US debt limit being...

April Day leads AFME capital markets

AFME has named April Day as head of capital markets.

Based in London, she replaces Rick Watson, who announced his retirement in July 2024.

Day has...

CFTC Chair Behnam to Step Down Amid Regulatory Transition

Rostin Behnam, chairman of the Commodity Futures Trading Commission, has announced his departure after steering the agency through a transformative period in digital and...

Wellington targets US wealth clients with interval fund

Responding to growing interest in alternative solutions, Wellington Management has launched its first interval fund.

Through the Wellington Global Multi-Strategy Fund, Wellington aims to provide...

Finsight acquires Credit Flow Research

Capital markets technology and market data firm Finsight has expanded its US fixed income market provision with the acquisition of Credit Flow Research.

The acquisition...

FEATURES

Is electronic trading levelling out the year-end liquidity shortfall?

Concern about liquidity shortfalls at year end could be alleviated by electronic market makers say traders, and the data seems to back them up.

A...

Matt Howell: Building a centre of excellence for derivatives trading

Matt Howell reveals how T Rowe Price optimised its derivatives trading capabilities ahead of the expected boom in trading activity this year.

How are the...

US vs Europe: The transatlantic divide for corporate bond traders

The DESK examines the different sizes, protocols and feedback traders can use on each side of the Atlantic to execute corporate bond orders.

While US...

When not to use portfolio trading

Portfolio trading cannot please all of the people all of the time.

The success of portfolio trading (PT) as a protocol has taken bond markets...

The DESK: Systematic trading

The DESK discusses effective systematic trading, the benefits to end investors, and the skills needed to create and run systematic workflows with Chris Minck,...

Primary ignition – at both ends

Politics are being sidelined in the battle for efficiency in primary markets for buyers and for issuers

The top operational priority for buy-side traders in...

PROFILES

RESEARCH

Investor Demand: How Trump tariffs could affect investor appetite for dollar,...

UBS House View, published by Mark Haefele, Global Wealth Management chief investment officer; Brian Rose, senior US economist, CIO America; Jon Gordon, strategist, UBS...

FROM THE ARCHIVES

Buy side reports price movement risk in Treasury trading

Automated trading and derivatives are changing the way US Treasuries are traded, exposing the buy side to high-frequency trading strategies. Chris Hall reports.

If big...

Buy-side firms may dominate front office tech

Buy-side firms need to make secular decisions about whether to buy or sell technology to other asset managers. Dan Barnes reports.

In April, CEO of...

Bloomberg and Goldman Sachs launch China USD Credit Liquid HY Index family

Bloomberg and Goldman Sachs have launched a Bloomberg China USD Credit Liquid HY Index family, which provides market participants with indices to adjust their...

A surfeit of bonds?

Henry I of England famously died from eating a surfeit of lampreys – a delicacy until consumed to excess. Central banks might want to...

Absorbing Gilt

The year after next, the UK is set to issue £305 billion gilts to support the government’s spending programme. The high level of issuance...

Bitcoin, blockchain and the DLT chimera

The uncertain promises of distributed ledger technology for financial markets. By Ferdinando Ametrano, Banca IMI (Intesa Sanpaolo).

Distributed ledger technology (DLT) is at a very...

Getting the most out of derivatives in credit

Bond investing has become more exciting in the past two years than in the previous ten, with interest rates and central bank activity fire-fighting...

BIS: Cut your trading costs in half by cosying up to dealers

A new working paper, written by the Monetary and Economic Department of the Bank of International Settlements, has found that dealer relationships are crucial...

Chris McConville joins Kepler Cheuvreux

Broker Kepler Cheuvreux has made three major new appointments to support its strategic ambitions in equity brokerage: Stéphane Bouret as global head of equity...

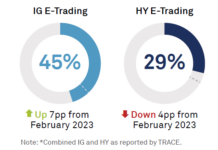

Coalition Greenwich: Electronic bond trading rises in US IG, declines in high yield

The use of electronic trading in corporate bonds will continue to increase, Coalition Greenwich’s March Data Spotlight has stated.

Electronic trading activity grew faster than...

Reviews of MiFID II transparency raise concerns

The European Securities and Markets Authority (ESMA) launched consultations on 3 February 2020 for the regime for non-equity instrument systematic internalisers (SIs), venues that...

ICMA responds to digital securities sandbox proposals

The International Capital Market Association (ICMA) has suggested a number of amendments to the FCA and Bank of England’s proposal to implement and operate...